- Crypto trades lower today (Oct 17, 2025) as $1.19B in 24-hour liquidations and negative ETF flows keep risk appetite weak.

- Stablecoin share rises while liquidity thins across spot and perps, amplifying intraday swings.

- A durable rebound needs better depth, positive ETF flow, and rotation from stablecoins back into major altcoins XRP, BNB, ADA.

The market remains risk-off today, October 17, 2025 as Bitcoin trades below $105,000 after a multi-session slide, while XRP is roughly down 20% week-over-week and includes BNB about 12%, and ADA near 25%, to cite CoinMarketCap data.

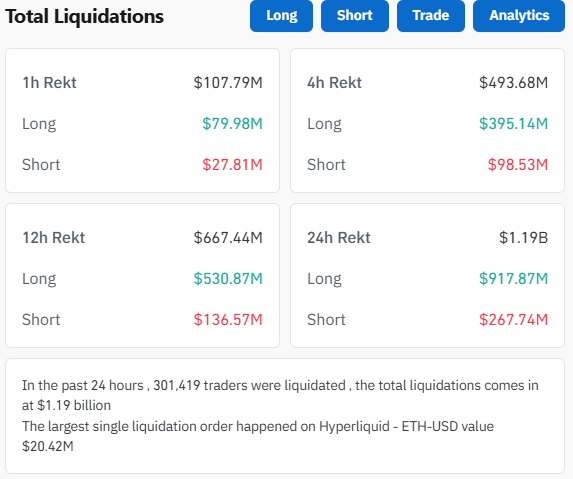

Risk-off persists as $1.19 billion liquidations, outflows weigh down prices

Coinglass shows $1.19 billion in liquidations over the past 24 hours, reflecting forced unwinds after the weekend deleveraging. Order books show wider spreads and faster slippage during peak hours, which magnifies moves when larger orders hit.

In short, Bitcoin traders accounted for the majority of losses as price volatility surged following the weekend deleveraging event.

ETF outflows and a rising stablecoin share pressure BTC and ETH

Spot Bitcoin ETFs reflected similar investor caution, posting a net outflow of $536 million on October 16, with none of the twelve approved ETFs recording inflows.

Ethereum ETFs also suffered a $56.88 million net outflow, except for BlackRock’s ETHA, which managed a minor inflow.

This mass deleveraging triggered a temporary liquidity crunch across exchanges, as traders rushed to unwind leveraged positions. However, analysts suggest that such cleanouts often precede periods of consolidation and renewed accumulation once selling pressure subsides.

Opportunity Amid the Fear

Swissblock noted that recent market behavior indicated a subtle structural shift rather than panic. The firm said that in recent weeks, Bitcoin was leaving exchanges in large volumes as long-term holders paused their distribution. While they have now resumed selling, the activity remains low in intensity.

Swissblock added that the true impact of the weekend’s deleverage would become clearer as market participants reposition, but on-chain behavior so far suggests short-term bullish consolidation rather than panic or forced selling.

Bitcoin is still experiencing net outflows from exchanges, implying that long-term holders remain relatively unfazed despite near-term volatility.

On the other hand, analysts at Altcoin Vector explained that the delicate balance between altcoins and liquidity had broken down. The recent deleverage event pushed USDT dominance higher, and historically, such moves have coincided with sharp declines in altcoins.

The firm added that for altcoins to stabilize, liquidity needs to rotate back from stablecoins. Until that shift occurs, altcoins are likely to continue struggling to establish a sustainable support base.

Price Analysis

Bitcoin (BTC)

- Trading zone: $105,000 to $100,000

- Supports: $102,000, $100,000, channel base $88,000 to $90,000

- Resistances: $112,000, $124,000

BTC holds near the midline of its multi-month uptrend channel. A daily close back above $112,000 improves trend repair toward $124,000. A decisive loss of $102,000 puts $100,000 in play and risks a test of the $88,000 to $90,000 channel base. Momentum indicators tilt soft but not broken, consistent with consolidation rather than a confirmed downtrend.

XRP

- Spot context: underperforms on the week

- Supports: $2.30, $2.05, psychological $2.00

- Resistances: $2.40 to $2.50, $2.80

XRP trades below the $2.60 handle and continues to probe $2.30 support. A base above $2.30 opens repair into the $2.40 to $2.50 supply zone. A weekly close above $2.80 flips momentum positive and points toward $3.30 to $3.67. A break under $2.05 exposes the $2.00 round number.

BNB

- Spot context: pulling back from the all-time high near $1,375

- Supports: $1,050, $1,000

- Resistances: $1,180, $1,250

BNB cools after the ATH push. Holding $1,050 stabilizes the tape and keeps a reclaim of $1,180 in view; strength above $1,180 targets $1,250 and then the prior peak.

Cardano (ADA)

- Spot context: heavier drawdown than majors

- Supports: $1.70, $1.50

- Resistances: $1.90, $2.10

ADA grinds near the lower end of its summer range. A hold at $1.70 allows a repair toward $1.90; a close above $2.10 confirms stabilization. A slip through $1.70 brings $1.50 into focus.

Related: Altseason 2025 Setup Builds as Bitcoin Dominance Slows, Analysts Eye Rotation

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.