- Messari tweeted 3 of the features included in XRPL’s feature set this morning.

- The features include Issued Currencies (IOUs) and Authorized Trust Lines.

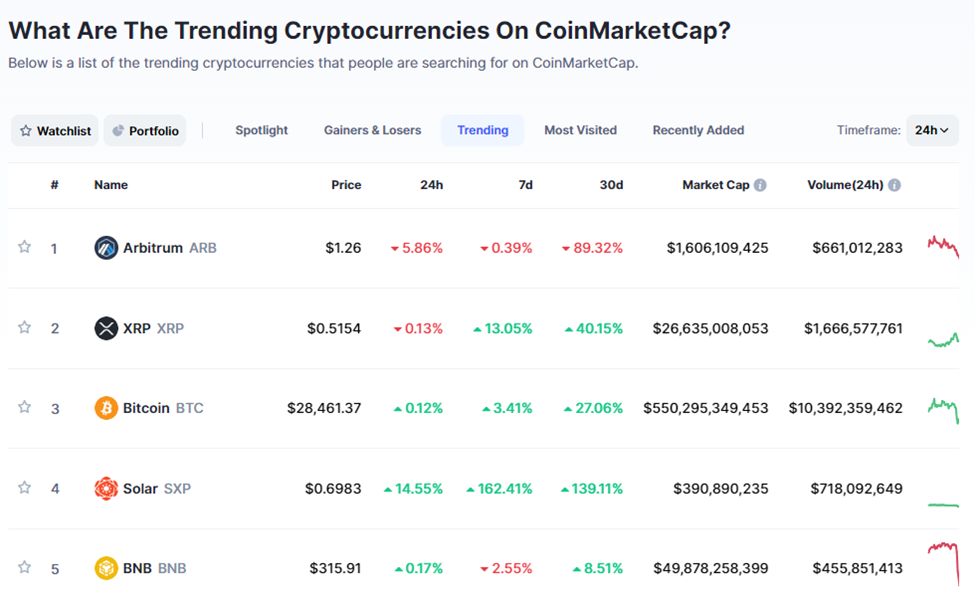

- In related news, the price of XRP has printed a 24-hour gain according to CoinMarketCap.

Messari (@MessariCrypto) tweeted this morning regarding XRP Ledger’s feature set. According to the tweet, XRP Ledger’s (XRPL) includes its Issued Currencies (IOUs), which creates functionality for multiple assets.

Another feature in the set is Authorized Trust Lines. This feature enables issuers to choose which wallets can interact with their tokens, added Messari’s tweet. Lastly, there is also a central limit order book in the feature set which supports low-liquidity IOUs.

At press time, the price of Ripple (XRP) is up 0.14% in the last 24 hours according to CoinMarketCap. The remittance token has also made its way onto CoinMarketCap’s trending list, and currently occupies the number 2 position.

XRP’s 24-hour gain has added to its positive weekly performance – taking XRP’s total gain over the last 7 days to approximately 13.02% at press time. As a result, XRP’s price stands at $0.5151 at press time.

XRP was also able to strengthen against the two crypto market leaders, Bitcoin (BTC) and Ethereum (ETH), by 0.16% and 0.53% respectively.

The altcoin has also had a comfortable month, printing a 40+% gain over the last 30 days. The main contributing factor to the remittance token’s outstanding price performance is the recent positive positioning of Ripple Labs in its longstanding lawsuit with the Security and Exchange Commission (SEC).

Many XRP traders and investors are confident that this lawsuit will come to an end quite soon and will see Ripple Labs the victors. Should this happen, it will not only be a win for Ripple Labs and their native token, XRP, but also give a much-needed boost for the broader crypto market in this latest crypto winter.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.