The year 2025 has been a brutal teacher for retail traders chasing quick gains in the meme coin and celebrity-token craze. Some coins soared briefly, but most crashed just as quickly, wiping out millions and leaving thousands with heavy losses.

According to DappRadar and on-chain sleuths, rug pulls are becoming less frequent than in the bull runs of 2021–2022. Notably, there’s a 66% year-on-year decrease in rug pull. However, the ones that do happen are far more damaging, often tied to celebrity hype and political endorsements. For context, over $6 billion has been lost to rug pull this year alone.

From Kanye West’s YZY token to Argentina’s LIBRA coin, these crashes show common problems: huge insider holdings, unclear teams, and poor liquidity protections. For the crypto community, the lesson is simple: hype doesn’t mean a project will last.

Case Studies: 2025’s Biggest Rugs and Fast Crashes

- YZY (Kanye West/ Ye)

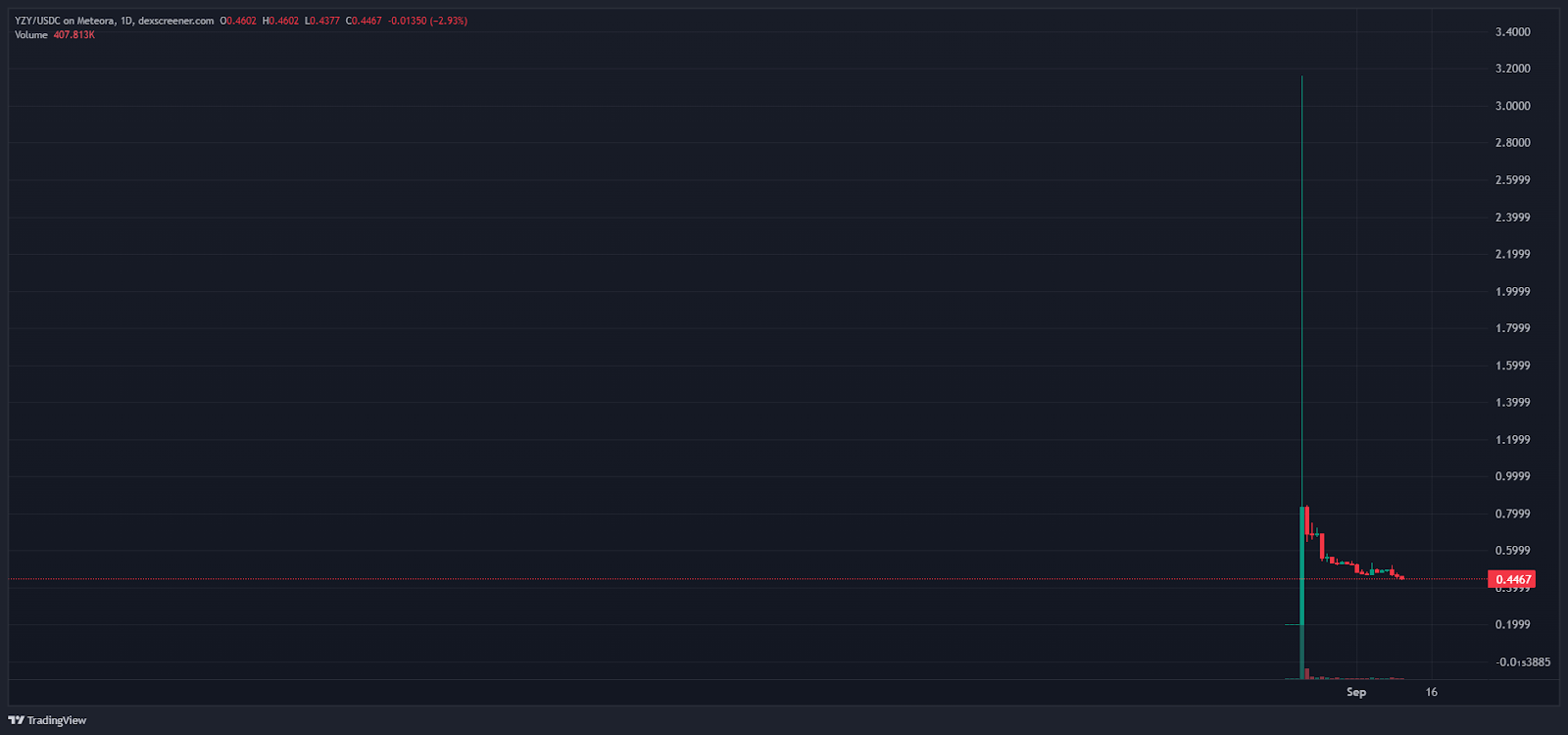

Launched on August 21, Kanye West’s YZY coin is the latest in the series of celebrity coins in 2025.

