- stETH has once again started to trade at a discount to Ethereum (ETH) itself.

- The stETH share of the Curve stETH/ETH pool has climbed up to 69%.

- stETH is currently trading at $1,159.99 after a 1.12% drop in price.

Crypto analyst Dylan LeClair took to Twitter on November 25 to share some information about the imbalances in Lido Staked ETH (stETH) that can be seen in the ecosystem at the moment.

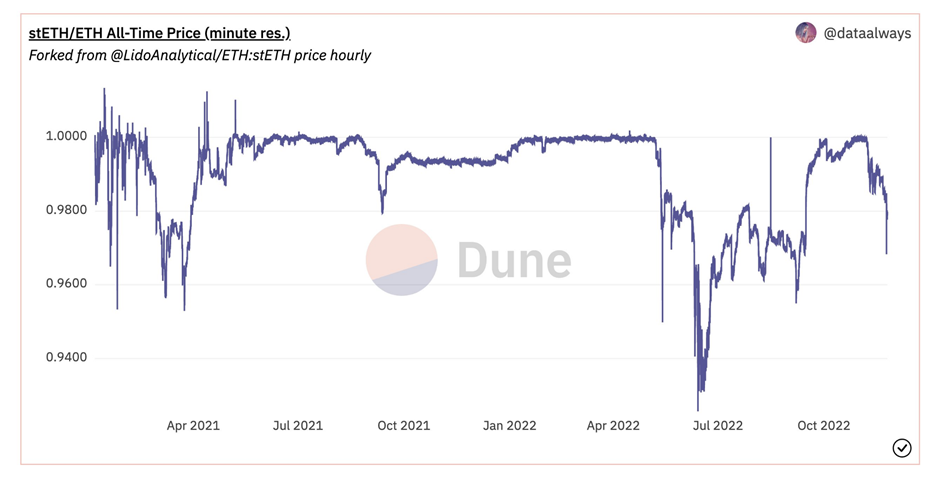

According to the post, stETH has once again started to trade at a discount to Ethereum (ETH) itself. The last time that this level was so low was during the Terra USD (UST) disaster.

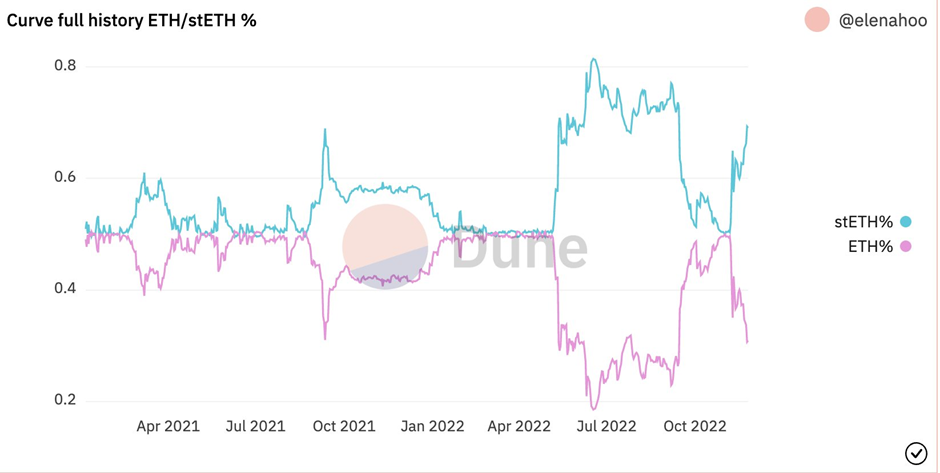

In addition to this, the stETH share of the Curve stETH/ETH pool has climbed up to 69%, which is a notable imbalance. LeClair concluded his post by mentioning that these numbers are something that investors should keep an eye on.

According to the crypto tracking website, CoinMarketCap, Lido Staked ETH (stETH) is currently trading at $1,159.99 after a 1.12% drop in price over the last 24 hours. stETH was also able to reach a low of $1,147.99 and a high of $1,179.90 over the same time period. In terms of weekly performance, the crypto is in the red as well by more than 2%.

In addition, stETH’s 24-hour trading volume is also in the red today as it currently stands at $374,721 after dropping more than 19% over the last day.

With its market cap of $4,046,851,334, stETH is currently the 203rd biggest cryptocurrency in the market in terms of market capitalization. This places the crypto right behind HEX in the 202nd position and in front of Frax (FRAX) in the 204th position on the list of cryptocurrencies.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.