- CRO consolidates near $0.205, balancing momentum between buyers and sellers.

- Rising futures open interest above $106M signals growing speculative bullish sentiment.

- Key resistance at $0.216 and support near $0.20 define CRO’s immediate trading range.

Cronos (CRO) is navigating a consolidation phase after rebounding from late-September lows, with its price holding near $0.205. The cryptocurrency’s movement between the 20-day and 50-day exponential moving averages (EMA) suggests a tug-of-war between buyers and sellers. Despite subdued price action, trading activity across derivatives has accelerated, pointing to renewed speculative interest and potential volatility in the near term.

Market Consolidation and Technical Setup

CRO’s recent trading range between $0.20 and $0.216 highlights a cautious market stance. The token faces immediate resistance near $0.216, where a prior rejection and the 100-EMA converge.

Breakout above this level could propel the price toward $0.241, corresponding with the 1.618 Fibonacci extension. Beyond this, the next resistance band sits between $0.256 and $0.266, forming a critical test area for momentum continuation.

On the downside, $0.20 acts as the first line of defense, followed by stronger support near $0.191. A decisive drop below that region might open the path to $0.175 the September low. However, as long as CRO maintains its footing above $0.20, bulls may continue accumulating in anticipation of a breakout attempt.

Related: Ethereum Price Prediction: Samsung Staking And BitMine Treasury Fuel Demand

Rising Open Interest and Market Sentiment

A notable development in recent weeks is the sharp surge in open interest across CRO futures. From under $40 million in late August, it has climbed to about $106.7 million as of October 7, marking its highest level in months.

This increase suggests that traders are actively positioning for price continuation rather than covering shorts. Historically, such synchronized growth in price and open interest points to a strengthening bullish narrative.

Moreover, this shift comes at a time when CRO has doubled from $0.10 to $0.21, signaling renewed investor confidence in its derivatives market. Higher participation often precedes stronger price moves, hinting that volatility could expand as speculative interest deepens.

Related: SUI Price Prediction: Mainnet Upgrade Boosts Momentum

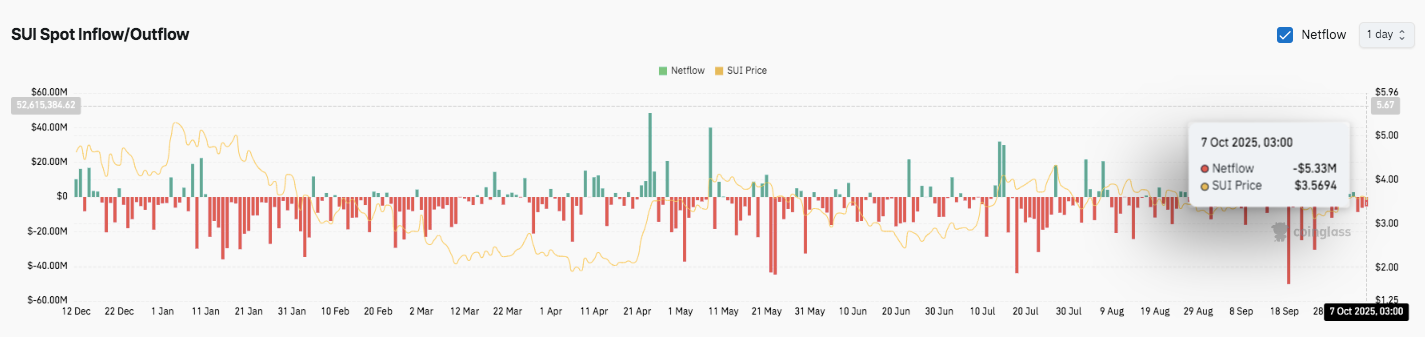

Outflow Trends Indicate Cautious Accumulation

Despite improving technical conditions, on-chain data shows consistent outflows throughout 2025, reflecting investor caution. The largest withdrawal spike occurred in late August, followed by a mild recovery phase. As of early October, daily net outflows stood at roughly $535,000.

Consequently, while market sentiment remains restrained, steady accumulation near $0.20 suggests that long-term holders are building exposure. If momentum strengthens above $0.216, Cronos could reenter a broader uptrend, with the $0.241–$0.266 range serving as the next major test for bulls.

Technical Outlook for Cronos (CRO)

Cronos (CRO) continues to consolidate within a well-defined range heading into mid-October, showing balanced momentum between buyers and sellers.

- Upside levels: Immediate resistance sits at $0.216, aligning with the 100-day EMA and previous rejection zone. A breakout above this mark could push prices toward $0.241 the 1.618 Fibonacci extension followed by $0.256 and $0.266 as extended upside targets.

- Downside levels: Near-term support rests at $0.20, followed by $0.191 as a stronger floor linked to the 3.618 Fibonacci extension. If selling intensifies, the next key support lies at $0.175, which marked the September rebound low.

- EMA structure: The 20-EMA ($0.2088) and 50-EMA ($0.2069) remain tightly aligned, signaling compression and potential volatility expansion. The 200-EMA ($0.2125) acts as a dynamic pivot holding above it would reinforce medium-term bullish sentiment.

Will Cronos Extend Its Rebound?

Cronos price outlook for October depends on sustained accumulation above $0.20 and open interest strength above $100 million. The rising derivatives activity suggests increasing speculative confidence, but on-chain outflows signal lingering caution among long-term holders.

Related: XRP Price Prediction: Trump’s Crypto Endorsement Sparks Ripple Momentum

If bulls manage a clean close above $0.216, the next target range between $0.241 and $0.266 could come into play. Conversely, losing the $0.19–$0.20 support band would risk a pullback to $0.175 and potentially stall short-term momentum.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.