Introduction

Crypto options trading is poised for accelerated growth, marking a pivotal moment in its trajectory, according to data. Currently, crypto options trading constitutes a mere 1% of the total trading volume, a stark contrast to the 53% contribution observed in the traditional finance market.

The latest centralized exchange in the market, Coincall, has embarked on a mission to develop the most user-friendly crypto options exchange, catering to both retail and professional traders. With the active global crypto trader community surpassing 50 million, the exchange anticipates a staggering tenfold growth within three years for its options trading platform.

The main goal of Coincall is to streamline the trading experience for individuals interested in the field. The exchange envisions a financial landscape where comprehending and participating in the trading world is no longer the exclusive domain of financial experts.

To achieve this vision, Coincall places a strong emphasis on providing user-friendly investment products to simplify the onboarding process for new investors. The exchange prides itself on modern interfaces and a comprehensive academy designed to empower novice traders with knowledge, enabling them to make informed decisions and trade more effectively.

| Website | https://www.coincall.com/ |

| Available on mobile | Yes, Android and IOS |

| Number of supported coins/tokens | +70 |

| Number of supported spot trading pairs | 4 |

| Founded year | 2023 |

| Trading types | Spot trading, options trading, futures trading, altcoin options trading, and non-liquidation futures trading. |

Table of contents

History Overview

The team behind Coincall boasts over nine years of collective experience in the crypto industry, with key members hailing from prominent financial institutions such as JP Morgan, Binance, OKX, and Bybit. Notably, the founding team possesses extensive expertise in crypto options trading, having established one of the top proprietary trading teams and managed assets exceeding $300 million

Coincall proudly declared itself the fastest-growing options exchange in 2023, garnering attention from 104,330 traders within a mere 181 days of its launch. Impressively, the options trading volume exceeded 100 million in just 86 days, underscoring the platform’s rapid and substantial impact on the market.

Key Features

Spot Trading

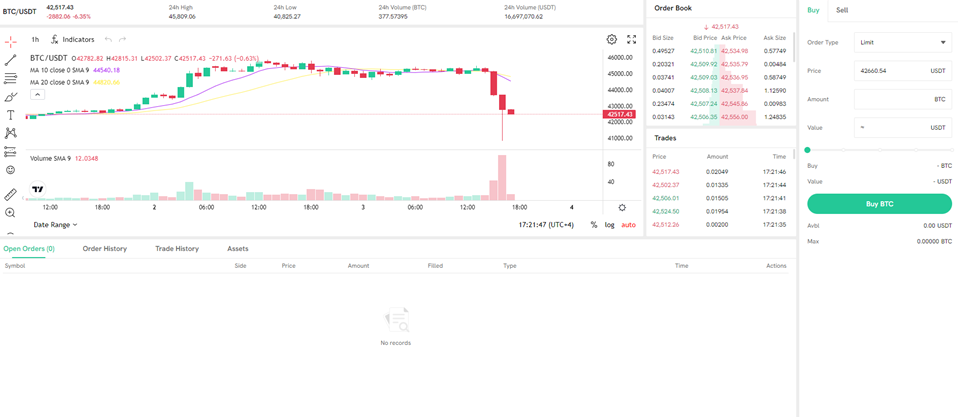

On Coincall’s Spot Trading interface, users can see real-time candlestick charts, an order book, open orders, and order history, with the option to buy or sell the assets. The supported cryptocurrency pairs are BTC/USDT, ETH/USDT, XRP/USDT, and TRX/USDT.

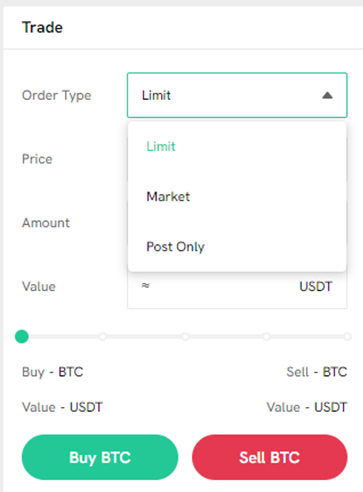

From the interface, traders can choose to buy or sell with three different order types, limit, market, or post only.

