- Crypto community thinks USDD is unsafe, given some unusual activities.

- A crypto enthusiast alleged that $548 million in the USDD’s reserve disappeared.

- The stablecoin trades at $0.9863 instead of the expected $1 price.

The crypto community speculates about a possible recurrence of the monumental stablecoin de-peg that happened seven months ago with UST. Given certain unusual activities around the Tron stablecoin USDD, the crypto community thinks the coin is unsafe to hold.

Last Wednesday, USDD lost its $1 peg. Twitter user @Lookonchain alleged that $548 million of the $990 million in the USDD’s reserve disappeared. They showed transaction trails proving that the USDD founder, Justin Sun, transferred $550 million from the stablecoin reserve to three different addresses for loan repayment.

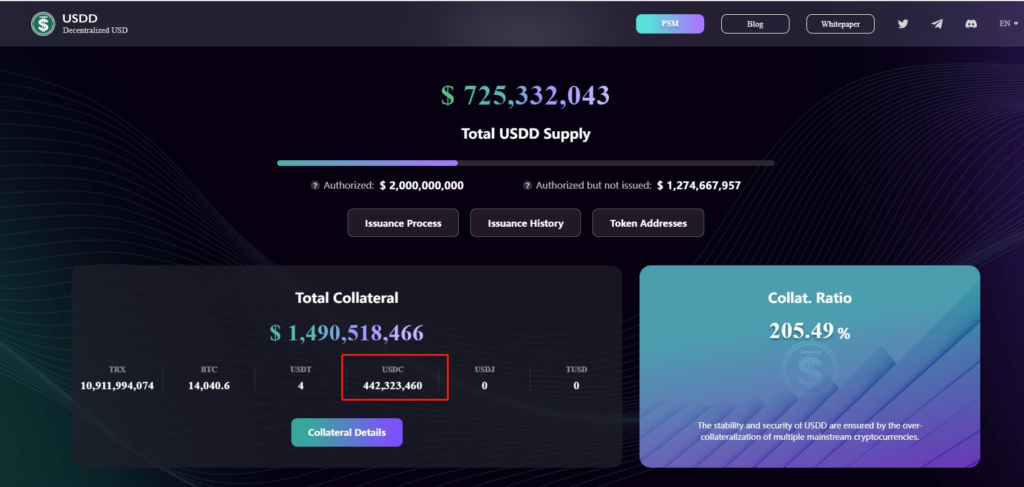

At press time, $442 million USDC token remains in the overall USDD reserve, of which $332 has been loaned out already. Consequently, the total available assets in the USDD are $139 million USDC and 14,040.6 Bitcoin.

However, in a further analysis, Twitter user @Lookonchain alleged that 99% of the TRX tokens in the USDD reserve were unavailable, as shown in the image above. The implication is that the collateral ratio of the USDD stablecoin reserve is only 50%.

Furthermore, blockchain data shows that the USDD founder withdrew $170 million of a stablecoin token from Binance to the USDC issuer, Circle. Notably, the USDD stablecoin trades at $0.9863 instead of the expected $1 price.

According to reports, the UST algorithmic stablecoin lost its peg seven months ago after some bad actors created enormous imbalances in a liquidity pool comprising the coin and three others. Later, UST’s sister crypto, LUNA, would fall from its all-time high price of $119.18 to $0.00001675 within six weeks.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.