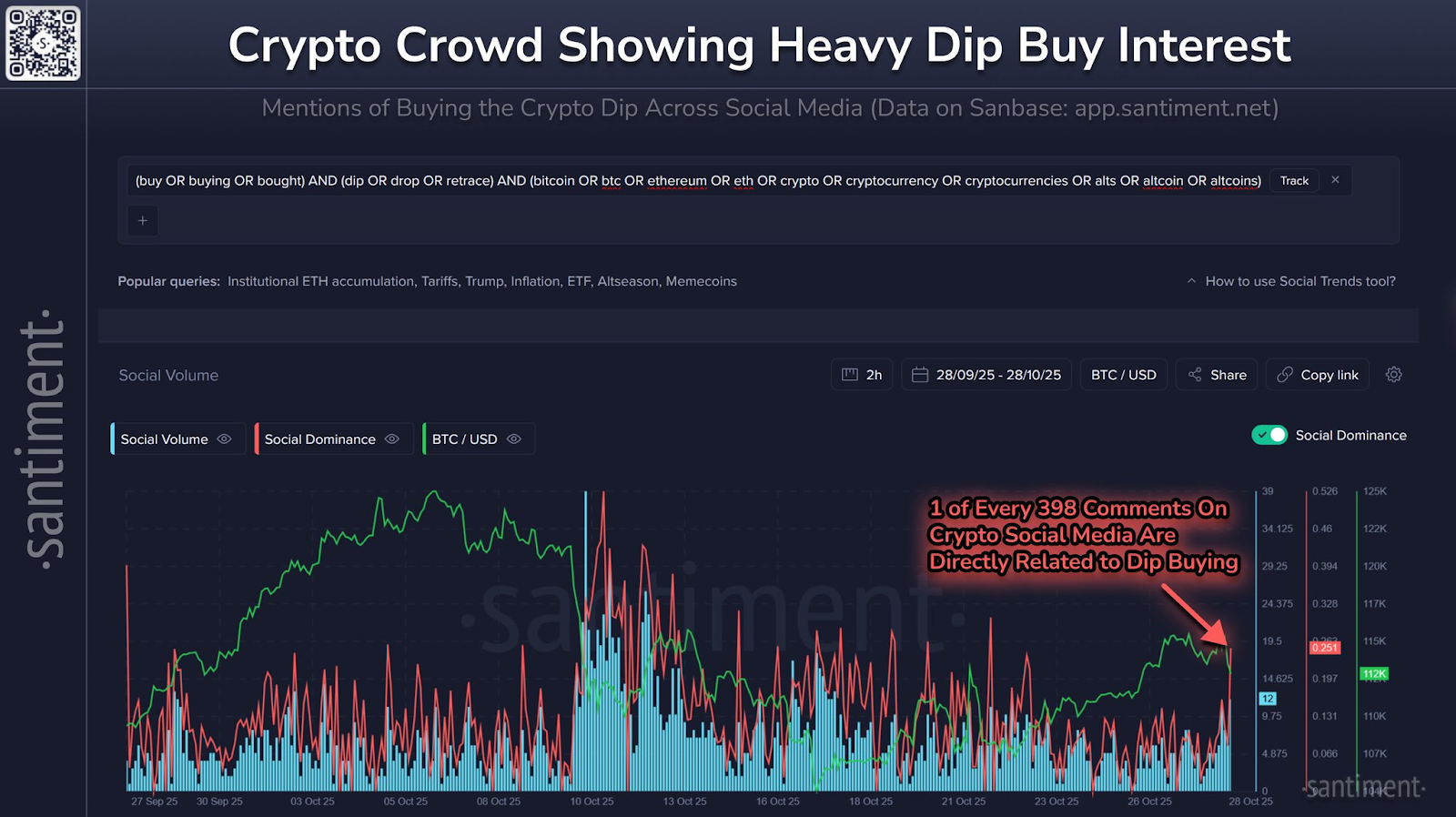

- Santiment: High crowd interest in buying the dip is a classic contrarian bearish signal.

- A $512M liquidation cascade, mostly longs, hit the market ahead of today’s FOMC decision.