Traders using the platform can make trading decisions based on their preferences and strategies, as Coincall supports three distinct order types:

Limit Orders: Users can set specific price levels at which they are willing to buy or sell a particular asset. This order type allows for precise control over the execution price.

Market Orders: Traders can execute orders at the current market price. This type of order ensures swift execution, as it is fulfilled at the best available price in the market.

Post Only Orders: This order type enables traders to post limit orders to the order book without immediately executing them. It ensures that the order will only be added to the order book and not match with existing orders. This can be useful for users looking to add liquidity to the market.

Coincall’s spot trading interface provides users with a user-friendly experience and a range of options to tailor their trading strategies to their specific needs.

Options Trading

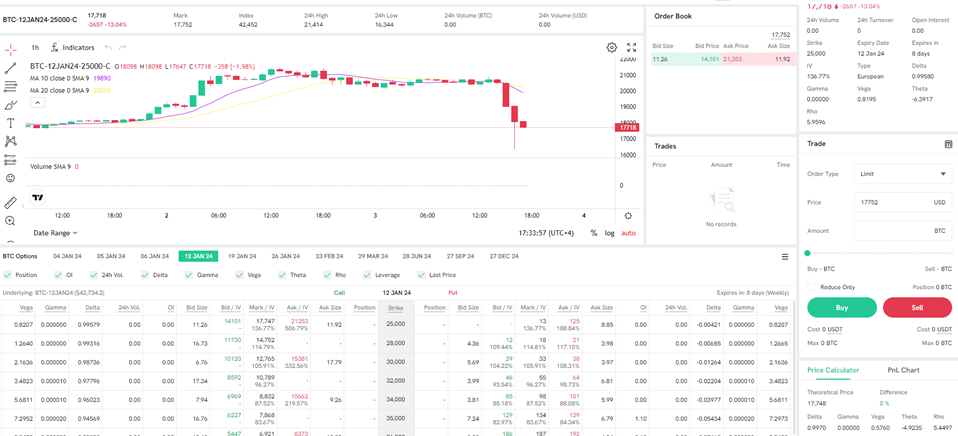

Coincall’s options operate under the European-style options framework, wherein they are automatically exercised at the time of expiration. This style contrasts with American-style options, as European options can only be exercised on the expiration date and not before.

Traders on the Coincall exchange enjoy the convenience of not having to manually exercise options. The system handles the exercise process automatically on the expiration day.

Notably, Coincall’s options contracts are cash-settled, meaning that there is no physical delivery of the underlying asset upon settlement. Instead, the settlement occurs in cash.

Both buyers and sellers have the flexibility to close out their positions before the option contract reaches expiration. By opting for an early closure, they can capitalize on the premium spread, which represents the difference between the buying and selling prices of the option.

Coincall’s options platform supports four transaction types: buying call options, buying put options, selling call options, and selling put options. The supported cryptocurrencies for these options are Bitcoin (BTC) and Ethereum (ETH).

| BTC Options (Calls and Puts) | ETH Options (Calls and Puts) | |

| Contract underlying | BTC/USD Index | ETH/USD Index |

| Settlement currency | USD | USD |

| Contract export | Current day, next day, third day, current week, next week, third week, current month, next month, third month, quarter, next quarter, third quarter, and fourth quarter | Current day, next day, third day, current week, next week, third week, current month, next month, third month, quarter, next quarter, third quarter, and fourth quarter |

| Minimum trading unit | 0.01 BTC | 0.1 ETH |

There are two versions of Coincall’s options trading interface. There is a Pro version for professional options traders and a Lite version that offers a simplified interface and process for options beginners.

The options trading page covers an account overview, where users can see their account data, total assets, available balance, and unrealized profit and loss. The interface also features a real-time candlestick chart that revolves around the four data points—the opening price, the highest price, the lowest price, and the closing price.

