- Prominent figures in the crypto community strongly respond to Gary Gensler’s crypto statements, accusing him of spreading FUD.

- Ryan Selkis, CEO of Messari, counters Gensler’s claims, emphasizing that Bitcoin has consistently proven itself as the top-performing investment.

- Coinbase Chief Legal Officer, Paul Grewal, questions the SEC’s credibility by highlighting recent misrepresentations in DEBT Box case.

Recent tweets from prominent figures within the crypto community have responded strongly to Gary Gensler’s crypto statements, accusing him of spreading fear, uncertainty, and doubt (FUD) about the crypto industry.

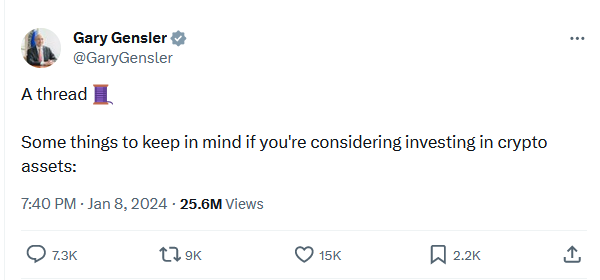

The SEC Chair laid out various risks associated with crypto, including non-compliance with securities law, volatility and risk, and the rise of fraudsters.

A number of major platforms and crypto assets have become insolvent and/or lost value. Investments in crypto assets continue to be subject to significant risk.

The founder and CEO of Messari, Ryan Selkis, took to X to counter Gensler’s claims. Selkis emphasized that Bitcoin has consistently proven itself as the top-performing investment over its 15-year history. He criticizes Gensler for omitting this vital information from his statements, calling attention to what he perceives as fear-mongering.

Coinbase Chief Legal Officer, Paul Grewal, brought attention to the SEC’s recent misrepresentations in a court case regarding DEBT Box. Grewal highlighted the SEC’s regrettable actions and questioned the sincerity of their apologies. By juxtaposing Gensler’s statements with the SEC’s court troubles, Grewal implies a lack of credibility and consistency within the regulatory body.

X account CryptoLaw contributed to the criticism by alleging that, under Gensler’s leadership, the SEC has been dishonest in a crypto case, facing potential sanctions. The tweet accuses Gensler of allowing fraudulent activities, such as the situation involving SBF (Sam Bankman-Fried), to occur under his watch.

The tweet calls for Gensler’s resignation, citing him as the wrong regulator and an incompetent leader. CryptoLaw also perceives him as a major liability, with doubts emerging about the veracity of his statements. Gensler’s recent crypto thread went viral, with impressions reaching over 25.4 million for a tweet that is not even a day old.

While Gensler received backlash from the crypto community, the timing of the tweet gave many anticipation that a spot Bitcoin ETF would be approved soon.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.