- Crypto Fear Index drops to 15, showing extreme market fear across major assets.

- Bitcoin slips amid ETF outflows and institutional retreat, signaling cautious investor sentiment.

- Analysts predict $160K to $170K BTC peak soon, citing on-chain data and long-term cycle models.

A stark disconnect is gripping the crypto market. The Crypto Fear & Greed Index has plunged to 15, signaling “Extreme Fear” as trader pessimism sinks to levels not seen since the 2022 bear market bottom. Yet, while “paper” markets panic, on-chain analysts remain firm, forecasting a parabolic peak between $160,000 and $170,000 within the next six weeks.

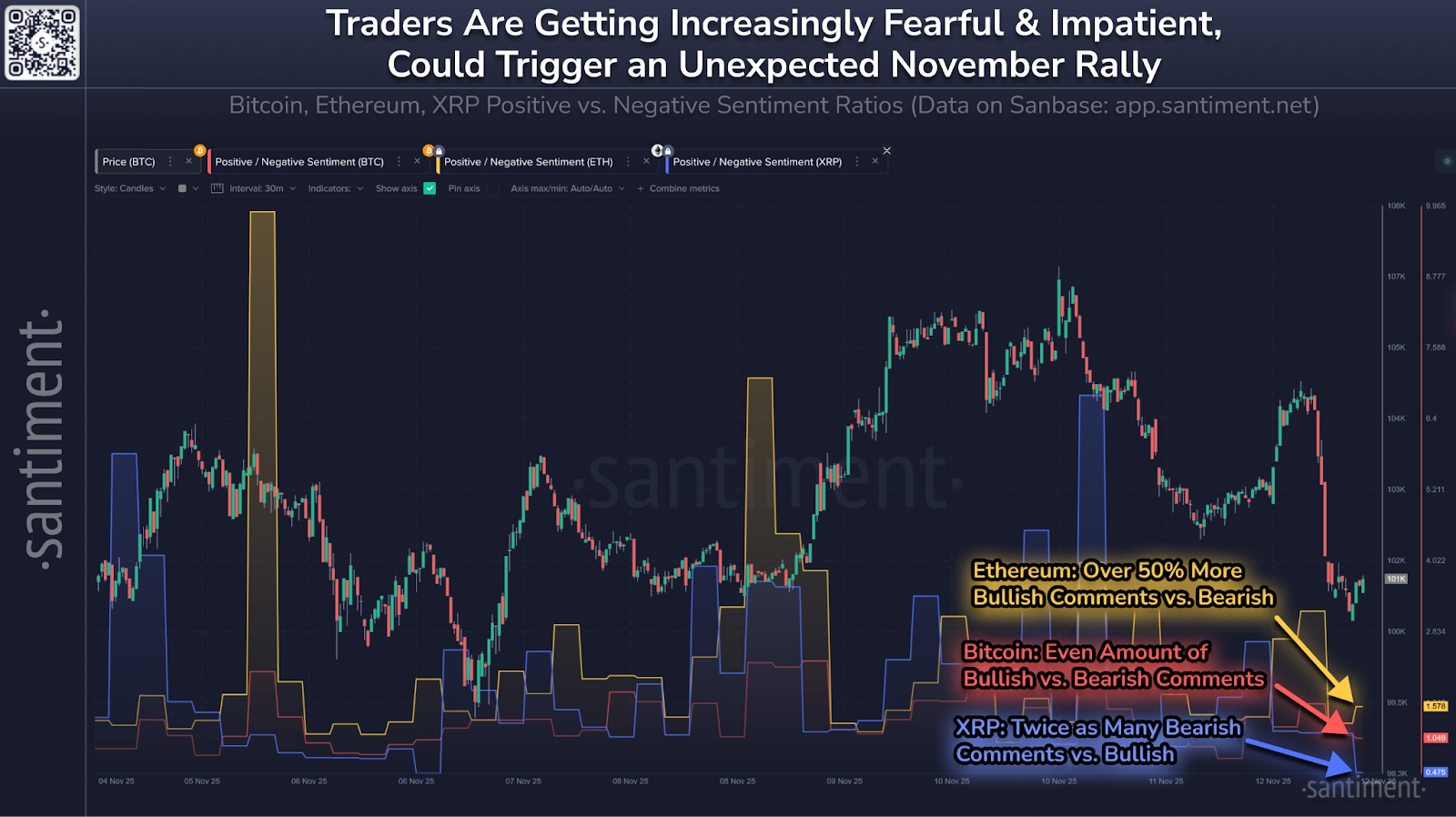

Data from Santiment shows traders have grown increasingly skeptical across major assets, with XRP sentiment now among the most fearful seen this year. Discussions about Bitcoin and Ethereum on social media have also shifted toward negativity.

Market watchers say this downturn in mood is a bullish signal. As Santiment noted, when retail traders begin to sell into fear, large stakeholders often accumulate, setting the stage for the next rebound.

Bitcoin Suffers ETF Outflows and Institutional Retreat

Bitcoin slipped 1.87% to $102,897 over the past 24 hours as institutional investors trimmed exposure. Spot Bitcoin ETFs recorded $278 million in outflows on November 12, continuing a month-long decline that saw total ETF assets under management fall from $154 billion to $140 billion.

CME futures open interest has also dropped by 34% since October’s highs, signaling reduced speculative activity. According to Wintermute, Bitcoin’s price reaction to Nasdaq movements now shows a growing downside bias, with BTC lagging equity rallies but amplifying losses.

However, analysts see a potential counterbalance ahead. Roughly $40 billion in deferred U.S. fiscal liquidity following the government shutdown could re-enter markets, providing near-term stability for risk assets like crypto.

