- Coinbase stocks have potentially bottomed out, akin to the wider crypto market.

- Goldman Sachs upgraded COIN stocks from neutral to a Buy rating on a strong economic backdrop.

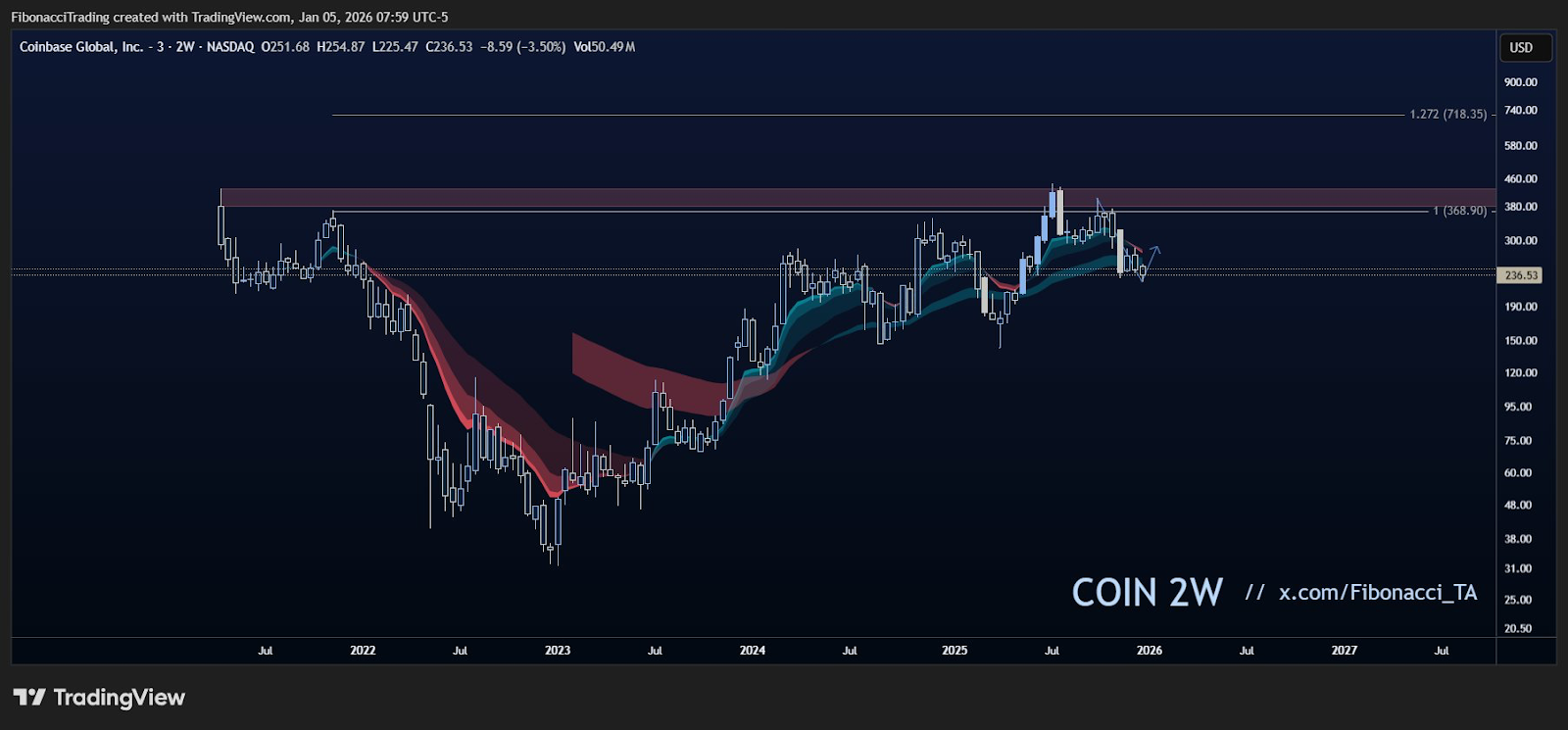

- The 2-week EMA Cloud shows that the COIN price is well-positioned to surge exponentially soon.

Coinbase Global Inc. (NASDAQ: COIN) stocks have signaled a potential market reversal. The COIN price surged around 8% during the past 24 hours to trade at about $255 at press time, signaling a notable decline in selling pressure and a potential renewed interest in crypto-related stocks.

Coinbase Stocks Gain on Rating Upgrade from Goldman Sachs

The main reasons Coinbase stocks have shown bullish sentiment are renewed interest in crypto from both retail and institutional investors. After bleeding in the four quarters of 2025, the crypto market opened 2026 on a bullish note, bolstered by the macroeconomic backdrop.

As such, Goldman Sachs upgraded COIN shares from Neutral to BUY. The bank turned other Wall Street investors bullish on COIN due to the company’s structural growth, amid widening infrastructure business.

According to Goldman Sachs’ report, Coinbase stocks will remain bullish as the company enables the mainstream adoption of tokenized real-world assets. Moreover, Coinbase has backed the Base layer-two scaling solution on the Ethereum (ETH) network, which the bank stated has new, secularly growing products, including prediction markets.

A Rising Competition

Coinbase has been working to improve its product through the Base chain, whereby it offers both traditional and crypto services to its global customers. As such, Goldman Sachs is bullish on COIN compared to its peers such as Robinhood Markets Inc. (NASDAQ: HOOD) and Interactive Brokers Group Inc. (NASDAQ: IBKR).

The firm has faced significant competition from other crypto exchanges, including Binance, Bybit, Crypto.com, and Kraken. However, Brian Armstrong, CEO of Coinbase, noted that investors using its products have an edge as they can access institutional-grade financial products on the blockchain. For instance, COIN holders through Coinbase can get competitive loan rates.

What’s Next for COIN?

Strong fundamentals and technical outlook back the recent COIN price rebound. With COIN stocks heavily correlated with the wider crypto market, a continued rally for Bitcoin (BTC) and Ethereum (ETH) will catalyze a further bullish outlook for Coinbase.

According to market analyst FibonacciTrading, COIN stocks have more upside potential in the near term. The analyst says that if the COIN price on the 2-weekly chart reclaims the EMA Cloud as support, a bull rally akin to the 2025 rally will be imminent.

Related: Coinbase Pauses Peso Services in Argentina as Fiat Operations Are Reviewed

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.