- CMLNs moved $16.1B in crypto in 2025, processing about $44M daily across 1,799+ wallets.

- Illicit inflows to CMLNs grew 7,325× faster than to centralized exchanges since 2020.

- Vendors shift platforms after crackdowns, highlighting the limits of platform-only enforcement.

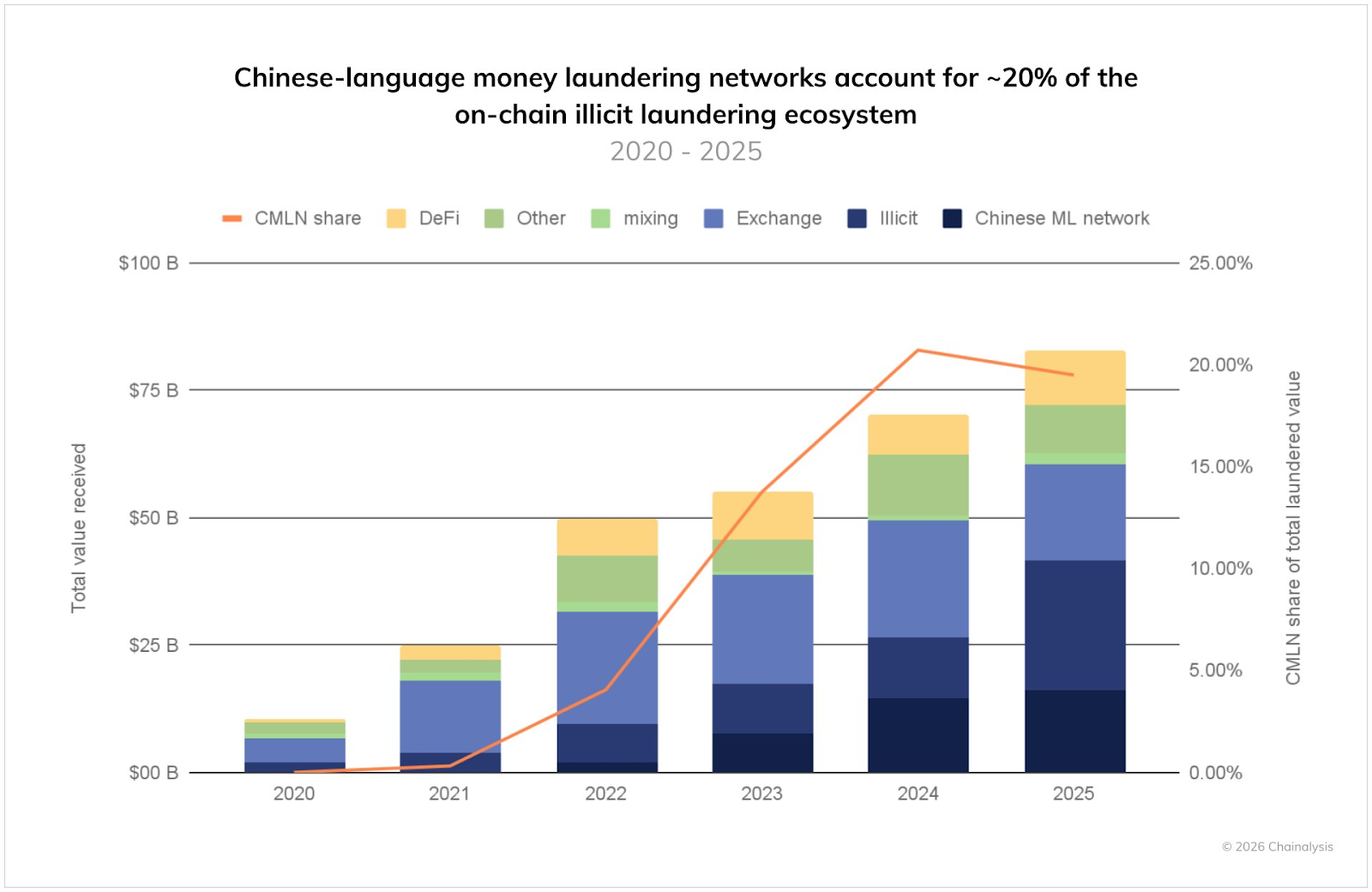

Chinese-language money laundering networks (CMLNs) processed an estimated $16.1 billion in illicit cryptocurrency funds in 2025, according to a preview chapter of the Chainalysis 2026 Crypto Crime Report. The activity equates to roughly $44 million per day across more than 1,799 active wallets, highlighting the scale and industrial nature of these operations.

Chainalysis data shows Chinese-language money laundering networks now account for about 20% of known illicit crypto laundering activity over the past five years. The report also indicates that inflows to these networks have grown 7,325 times faster than illicit inflows to centralized exchanges since 2020, highlighting a shift away from exchange-based laundering routes.

Six Service Types Define the CMLN Ecosystem

Chainalysis identified six primary service categories within the Chinese-language money laundering network ecosystem. These include running point brokers, money mules, informal over-the-counter services, Black U services, gambling platforms, and crypto mixing or swapping services.

Black U services and gambling-related services fragment large transactions into smaller amounts to evade detection, while OTC services aggregate smaller transfers into larger sums for integration into financial systems. Guarantee platforms such as Huione and Xinbi function as marketplaces and escrow hubs for vendors, but do not directly control laundering activity and were excluded from the total estimates.

Rapid Scaling and Operational Infrastructure

The report points out the rapid scaling of these operations. Black U services reached $1 billion in processed funds within 236 days, while OTC services required 1,136 days. Money mules and money movement services grew more gradually, reflecting constraints on manual processing. Overall, the ecosystem processed nearly $44 million per day in 2025.

Chainalysis also noted structural similarities across vendor platforms, suggesting coordinated or centralized operational models. These networks combine on-chain automation with off-chain criminal infrastructure, enabling fast processing and broad geographic reach, including reported activity across Africa.

Enforcement Actions and Ongoing Risks

Recent enforcement measures include sanctions against the Prince Group, FinCEN’s designation of Huione Group as a primary money laundering concern, and advisory actions targeting Chinese money laundering networks. However, the report states that vendors often migrate to alternative platforms following disruptions, maintaining continuity of operations.

The report concludes that coordinated public-private collaboration, blockchain analytics, and intelligence sharing remain necessary to identify and disrupt laundering operators rather than only targeting platforms.

Related: South Korea Targets Crypto Money Laundering with New Customer Verification Measures

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.