Related: ‘Good News Is Bad News’: Why the Shutdown’s End Is Hurting Bitcoin

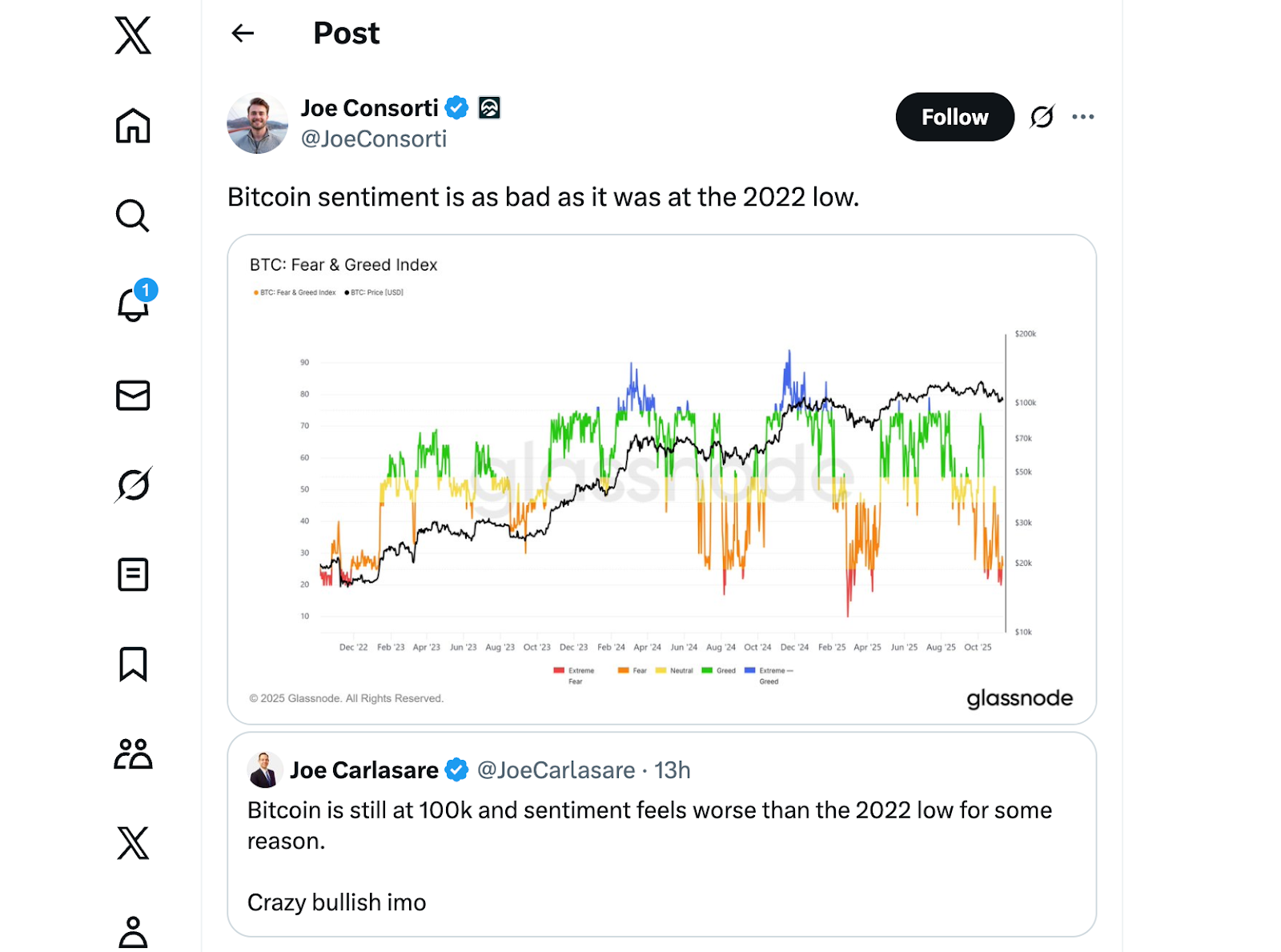

Sentiment Mirrors 2022 Lows

Despite Bitcoin holding above $100,000, sentiment feels “worse than the 2022 bear market,” according to pro-Bitcoin attorney Joe Carlasare.

Horizon’s Joe Consorti added that Glassnode’s data confirms this, showing trader sentiment at levels last seen during that historic bottom. The pessimism contrasts sharply with on-chain data indicating that whales have accumulated more than 45,000 BTC this week.

Analysts Predict $160K–$170K Top Within Weeks

Amid widespread fear, a handful of analysts remain confident that Bitcoin is nearing its next parabolic phase. Market analyst Bitcoin Teddy believes the asset could surge to between $160,000 and $170,000 within six weeks, citing CryptoCon’s “Diminishing Golden Curves” model.

This model, which has accurately mapped every major Bitcoin cycle since 2011, suggests that each successive top occurs at a lower deviation from the main growth curve.

Following this trend, the next peak could form near the +2 curve, historically consistent with late-cycle highs.

The model’s timing also aligns with Bitcoin’s halving rhythm, predicting that the final phase of this cycle should unfold into late 2025.

Liquidity Signals a Possible Reversal

Supporting the bullish case, the Stablecoin Supply Ratio has fallen to levels that have historically preceded strong market recoveries. On-chain data from Binance shows stablecoin reserves rising while Bitcoin reserves decline, indicating renewed accumulation.

CryptoQuant analyst Moreno notes that this combination of increasing liquidity and low volatility presents an attractive risk-reward profile. Essentially, the downside risk is limited, even as the market remains deeply fearful.

Ultimately, while fear dominates the current sentiment and institutional flows remain weak, underlying on-chain data and long-term models hint that Bitcoin’s next major rally could be closer than most expect.

The market may be in the “pain before gain” phase, a familiar pattern that has historically marked the end of every Bitcoin correction.

Related: Bitcoin Price Prediction. Sellers Defend EMA Cluster As Fed Divide Keeps Bulls On Edge

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.