- $600M long liquidations cleared leverage and widened spreads across venues

- $550M in ETF outflows removed passive bids and kept rallies shallow

- Bitcoin hovered near $110,000 as flows and whale supply pressured depth

The cryptocurrency market faced a sharp pullback over the past 24 hours after over $600 million in long liquidations swept derivatives and $550 million in net outflows left spot crypto ETFs. Bitcoin fell below the $110,000 mark, declining 3.5%, while Ethereum slipped to around $3,800.

This sudden move triggered a cascade, with Coinglass reporting $206.26 million liquidated in just one hour. Leveraged bulls were hit hardest, as $612.24 million of the 24-hour total came from long positions.

Related: Crowd FOMO-Buys Dip, Santiment Warns of ‘More Pain’ Ahead of FOMC Meeting

What’s Driving the Crypto Market Weakness Today?

The market weakness was amplified by massive institutional outflows from spot ETFs on October 29. Data shows Bitcoin ETFs recorded $471 million in total net outflows, with no inflows registered across any of the 12 funds. Ethereum ETFs followed this trend, posting $81.44 million in outflows, with only BlackRock’s ETHA fund attracting net inflows.

This institutional exit is compounded by persistent macro uncertainty. US President Donald Trump and China’s Xi Jinping met in South Korea to ease tariff disputes.

Trump’s back-to-back use of tariffs since returning to office, along with China’s countermeasures on rare earth exports, has resulted in a global economic slowdown.

Previous tariff escalations resulted in massive declines in crypto, including the October 10 crash that drove Bitcoin from $121,560 to below $103,000. Although the meeting aimed to stabilize relations, crypto traders remain cautious.

Whale Activity and Fed Moves Compound the Decline

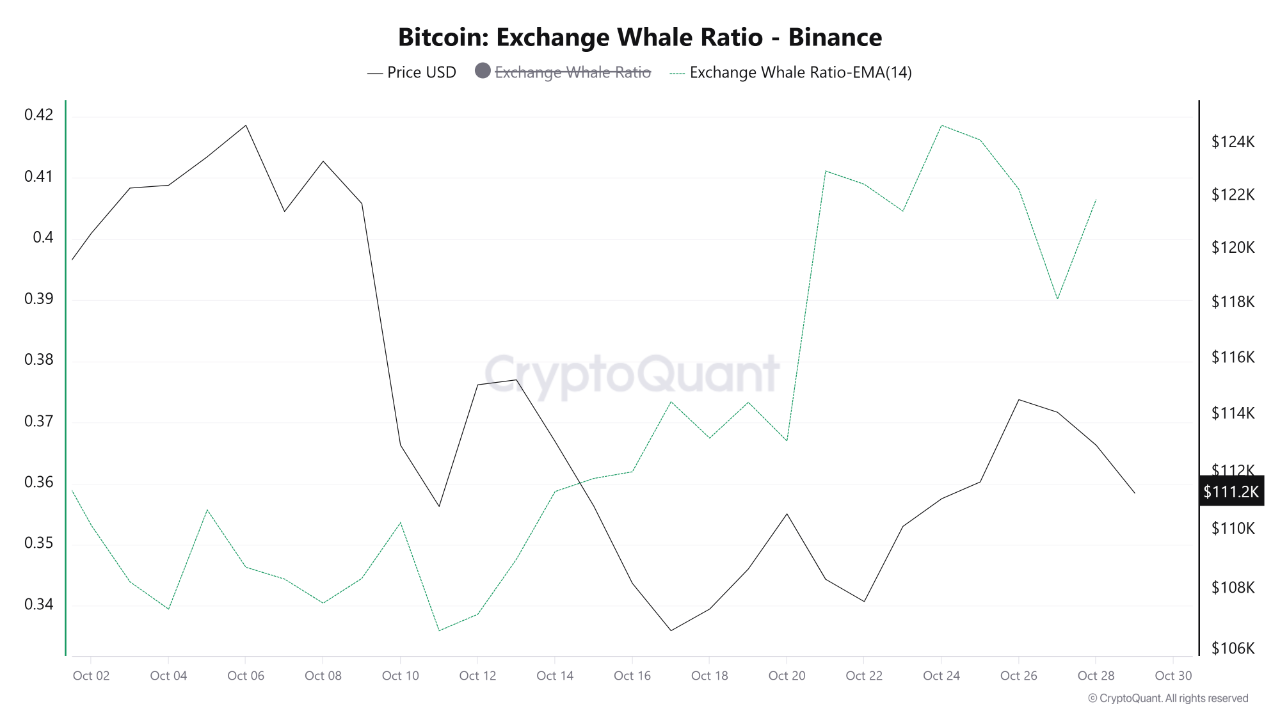

Data from CryptoQuant shows that Binance’s Exchange Whale Ratio, a measure of how much BTC large holders are sending to exchanges, has been climbing steadily since mid-October.

The 7-day EMA of this ratio rose from 0.33 on October 12 to 0.41 by October 25, indicating whale deposits likely intended for selling into market strength.

Meanwhile, the US Federal Reserve announced a 25-basis-point rate cut and confirmed plans to halt its balance sheet reduction by December 1. While lower rates are typically supportive of risk assets, Bitcoin failed to push higher.

Interestingly, analyst Jason Pizzino added that Bitcoin’s 5 & 10-year composite cycle has a strong divergence forming. He added that if the leading digital asset doesn’t recapture resistance levels soon, prices might continue to drop.

Related: Bitcoin Price Prediction: BTC Price Consolidates as Open Interest Hits $73B

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.