The options chain is one of the most important sections of options, as it displays market information of options contracts, including underlying price, strike price, mark price, greeks, trading volume, leverage, ask/bid size, ask/bid price, etc.

Perpetual Futures

Perpetual futures, commonly referred to as perpetuals, represent a derivative contract allowing traders to speculate on the future price of an asset without the constraints of an expiration date. This sets them apart from traditional futures contracts, which come with predetermined expiration dates. Perpetual futures, in contrast, can be held indefinitely.

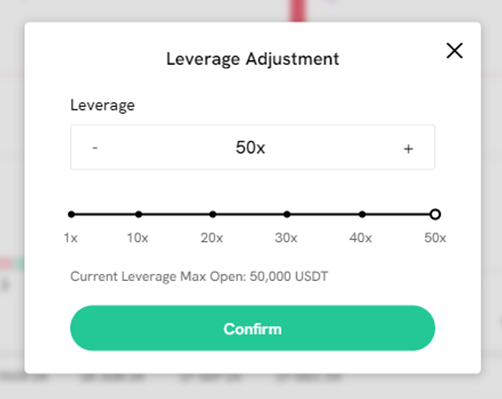

One notable advantage of engaging in perpetual futures trading is the increased flexibility they offer, including higher leverage and enhanced liquidity. Traders can maintain positions for an extended period without being bound by a fixed expiration date.

The Coincall platform facilitates perpetual futures trading through two distinct interfaces tailored to professional and novice traders. This dual-interface approach ensures that traders, regardless of their experience level, can seamlessly and effectively participate in perpetual futures trading.

Non-Liquidation Futures

Traders often fear the risk of liquidation when trading futures contracts. Crypto futures involve agreements where traders can buy or sell a cryptocurrency at a predetermined price on a future date. However, in times of heightened market volatility, if a trader lacks sufficient funds in their trading account to cover potential losses, their positions may face liquidation.

In response to this common concern, Coincall has introduced an innovative solution known as “Non-Liquidation Futures.” This product addresses the high risks associated with liquidation, where even if the cryptocurrency’s price rebounds to its original level, the losses incurred during liquidation are irreversible.

The non-liquidation futures are a cryptocurrency contract settled in Tether (USDT). The exchange clarified that the underlying asset of the non-liquidation futures is the corresponding crypto’s options.

The primary objective of this product is to enable investors to capitalize on both upward and downward movements in cryptocurrency prices by either buying long or selling short non-liquidation futures. It’s important to note that, as of now, the exchange supports only buying long, and efforts are underway to develop futures for selling short.

Altcoin Options Trading

Coincall has made an innovative move in the market by introducing options trading for 10 altcoins, positioning itself as the world’s first exchange to offer this feature. Traders can now engage in options trading for a diverse range of altcoins, including Solana (SOL), Bitcoin Cash (BCH), Litecoin (LTC), Chainlink (LINK), Kaspa (KAS), Polygon (MATIC), Filecoin (FIL), Ripple (XRP), Tron (TRX), and Dogecoin (DOGE).

This expansion in Coincall’s offerings not only broadens the range of cryptocurrencies available for options trading but also provides traders with additional opportunities to diversify their portfolios and capitalize on market movements across various altcoins.

Take Profit (TP) and Stop Loss (SL) Orders

Implementing Take Profit (TP) and Stop Loss (SL) orders is widely recognized as an effective risk management strategy in trading. A Take Profit order allows traders to secure profits when their market predictions align with actual movements, while a Stop Loss order serves as a protective mechanism, enabling traders to minimize losses when the market moves unfavorably.

The automated orders help traders manage risk and reward by planning and letting the system execute the orders automatically, eliminating the need for constant monitoring.

Coincall’s TP and SL orders help traders engage in momentum trading and limit their losses in a volatile market. Once the mark price reaches the predefined trigger price to “take profit” or “stop loss,” the orders will be placed automatically at the predefined order price.

