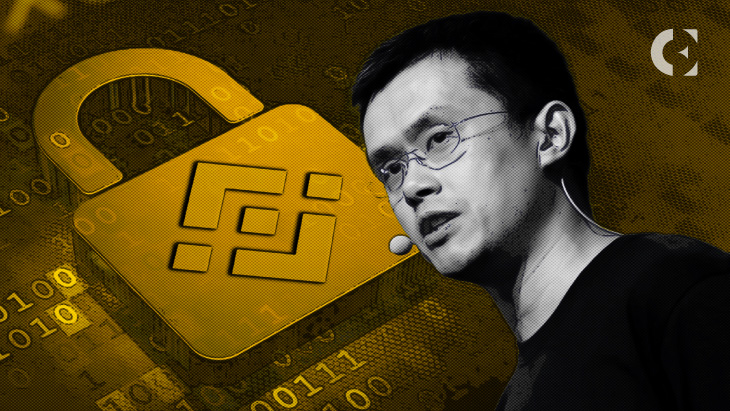

- Bitfinexed accused the Binance CEO of trading customer funds, in a recent post on X.

- Paxos Trust’s latest report reveals Changpeng Zhao took a $250 million loan in December.

- In January, Paxos returned converted funds to BAM Trading.

A popular account in the crypto X (formerly Twitter) space recently accused Binance CEO Changpeng Zhao of trading with customer funds. On September 19, Bitfinexed tweeted about the rise in the value of Bitcoin back in January, claiming that it had been triggered after Zhao “loaned himself $250 million dollars from his own exchange.”

The account shared screenshots on X from Paxos Trust’s Transparency Report which highlighted a number of questions including the reason behind why Paxos Trust Company transferred $183 million to BAM Trading, a Binance crypto exchange in January. The answer noted that in December 2022, Zhao received a $250 million convertible note from BAM Management US Holdings, Inc.

To acquire this note, he used BUSD, with $183 million of that amount being forwarded to Paxos Trust Company, the issuer of BUSD, for its conversion into USD. Henceforth, in January 2023, these converted funds were subsequently transferred to BAM Trading.

In late February, the New York Department of Financial Services (NYDFS) instructed Paxos to stop issuing BUSD after Paxos received a Wells notice from the Securities and Exchange Commission (SEC) for alleged violations of investor protection regulations. Binance, which held 90% of BUSD at that moment, announced in August that the exchange would end support for the stablecoin in 2024. Additionally, Binance urged users to convert their BUSD to TrustToken’s TUSD, which surpassed BUSD’s market supply on September 5.

As mentioned in Bitfinexed, Binance rallied at the beginning of the year, According to CNBC’s report from January 16, the leading crypto had grown almost 28% since the beginning of the year, reaching as high as $21,000 for the first time since November 2022.

At the time of writing, BTC is trading at $27,170, as per data from CoinMarketCap.

However, Glassnode’s on-chain data concluded that Bitcoin is currently undergoing a period of fluctuation. While there has been an inflow of fresh capital into the market in 2023, this influx lacks significant momentum. Additionally, a majority of short-term holders find themselves “underwater on their position,” suggesting prevalent negative sentiment.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.