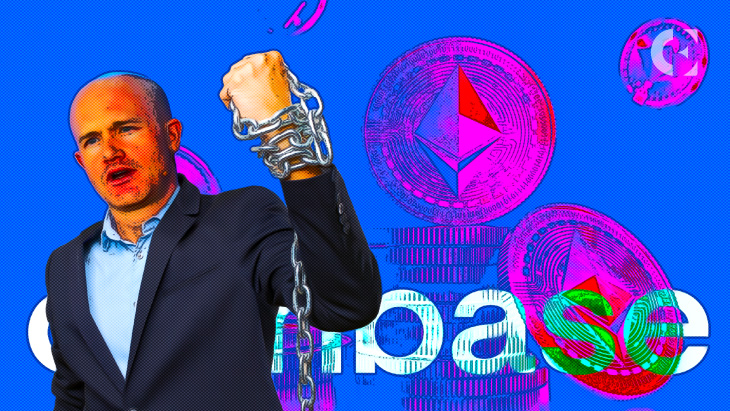

- Brian Armstrong opts to shut down the staking service and preserve network integrity.

- JP Morgan Analysts predict Coinbase could go bullish.

- Armstrong’s view on sanctioning Tornado Cash by the US Treasury Regulatory for laundering about $ 7 billion since 2019.

Coinbase CEO Brian Armstrong says he would opt to shut down the company’s staking service to preserve the integrity of the blockchain network rather than comply with regulatory censorship in response to a hypothetical question posted on Twitter.

While responding to a hypothetical question posted on Twitter by Lefteris Karapetsas, founder of open-source crypto analytics and accounting app Rotki, Armstrong selected the second answer: Shut down the staking service and preserve network integrity.

Question for @LidoFinance, @coinbase, @krakenfx, @stakedus, @BitcoinSuisseAG

— Lefteris Karapetsas | Hiring for @rotkiapp (@LefterisJP) August 14, 2022

If regulators ask you to censor at the #ethereum protocol level with your validators will you:

A) Comply and censor at protocol level

B) Shut down the staking service and preserve network integrity https://t.co/UYVR2L6tB1

However, Armstrong fancied a better third option or a legal challenge that could have had a better outcome.

With the Ethereum Merge fast approaching, JP Morgan analysts predict that Coinbase will go bullish with the Merge for its Ethereum staking service.

The sanctioning of Tornado Cash by the US Treasury for pleading guilty to laundering $7 billion since its inception in 2019 has raised alarms about the possibility of government regulations impacting the network’s fundamental operations.

Armstrong, while revealing his thoughts on the sanctioning of Tornado Cash, made it clear that the adjudication looked like a bad precedent and that it should be challenged. Nonetheless, he further went on to say that he’d follow the protocols and laws.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.