- Political interests pose a distraction for big governments in terms of regulation.

- Coinbase CLO exposed some findings the crypto exchange has made against the FDIC.

- Coinbase has received information about letters the FDIC sent to financial institutions.

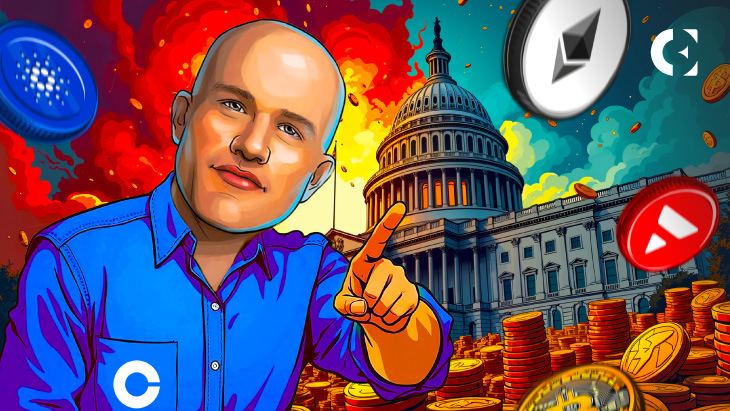

Coinbase founder Brian Armstrong believes large governments often become overly influenced by politics and operate outside the law. He argues that smaller governments are better equipped to handle regulatory challenges because they face fewer political pressures.

Armstrong made these remarks on X after Coinbase Chief Legal Officer (CLO) Paul Grewal revealed findings from a Freedom of Information Act (FOIA) request the exchange made to the Federal Deposit Insurance Corporation (FDIC).

Grewal explained that the FDIC provided information about letters it sent to financial institutions as part of Operation Choke Point 2.0. He characterized the content as “a shameful example of a government agency trying to cut off financial access to law-abiding American companies.”

FDIC Pressuring Banks to Deny Crypto Services

Meanwhile, the Coinbase CLO noted his firm has uncovered over 20 examples of the FDIC telling banks to “pause” or “refrain from providing” or “not proceed” with offering crypto-banking services. He insists that the public deserves transparency and accused the FDIC of working behind a bureaucratic curtain.

Grewal highlighted the magnitude of Coinbase’s discoveries despite noting the crypto exchange has yet to receive the full letters it requested. He promised to continue exploring the FOIA and other necessary means to pursue clarity from regulators.

Earlier this year, Coinbase sued the SEC and FDIC over document requests related to past actions in the crypto industry. The lawsuit asks the Federal Court to compel the agencies to release documents previously requested by Coinbase.

Read also: Coinbase vs. FDIC: Court Orders Agency to Disclose Crypto Crackdown Docs

Notably, Coinbase believes financial regulators have used tools at their disposal to target the digital assets industry. The crypto exchange accused the FDIC of inconsistency and deliberately pressuring financial institutions to cut off access to crypto.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.