- Coinbase has pulled support for the Clarity Act highlighting restriction over stablecoin rewards.

- The crypto exchange has pointed to rising pressure from the banking industry to influence the Clarity Act.

- The Senate Banking Committee has postponed the scheduled markup to consider this feedback.

Coinbase Global Inc. (NASDAQ: COIN) has withdrawn its support for the Clarity Act. The top-tier cryptocurrency exchange, with significant political influence, pulled its support for the crypto market structure legislation less than 24 hours before the scheduled markup hearing, thus resulting in its delay.

Coinbase Points Flaws on Clarity Act

According to Coinbase CEO Brian Armstrong, the current crypto market structure draft bill has too many issues. As such, Armstrong stated that more revisions are needed on the draft to ensure good faith for the crypto industry.

“We appreciate all the hard work by members of the Senate to reach a bipartisan outcome, but this version would be materially worse than the current status quo. We’d rather have no bill than a bad bill. Hopefully, we can all get to a better draft,” Armstrong stated

Some of the issues pointed out by Armstrong include:

- The current draft of the Clarity Act has subtly banned tokenized equities.

- Unlimited access to DeFi protocols to the U.S Government, which erodes users’ privacy.

- More power to the Securities and Exchange Commission (SEC) instead of the Commodity Futures Trading Commission (CFTC).

- Prohibition of rewards on stablecoin, a feature that is key to DeFi protocols

Several Crypto Firms Support Market Structure Bill

Meanwhile, several crypto firms have already issued support for the Clarity Act draft. Some of the crypto firms that have advocated for the passage of the Clarity Act in its current form include Ripple Labs, Kraken, a16z, Circle, The Digital Chamber, and Coin Center.

Related: Can One Bill Fix U.S. Crypto Rules? Inside the Push for the CLARITY Act

Bigger Picture

As the Clarity Act gets polished up in the Senate, it has received significant bipartisan attention ahead of the 2026 midterm elections. From the viewpoint of the crypto industry, the Clarity Act has already been hijacked by the major players in the traditional banking sector seeking to preserve the status quo.

Furthermore, traditional banks have pointed out that the DeFi space could destabilize their operating models, including community lending. However, Coinbase has championed the empowerment of retail investors through privacy and stablecoin rewards.

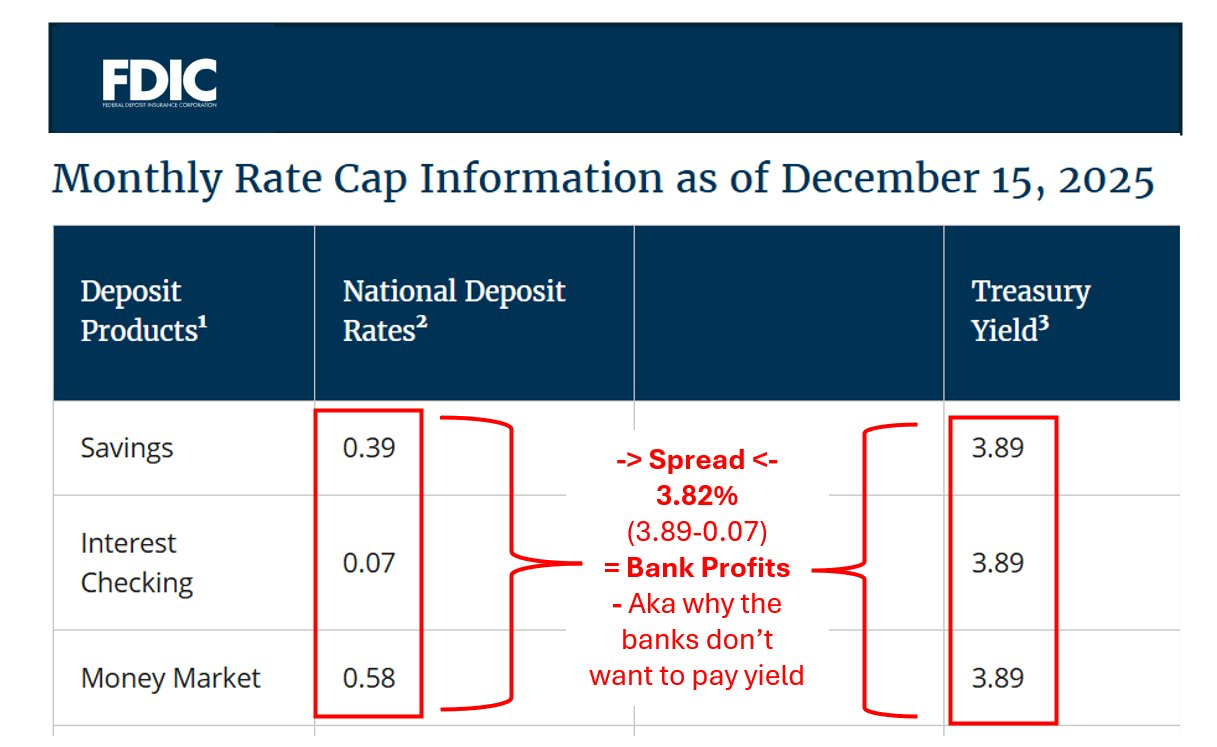

Notably, traditional banks offer almost zero rates on fiat deposits while stablecoins pay over 3.5%.

Source: X

What’s Next?

Following the disagreements on the Clarity Act’s draft, Senator Tim Scott, who chairs the Senate Banking Committee, stated that the scheduled markup has been postponed. David Sachs, the White House crypto and AI czar, urged the crypto industry to resolve the remaining differences on the Clarity Act in a bid to expedite its enactment.

Following the cancellation of the scheduled Senate markup for the Clarity Act, the crypto market retracted gains made in the past few days. Nonetheless, the crypto community has high optimism about the Clarity Act getting enacted in the near future.

Related: Clarity Act Set Markup as Senator Cynthia Lummis Campaigns for Bipartisan Support

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.