- Bitcoin trades below $94,000 resistance while buyers protect support near the $88,000 level.

- Ethereum has fallen 35% in recent weeks and is now testing a crucial support zone.

- XRP holds near $2.00 as traders watch closely for a possible breakout move.

The crypto market is entering a critical phase, with the top three tokens sending mixed signals. Ethereum is once again testing an important support level, Bitcoin is moving sideways below strong resistance, and XRP is closing in on a price level.

Bitcoin Struggles Below Resistance

Bitcoin has spent the past few weeks consolidating after its recent pullback. While the broader trend remains bearish, short-term price action shows some stability. Bitcoin continues to face heavy resistance between $92,000 and $94,000, an area it has failed to break multiple times.

On the positive side, Bitcoin is forming higher lows on shorter time frames, indicating buyers are still stepping in on dips. Strong support sits near $88,000 to $89,000, with deeper support closer to $85,000 if selling pressure increases. For now, Bitcoin remains stuck in a wait-and-watch zone.

Ethereum Turns Red, But XRP Could Shine

Ethereum has been weaker than Bitcoin and is now down around 35% over the past 12 weeks. The asset is retesting a key support level, and the next move will be decisive. A weak bounce could confirm a deeper correction, while a strong recovery may mean that the worst of the pullback is over.

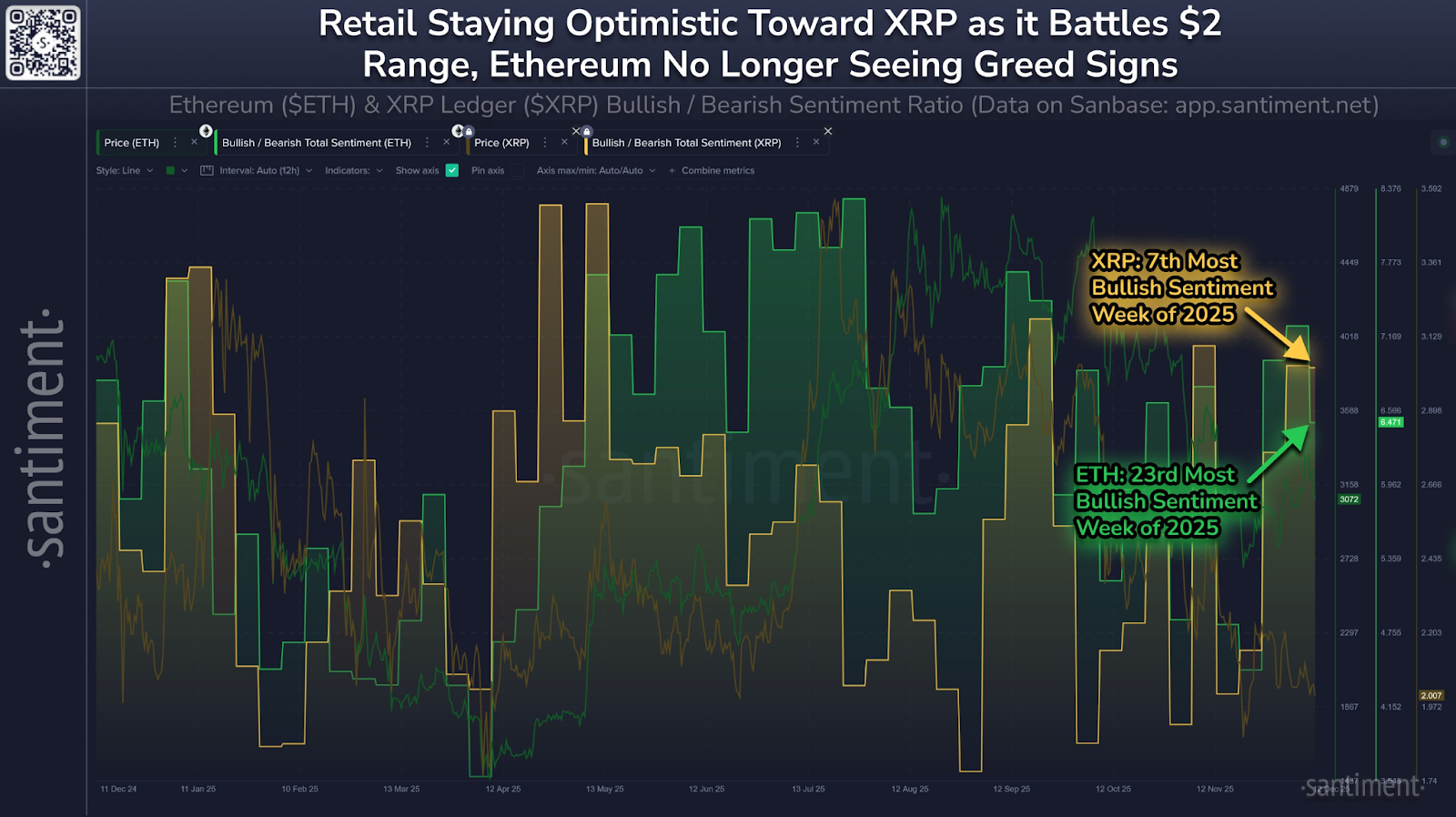

Unlike earlier in the year, retail excitement around Ethereum has cooled. This could reduce panic selling, but it also means fewer short-term buyers to push prices higher.

XRP continues to trade near the $2.00 mark, with bulls and bears locked in a tight battle. Social media sentiment remains positive, and price action suggests XRP is approaching a major technical level. A clean break could trigger higher volatility in either direction.

Macro Factors Are Starting to Rebuild

Beyond charts, macro factors are playing a growing role:

- The US Federal Reserve recently cut interest rates by 25 basis points, a move that was widely expected. Lower rates usually support risk assets like crypto by encouraging borrowing and investment.

- The global M2 money supply has hit a new all-time high, showing that liquidity is slowly coming back. In the past, Bitcoin and altcoins have often risen when liquidity increases.

Related: Trump’s AI Executive Order to Reignite Demand for $ATH, $RNDR, $AKT, $TAO

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.