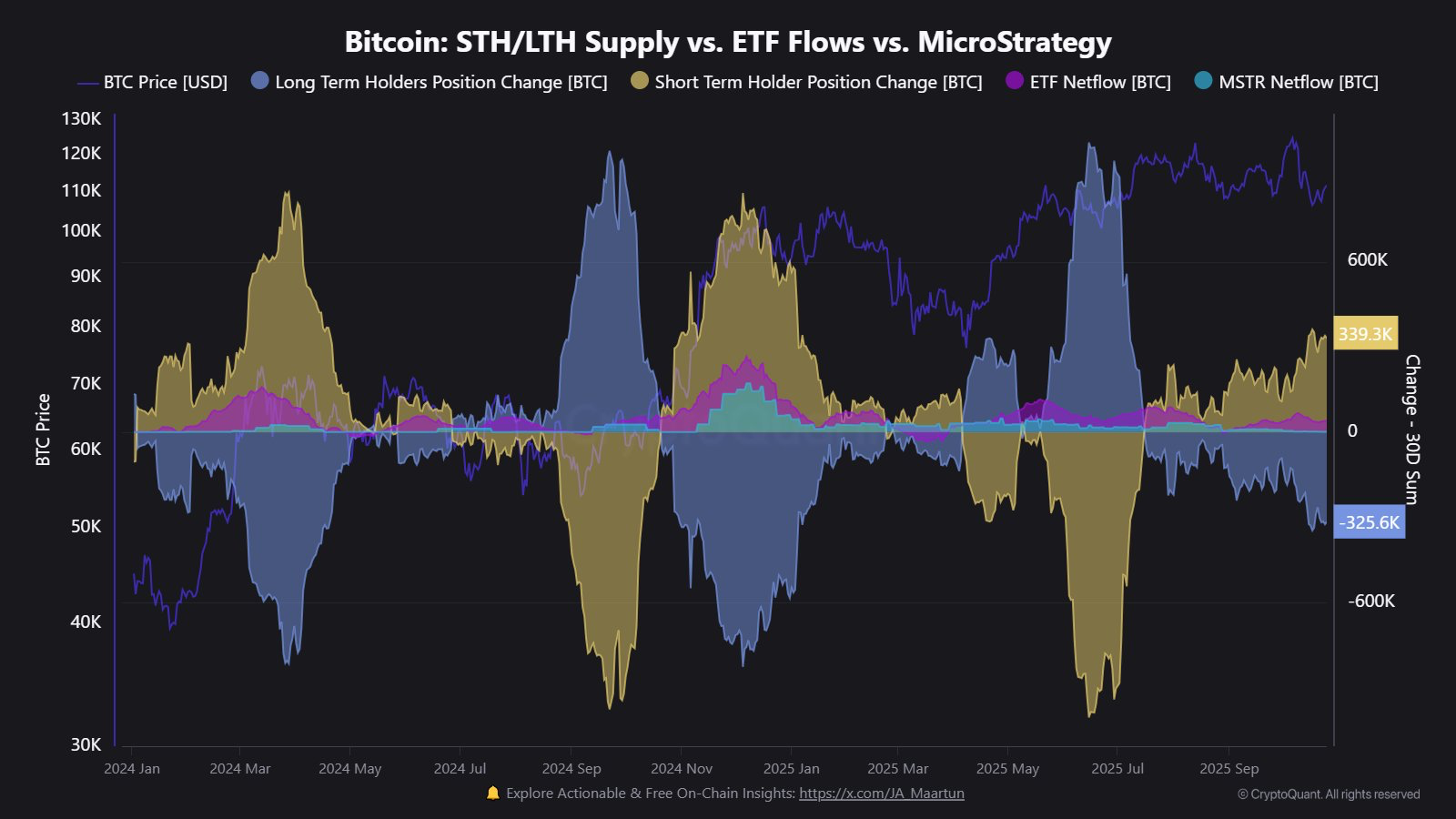

- CryptoQuant: Long-term Bitcoin holders sold 325,600 BTC in the past 30 days.

Santiment data analysis reveals the midterm crypto market pain may not be over. A slight market drop on Tuesday triggered over $512 million in liquidations from leveraged traders. In response, Santiment’s data now shows a high level of interest among the crowd to “buy the dip.”

Santiment warns that more pain is likely before an ultimate rebound. Historically, a high volume of dip-buying calls is a contrarian indicator. This pattern often precedes a mild short-term retrace, which is then followed by further downside pressure.

Related: FOMC Day: Bitcoin Stays Strong as Altcoin Catalysts Build with these 4 Altcoins

“Once their (crowd) optimism (FOMO) turns to fear (FUD), this is when we see the biggest rallies,” Santiment noted.

Why a Midterm Crypto Retrace is Likely Amid Robust Fundamentals

Market Weak Ahead of FOMC

The crypto market is showing midterm bearish sentiment just hours before today’s October 29 Fed rate decision. This market uncertainty persists despite Polymarket and Kalshi showing odds of a 25 bps rate cut at over 97%.

According to Tom Lee, the Fed’s QT is likely to end on Wednesday, which is ultimately good for equities and the crypto market. Meanwhile, the macroeconomic uncertainty caused by ongoing tariff trade negotiations amid geopolitical tensions between Russia and Ukraine has caused concern of further downside risk.

Sell-the-News Impact After Potential Fed Rate Cut and Listing of Spot Alts ETF

The crypto market is likely to experience mid-term bearish sentiment due to the classic selling on the news impact. Notably, the crypto market’s bullish momentum may momentarily fade after the Fed initiates a 25 bps rate cut, it ends QT, and amid the ongoing listing of spot altcoin exchange-traded funds (ETFs).

