- Fed independence concerns raise broader questions about monetary policy and long-term dollar stability.

- Bitcoin stays calm as stocks and metals react to political and economic uncertainty.

- The CLARITY Act could redefine Bitcoin as a regulated digital commodity in the U.S.

A mix of political tension and regulatory movement in the United States is reshaping how markets view Bitcoin, not through sudden price jumps, but through quieter structural changes.

Fed Pressure Raises Bigger Questions

Recent reports revealed rising pressure on the U.S. Federal Reserve, including legal actions tied to testimony by Fed Chair Jerome Powell. Powell pushed back strongly and released a video statement, saying the central bank must set interest rates based on economic data, not political pressure.

While stocks and metals reacted to the uncertainty, Bitcoin’s price remained relatively calm.

CLARITY Act Adds To It

Crypto Market Structure Bill, known as the CLARITY Act, is scheduled for markup in the U.S. Senate Banking Committee on January 15, 2026. Lawmakers are debating how digital assets should be regulated and classified.

Market analysts say the bill should not be seen as a short-term price trigger. Instead, it could mark a longer-term shift in how Bitcoin is treated inside the U.S. financial system, potentially as a regulated digital commodity rather than a gray area asset.

Bitcoin Is Not Reacting Like Before

In earlier regulatory scares, Bitcoin often rushed onto exchanges as investors prepared to sell. This time, onchain data shows something different. Exchange inflows remain low, suggesting holders are not rushing for exits.

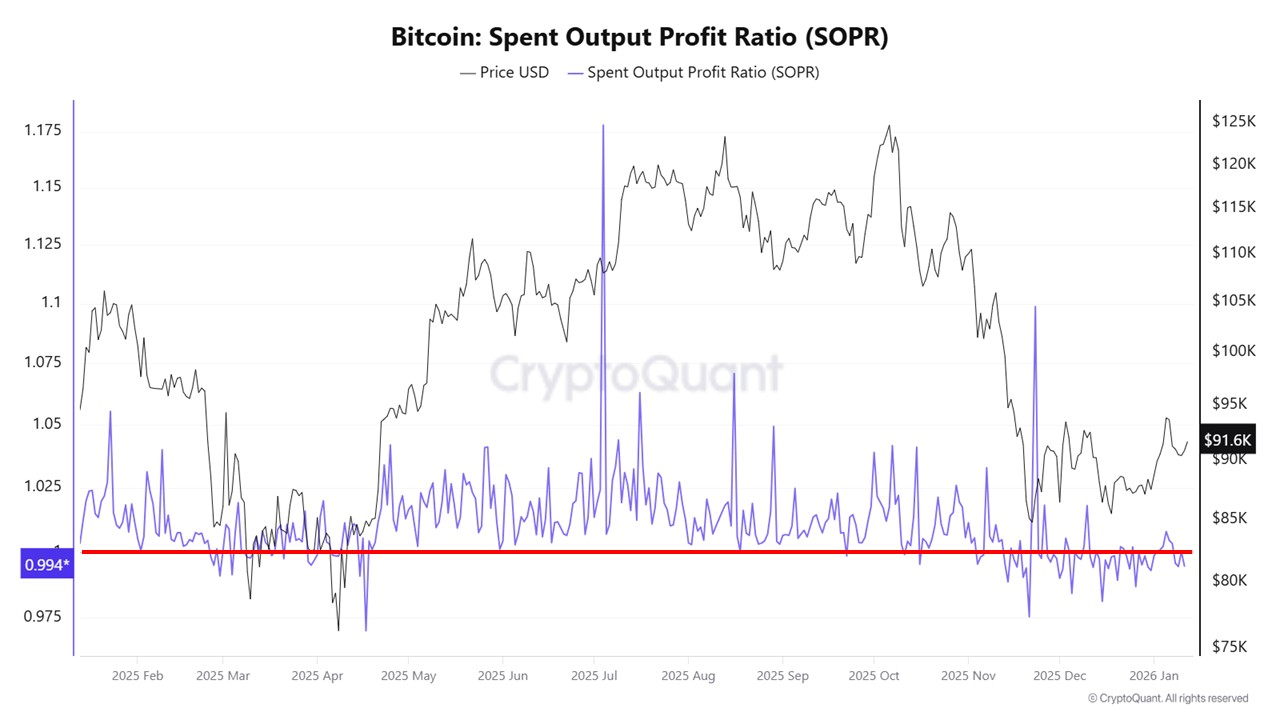

Another important indicator, known as SOPR, shows that coins are barely moving, and profit-taking is limited. In simple terms, investors are holding rather than trading. This points to patience, not fear.

Bitcoin Price Analysis

Bitcoin is trading sideways and has remained quiet this week, though volatility could rise with U.S. CPI data due today, Wednesday’s retail sales report, and a possible Supreme Court ruling on tariffs.

Right now, Bitcoin is stuck in a range. Strong resistance sits between $90,950 and $92,300. Price has been rejected from this area several times. If Bitcoin fails again here, it could pull back toward support between $86,500 and $88,200.

If Bitcoin breaks above the Monday high around $92,450, it could open the door for a move toward $97,000 to $98,400. That said, sellers are not showing much strength. As long as Bitcoin stays above the recent low near $89,200, the overall structure still looks stable.

Related: Bitcoin Waits While Gold and Silver Break Records Ahead of Key U.S. Data

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.