- The Solana-based coin tied to Ye’s Yeezy brand soared nearly 1,400% in its first hour. It hit $3.16.

- Within 24 hours, it crashed below $0.83, later touching $0.44, erasing up to 90% from its peak value.

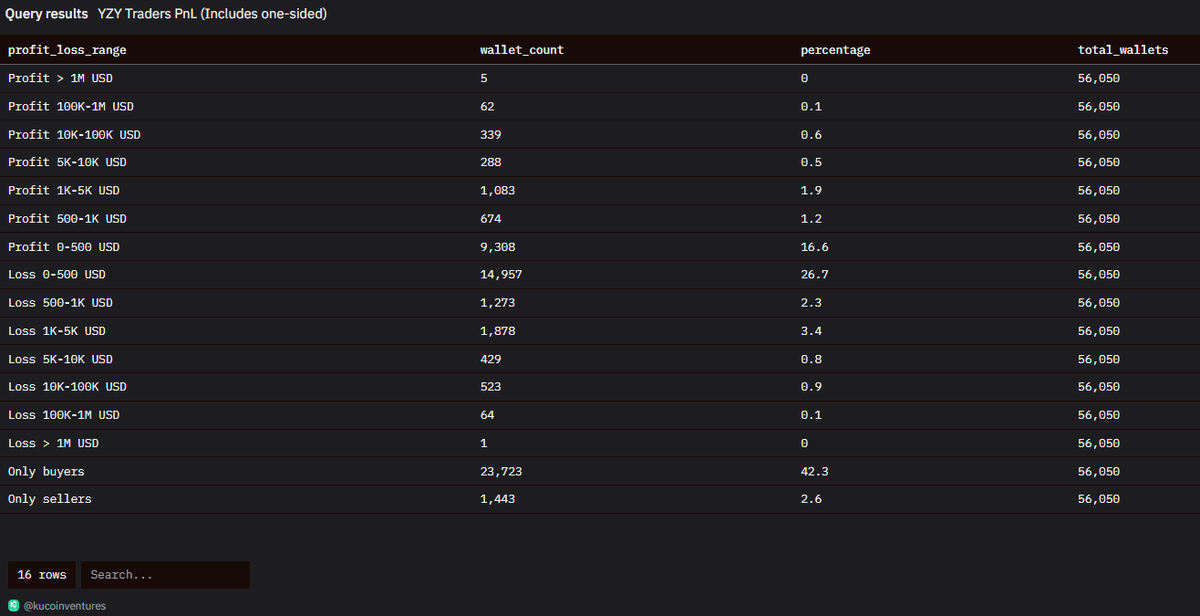

- Over 51,000 traders reportedly lost $75 million, while a handful of wallets captured outsized insider gains.

On-chain data revealed wallet clustering and concentrated insider exits. The hype of a Yeezy-linked token lasted hours before unraveling into one of Solana’s fastest crashes.

- TRUMP (Donald Trump)

Backed by U.S. President Donald Trump, the TRUMP meme coin launched on January 18, 2025. It launched with a $1.2 price on the eve of the presidential inauguration.

- It peaked at an all-time high of $75 on January 19.

- By April, its price had sunk to $7, down by approximately 90% from its peak as liquidity drained and whales exited.

- The token now trades at $8.83 after a moderate 6.2% rise in the past week.

- TRUMP initially outranked Shiba Inu to become the biggest meme in the market in the heat of the frenzy. It’s at position 7 today.

Promoted by Donald Trump himself, TRUMP saw vertical growth to a fully diluted cap of $75 billion before bleeding out. Retail bought into political clout, but whales dumped, leaving the majority of holders in heavy losses.

Related: Justin Sun Rejects Bribery Claims After TRUMP Memecoin Gala With Trump

- MELANIA (Melania Trump)

Barely two days after TRUMP, the wife of U.S. President Melania Trump, launched her MELANIA token.

- Opening near $8.40, it spiked to $13.16 before collapsing within hours to $3.74.

- Analysts flagged massive profit-taking by insiders and early buyers who acquired tokens at near-zero cost.

- The token hasn’t recovered since then. It now trades at $0.1988, a 98.54% loss from its all-time high.

- LIBRA (Javier Milei, Argentina)

Promoted by Argentina’s libertarian president, LIBRA debuted on February 14 at a launch price of $0.216.

