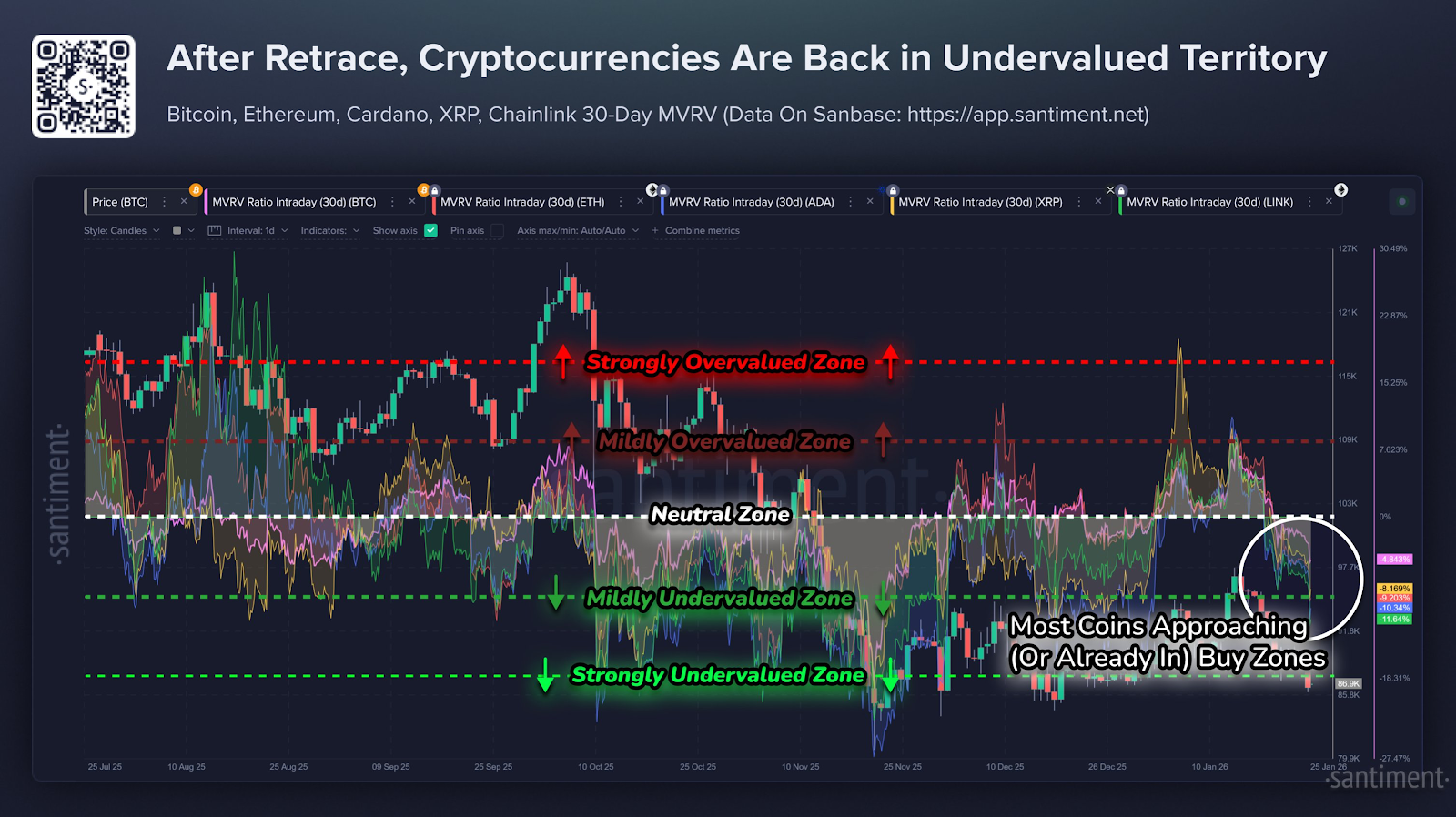

- Santiment’s 30-day MVRV shows crypto assets have dropped to undervalued levels.

- Chainlink and Cardano are more undervalued large-cap altcoins than XRP.

- Rate-cut signals and institutional demand could lift undervalued altcoins.

After a brutal retrace in the past three weeks, the wider crypto market has approached historical undervalued territory. According to Santiment’s 30-day MVRV indicator, Bitcoin (BTC) has led the wider altcoin market in undervalued levels, which have historically proved to be profitable purchases.

What are The Top Undervalued Crypto Assets?

The Santiment’s 30-day MVRV indicator shows most cryptocurrencies have dropped to negative percentages. Currently, Bitcoin’s 30-day MVRV hovered around negative 3.7%, which represents mildly undervalued.

Chainlink (LINK)

According to Santiment, Chainlink (LIINK)‘s 30-day MVRV indicator hovered around negative 9.5%, signaling its undervaluation. This midcap altcoin, with a fully diluted valuation of about $11.8 billion, dropped over 8% last week to trade at $11.8 at press time.

However, the LINK/USD pair in the weekly timeframe shows potential for further downside in the coming days towards its support level around $8.5 before rebounding.

Cardano (ADA)

According to Santiment, Cardano’s 30-Day MVRV Indicator hovered around negative 7.9%, thus also signaling undervaluation. This large-cap altcoin, with a fully diluted valuation of over $12.4 billion, dropped nearly 7% last week to trade about $0.34 at press time.

However, technical analysis shows the ADA/USD pair is under midterm bearish pressure with a target of about $0.27 before a bullish rebound happens.

Ethereum (ETH)

As for Ethereum (ETH), its 30-day MVRV indicator dropped to negative 7.6% after its drop last week. This large-cap altcoin, with an FDV of about $348 billion, dropped over 10% last week to trade at about $2,887 at press time.

XRP (XRP)

Meanwhile, XRP’s 30-day MVRV indicator dropped to about negative 5.7%, which is also in undervalued territory. From a technical analysis standpoint, the XRP/USD pair is likely to retest its 2021 peak, which was converted to a support level in 2025.

Bigger Picture

The crypto market has largely wiped out all the gains it recorded in the first week of 2026 to date. Following the ongoing parabolic rally in Gold (XAU) and Silver (XAG), the crypto market has suffered bearish sentiment.

However, a reversal is expected in the midterm, catalyzed by the macroeconomic outlook. For instance, the crypto community is anticipating the passage and enactment of the CLARITY Act to legalize the industry in the United States.

Additionally, President Donald Trump has hinted that his new Federal Chairman will focus on lowering interest rates to 1%. With the renewed demand for crypto by institutional investors, as portrayed by Strategy and BlackRock, paying attention to these undervalued altcoins will be profitable in 2026.

Related: Bitcoin Price Prediction: Polymarket Bets 27% Chance Of $85K Drop As Shorts Get Squeezed

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.