Notably, several altcoins, including Solana (SOL), Litecoin (LTC), and Hedera’s (HBAR), have seen the listing of their respective spot ETFs after the U.S. Securities and Exchange Commission (SEC) approved generic listing standards before the ongoing government shutdown.

Long Squeeze Impact Amid Low Demand from Whales

Following the liquidation of over $512 million during the last 24 hours, about $354 million involved long traders. As such, midterm leverage buyers may turn bearish to ride on the bearish wave, thus further increasing downside momentum.

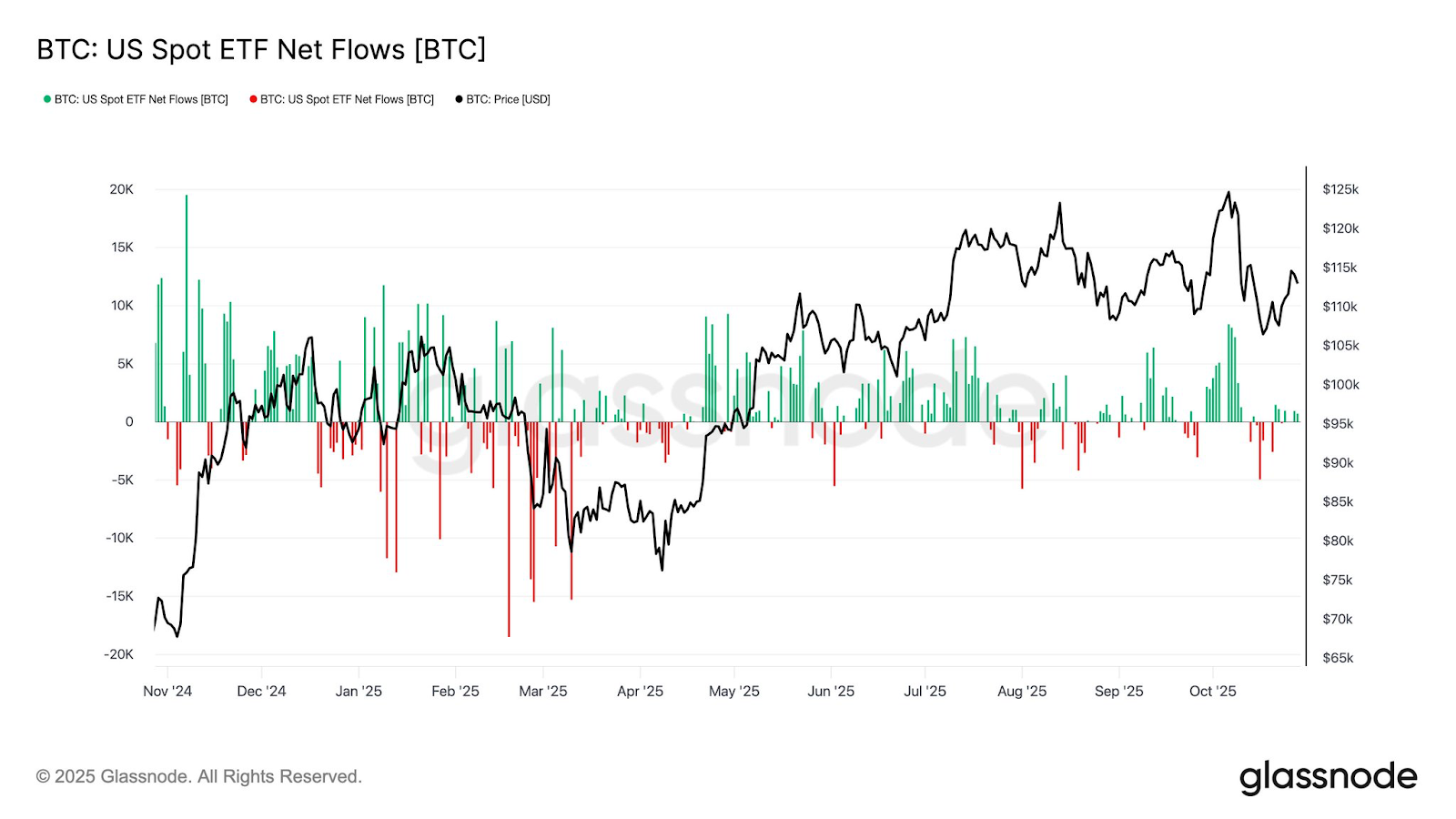

The demand for crypto assets by whale institutional investors has significantly declined in the recent past. For instance, the U.S. spot BTC ETFs have recorded positive cash inflows in the last few days but significantly lower compared to earlier this year.

According to on-chain data analysis from CryptoQuant, the long-term Bitcoin holders have shed 325,600 BTC over the last 30 days.

Notably, this is the sharpest monthly drawdown since July 2025, thus further weighing down on midterm crypto bullish sentiment.

Related: Arthur Hayes Uses 100 Years of Stock Data to Predict Crypto Graveyard – 99% Failure

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.