- Within hours, the token rocketed to $4.57 before collapsing nearly 90% to $0.88 as insiders dumped.

- The scandal triggered political uproar in Argentina, with investigations linking it to broader “celebrity coin” schemes.

- Local media called it a “rug pull,” triggering investigations and fueling debates about corruption.

President Javier Milei’s deleted tweet that promoted the LIBRA coin

Related: Argentina’s President Javier Milei Shuts Down $LIBRA Memecoin Scandal Investigation

- AQUA (Aquabot Trading Bot)

Most recently, Aquabot staged a presale of 21,770 SOL ($4.65M) before its launch in September.

- Within 75 minutes of trading at $0.03303 on September 8, AQUA plunged 61% to $0.0129.

- On-chain sleuth ZachXBT flagged suspicious presale routing, while the team went silent and locked replies on X.

- Fake CR7 (Cristiano Ronaldo) Tokens

On August 25, 2025, a flurry of fake Solana-based $CR7 tokens rode on rumors of Cristiano Ronaldo launching a coin.

- One version briefly touched a $143M market cap before dumping 98% in 15 minutes.

- Ronaldo himself had no token, only prior NFT deals. This highlights the risk of rumor-driven apes. Analysts called it a “classic rumor-pump” rug.

Why Retail Keeps Getting Trapped

These cases all share red flags:

- Opaque teams

- Celebrity clout over fundamentals

In each instance, early insiders dumped on retail, while communication channels went silent. Analysts often warn that such “celebrity meme coins” disproportionately end in pump-and-dump.

It’s a simple pattern: when celebrities promote something, people rush in out of fear of missing out—often without doing any research. In Argentina, the LIBRA fiasco showed how even politicians can fuel the hype. And with Solana’s fake CR7 tokens, just rumors were enough to drive prices up by $143 million.

Additionally, there are weak safeguards.

- Liquidity not locked

- Concentration of supply in a handful of wallets.

Many of these coins had no liquidity locks, no vesting schedules, and no code audits. Wallet analysis also shows that insiders often held most of the supply, making it easy for them to dump on the market.

These rug pulls aren’t one-offs—they follow the same pattern every time: hype, a sudden price spike, insider sell-off, then silence.

How to Spot Rugs Before You Ape

The 2025 rug cycle highlights the importance of DYOR (Do Your Own Research). Here’s a checklist every trader should run through:

A. Fundamentals (Project & Team)

- Team Transparency: Are founders doxxed with verifiable history, or anonymous accounts?

- Docs & Roadmap: Is there a real product or demo, or vague promises of “soon”?

- Tokenomics: Fair distribution and vesting, not massive insider allocations. Tools like Bubblemaps can reveal wallet clustering.

B. Technical (Contract & Liquidity)

- Liquidity Lock: Is DEX liquidity locked and verifiable on-chain?

- Contract Safety: Scan for blacklists, mint authority, trading blocks, or fee switches.

- Audits: Credible audits or scanner checks (RugCheck, SolanaTracker, GeckoTerminal).

C. Market Behavior

- Holder Concentration: If top 3 wallets hold >70–80%, expect coordinated dumps.

- Hype Script: Sudden celebrity/political endorsements, vertical pumps, blocked comments, then funds bridged out.

- Presale Custody: If funds sit in a single EOA and start moving to exchanges before launch (like AQUA), that’s a red flag.

D. Rug-Sense Practical Checklist

- Contract scan (mint, blacklist, tax >10%).

- Liquidity lock expiry check.

- Top-holder distribution maps.

- Team communication channels are open and verifiable.

- Third-party audit/KYC present.

- Narrative check: if utility = celebrity clout only, it’s pure speculation.

As CoinGecko notes, no single check guarantees safety, but ignoring them almost guarantees loss.

Related: Crypto Rug Pull Threat Shifts: Less Frequent But Far More Damaging in 2025

Lessons for the 2025 Bull Run

The rugs of 2025, from Kanye’s YZY to Milei’s LIBRA, show a troubling shift: while fewer in number, they’re larger in scale and more tied to celebrity or political branding. Retail continues to suffer because FOMO overrides research, and insiders exploit that psychology.

For crypto to mature, retail traders must develop discipline. The bull run will bring new opportunities, but the cost of ignoring due diligence has never been higher. If the only utility a token offers is hype, then odds are it’s a setup for a rug.

As one analyst noted after the LIBRA crash: “In 2025, the most dangerous utility in crypto is fame itself.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.