Security

First CEX With 100% Third-Party Fund Custody

Coincall is the first centralized exchange to store all customer assets with third-party custodians. The exchange itself never stores any funds, increasing the assets’ security. The third-party custodians are Copper, Cobo[1] [2] , and Clearloop.

Copper is one of the leading crypto custodians, providing crypto asset custody to more than 500 institutions, including Deribit, Bybit, and OKX. Copper operates a cryptocurrency custody and prime broking platform for digital assets.

Copper uses Multi-Party-Computation (MPC) technology to deliver secure custody to institutional clients. The MPC technology allows multiple parties to share data for computing tasks without revealing each other’s data. This technology enables Copper’s clients to acquire, store, and trade digital assets without sacrificing privacy.

Moreover, leading crypto custodian Cobo[1] [2] is one of Coincall’s trusted custodians, a well-known custodian who has been in the market for six years now. With more than one million registered users and more than 100 billion transactions, Cobo is the perfect safe to store crypto assets.

Thirdly, Clearloop, Copper’s off-exchange collateral management and settlement solution, helps institutional clients mitigate risks and increase capital efficiency by settling trades while traders’ assets remain secure in Copper’s segregated custodian account.

Coincall Bug Bounty Program

To improve the exchange’s security, Coincall introduced the Bug Bounty Program. The program bolsters the security and reliability of the platform by inviting all ethical hackers, security researchers, and community members to strengthen the exchange’s security and help uncover potential vulnerabilities in the system.

The Coincall Bug Bounty Program came to be because the exchange believes that through collaborative efforts with the community, they can ensure a safer trading environment. The exchange offers rewards for identifying and responsibly disclosing security issues.

KYC

Know your customer (KYC) is the first stage of anti-money laundering due diligence. KYC procedures aim to identify and verify a customer’s identity in order to reduce identity theft and fraud.

Coincall exchange requires KYC to be completed to ensure that the exchange complies with legal and regulatory requirements, enhances the security level of users’ accounts, and better combats money laundering and terrorist financing.

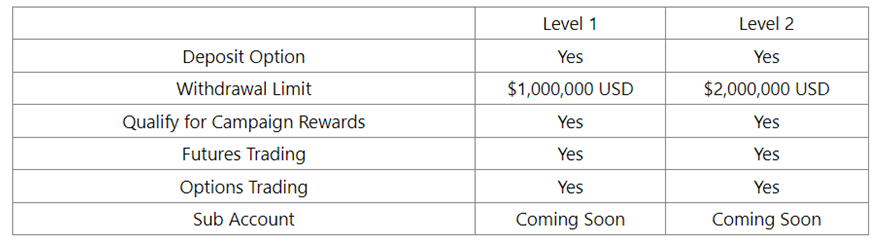

Getting KYC verified at the Coincall exchange proves to be beneficial for traders, as there are a few advantages to getting verified. After getting KYC verified, users gain a deposit option, a higher withdrawal limit, qualify for campaign rewards, and will have futures and options trading.

Depending on the user, there are two types of KYC verification at the Coincall exchange, individual and institutional. The personal/individual KYC verification procedure consists of three levels, basic, level one, and level two. The documents required for verification are a personal ID card and a passport or driving license.

Any non-individual accounts on Coincall have to be verified with an institutional KYC. The key requirements for the verification differ from the individual KYC, and Coincall explains the whole process in a detailed guide, helping institutional investors trade with ease.

Deposit/Withdrawal/Trading Fees

Coincall’s options and futures trading have different fees that vary by product and are calculated as a percentage of the underlying asset of the contract.

