- Q1 2023 crypto developer activity remains robust despite market declines.

- Over nine thousand new developers have joined the industry.

- Full-time developers account for 70-75% of the total commit volume.

The DeveloperReport has released its Q1 2023 report on crypto developer activity, highlighting that despite the recent price declines in the market, developer activities have remained strong, with approximately 21,697 active developers per month.

According to the report, there were 9,350 new developers gained in Q1, and of the total monthly active ones, 7,039 were full-time developers. Nonetheless, part-time developers comprised the most significant portion of the spectrum with over 52% share.

However, the report indicated that active software engineers declined by approximately 17% from all-time highs in 2022, with full-time developers also decreasing by 10%. DeveloperReport noted that the decline may be attributed to seasonal factors, with a drop in developer activity during December-January observed annually, referred to as “Developer Seasonality.”

It also pointed out that 50% of developers that previously left joined during the 2021-2022 bull market, and 65% were part-time and one-time developers.

According to the report, full-time developers are considered the backbone of the crypto industry, accounting for approximately 70-75% of the total commit volume. The ones who persisted increased their commit volume by 16%, from 343k to 398k since the start of the year.

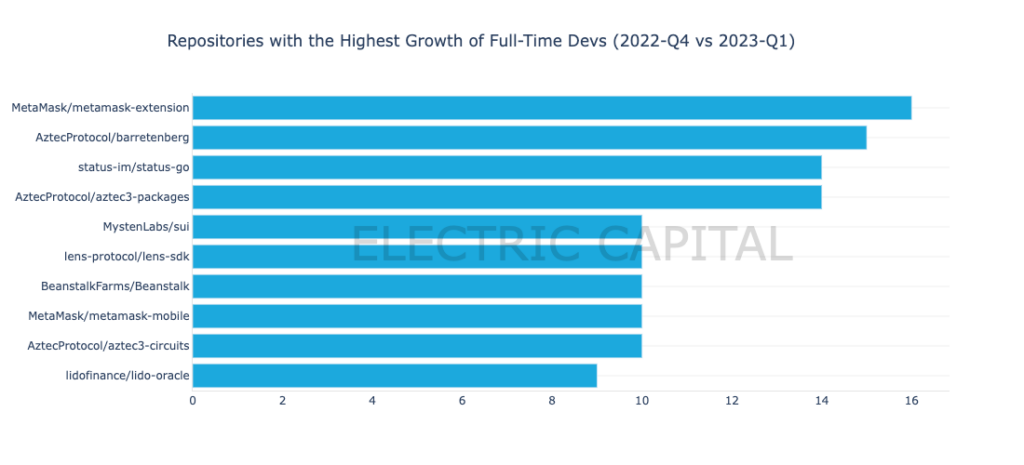

The report also revealed that many ecosystems continue to grow, with Aztec, Metamask, Status, Hyperledger, and Taiko gaining the most significant number of full-time developers. Notably, the repositories with the highest growth in Q1 2023 were Metamask’s metamask-extension, Aztec’s barretenberg, Status’s status-go, Aztec’s aztec3-packages, and Mysten Labs’ sui.

Ultimately, the Q1 2023 DeveloperReport shows that the crypto industry remains attractive to developers with a continued influx of new talent as many ecosystems continue to grow despite the recent market declines.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.