- Circle reported a 202% year-on-year surge in Q3 net income, reaching $214 million.

- USDC circulation grew 108% to $73.7 billion, reflecting robust global adoption.

- The firm explores launching a native Arc token to power its new Layer-1 blockchain ecosystem.

Circle Internet Group, the issuer behind USD Coin (USDC), reported a 202% year-on-year surge in net income to $214 million in its third-quarter 2025 results released Wednesday. The company’s strong financial performance was driven by increased interest income on USDC reserves, rapid adoption of the stablecoin, and expanding institutional partnerships.

USDC Circulation Reaches $73.7 Billion

According to the filing, USDC in circulation reached $73.7 billion, marking a 108% annual increase, while total revenue and reserve income rose 66% to $740 million. Adjusted EBITDA climbed 78% to $166 million, emphasizing Circle’s profitability amid rising global stablecoin demand.

CEO Jeremy Allaire said the company’s goal remains to build the “Economic OS for the Internet,” emphasizing that digital dollars are evolving into programmable, trusted instruments for global commerce. He noted that growing institutional interest demonstrates the market’s readiness for interoperable, transparent financial infrastructure powered by blockchain.

Arc Network Draws 100 Institutions

A key highlight of the quarter was Circle’s Arc Network, a newly launched Layer-1 blockchain optimized for stablecoin transactions, featuring sub-second finality and stablecoin gas payments. Over 100 institutions, including major banks and fintech firms, have joined its public testnet, exploring use cases from instant settlements to tokenized asset issuance.

In its earnings report, Circle disclosed it is considering the launch of a native Arc token to incentivize network participation and align stakeholders as it expands the Arc ecosystem. The potential token would represent a significant milestone, marking Circle’s deeper integration into the on-chain economy.

Trading Volume Slips but Payments Network Grows

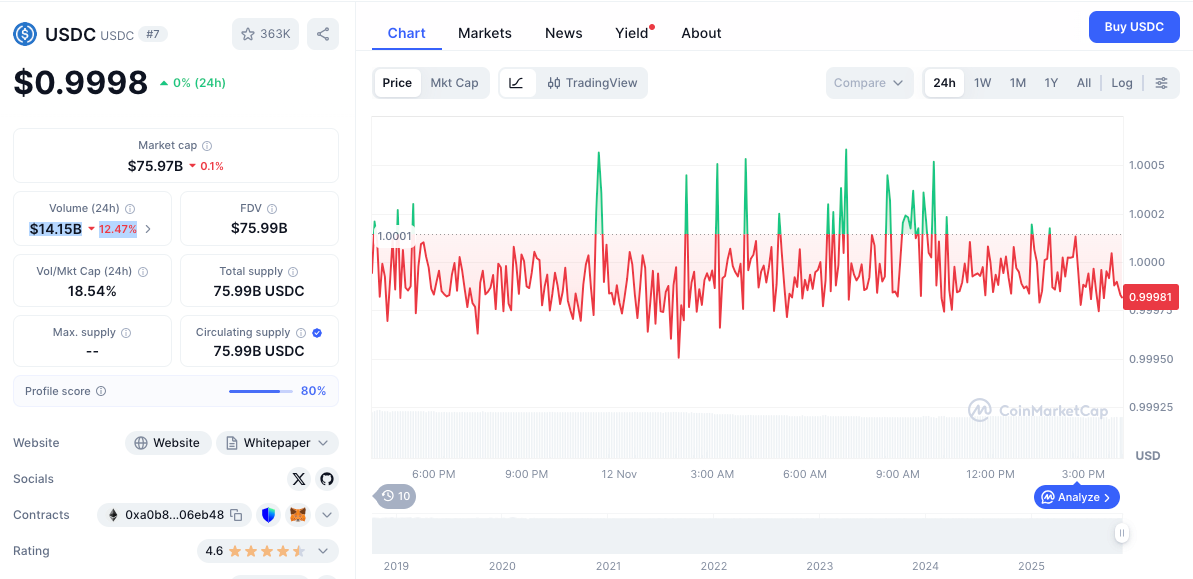

Meanwhile, data from CoinMarketCap showed USDC trading volume declined 13.04% to $14.17 billion in the last 24 hours, as investors react to ongoing market turbulence.

Circle also revealed that 29 financial institutions have joined its Circle Payments Network (CPN), with 55 more undergoing eligibility reviews and over 500 in the pipeline.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.