Trading Fees

A trading fee will be charged after opening or closing a position. Each transaction’s trading fee is calculated based on the underlying asset’s spot index price at the time of order completion.

| Maker Fee Rate | Taker Fee Rate | |

| Futures | 0.02% | 0.06% |

| Bitcoin and Ethereum Options | -0.02% | 0.10% |

| Altcoins Options | 0.02% | 0.06% |

| Spot | 0% | |

Delivery Fees

The exchange charges delivery fees whenever the options are exercised, and they’re calculated based on the settlement price at the time of order completion.

| Products | Types | Fee Rate |

| Options | Daily | 0 |

| Options | Weekly/Monthly/Quarterly | 0.015% |

Deposit and Withdrawal Fees

Coincall doesn’t charge any fees for deposits. However, the exchange does have a minimum deposit requirement and some withdrawal fees.

| Coin | Network | Minimum Deposit | Withdrawal Fees |

| USDT | Ethereum | 0.01 | 7.5 |

| USDT | Tron | 0.01 | 2 |

| TRX | Tron | 0.01 | 21 |

| XRP | XRP Native | 0.01 | 0.4 |

Coincall Academy

Coincall Academy offers free education for traders, with teachers available in the community to help beginners and advanced traders with all their trading inquiries. Moreover, Coincall hosts weekly lessons and live streams on the Coincall Academy website. The website is available in English, Spanish, Korean, Japanese, and Chinese.

The academy provides guides for beginners and advanced traders. For beginners, the Coincall Academy has a separate guide for everything traders need to know about option trading, covering all information from what options trading is, when to trade options, the advantages of options trading, and the types of options trading.

The advanced traders guide section covers more advanced guides such as implied and realized volatility and a few other technical terminologies. Moreover, the academy covers a “Practical Strategies” section, helping traders benefit from the Coincall exchange to the maximum and trade with profit. Strategies such as selling call options, selling put options, bull spread, bear spread, buying put options, and buying call options are all covered in the Coincall Free Academy.

Pros and Cons

| Pros | Cons |

| Non-liquidation futures trading | No fiat currency deposits or withdrawals |

| Beginner and advanced trading tools | |

| Variety of trading types | |

| Free academy and guides for beginner and advanced traders | |

| Zero spot trading fees |

Final Score

| Services offered | 5/5 |

| Cryptocurrency support | 4/5 |

| Fees | 4/5 |

| Security | 3/5 |

| Review score | 4/5 |

Summary

As one of the latest crypto exchanges in the market, Coincall offers innovative trading tools for beginners and advanced traders, helping them trade easily and securely. The exchange boasts of having 100% third-party fund custody, making it the first centralized exchange to not hold any users’ funds.

The team behind the Coincall exchange is a talented and experienced team with more than nine years of experience in the crypto industry. A team that previously founded one of the top proprietary trading teams that ranked number one globally on Binance’s total PnL leaderboard in 2020 and 2021.

Spot trading, options trading, futures trading, and non-liquidation futures trading are all trading options on the Coincall exchange. Each trading type on the exchange features a lite and a pro version, making the exchange user-friendly for both beginners and advanced traders.

One of the key services of the exchange that distinguishes it from the rest is altcoin options trading. Users can trade up to 70 altcoins on the Coincall exchange.

Frequently Asked Questions (FAQs)

Traders can utilize Coincall’s variety of cryptocurrency options, as the platform offers BTC, ETH, XRP, and TRX for spot trading and BTC and ETH for non-liquidation futures. Additionally, there are almost 70 cryptocurrencies for futures trading, such as BTC, ETH, SOL, DOGE, XRP, LTC, ADA, LINK, MATIC, TRX, ALGO, PEPE, BNB, UNI, SEI, and AAVE.

As for options trading, there are 12 cryptocurrencies, such as BTC, ETH, SOL, DOGE, XRP, MATIC, LINK, and TRX.

The fees vary depending on the trading market type. For makers, the fees are as follows: futures: 0.02%, BTC and ETH options: -0.06%, altcoin options: 0.02%, and zero trading fees for spot trading. As for takers, futures fees are 0.06%, BTC and ETH options are 0.015%, altcoin options are 0.06%, and zero trading fees for spot.

Coincall boasts of having many types of trading markets on its platform. Options trading, altcoin options trading, futures trading, spot trading, and non-liquidation futures trading.

Yes, other than the desktop version, Coincall is available for Android and iOS users.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.