- A technical analyst used BTC trend context and on-chain data to predict whether to go long or short.

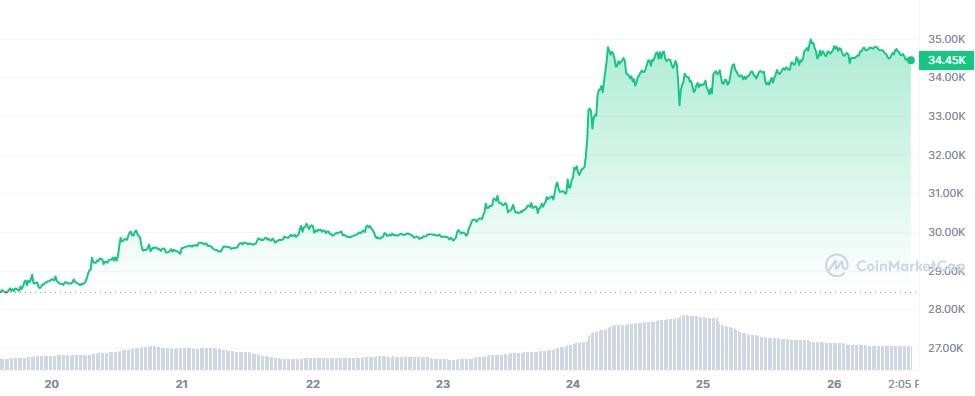

- BTC experienced a massive spike on the fifth; it rose from $30.6K to $34.7K.

- BTC regains its lost uptrend gradient but it won’t be able to hold that shape for long.

Technical Analyst CryptoSoulz expounded reasons as to what made BTC spike by 25% during the last 5 days, in a tweet. The analyst supplemented his reasoning on the on-chain data and the context of Bitcoin’s uptrend. Based on that, CryptoSoulz advised his followers to either short or go long.

In the thread, the analyst requested his followers to short BTC as he was tentative about BTC testing the key resistance is placed at $37,330. When looking at the weekly chart below, it could be seen that BTC was gaining value throughout the week except for the few retracements it went through.

The price action for BTC was very limited during the first four days of the week. But come the fifth day of the week, BTC rose from $30.6K to $34.7K within a few hours. After reaching its highest value of $34.78K, it is currently consolidating between the $34K and $35K limit. The price of BTC at press time is $34,404 after it experienced a 21% surge in 7 days.

The above chart shows that BTC has regained the rising gradient that it lost during mid-August 2023. If BTC manages to hold this shape and keeps rising, it could likely reach $39,950. However, the Accumulation/Distribution Line (ADL) reads a value of 10.73M and the line keeps falling down, hence, this shows that the surge in BTC is not supported by volume. As such, BTC could fall at any given time.

If BTC is to fall it may land on $31,500, but whether that will support BTC’s fall is questionable. Notably, the above-mentioned support level was tested just once, hence, it would be interesting to see whether $31,500 could hold the bear -pressure.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.