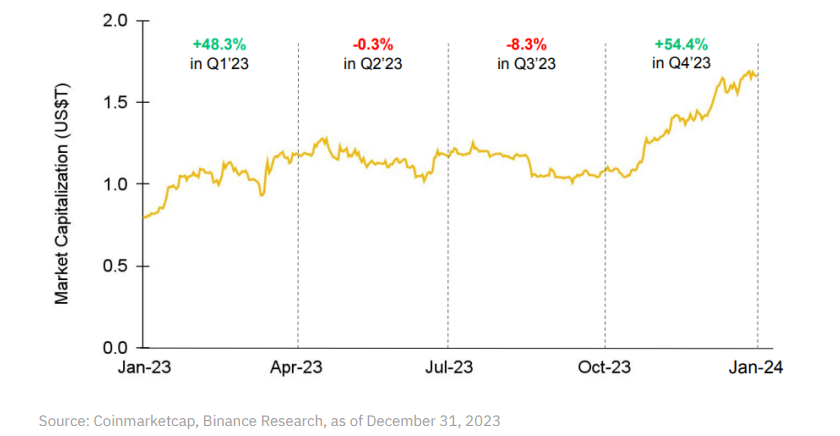

- Research shows a 109% increase in the crypto sector valuation in 2023, driven by Q1 and Q4 gains.

- Non-fungible tokens volumes rebounded, generating $1.7 billion in December.

- 1,173 projects secured $9 billion in investment in 2023, with infrastructural projects taking the largest share.

Leading cryptocurrency exchange Binance has released a research report on the crypto market, highlighting the developmental increase recorded in 2023 and the projection for the market in 2024.

According to the research, the crypto sector valuation increased by 109%, with significant gains recorded in the first and last quarters of 2023. The report attributed the surge in Q4 to the optimistic drive surrounding the now-approved Bitcoin spot ETF and the upcoming Bitcoin halving.

The report noted that the gains recorded for early and late 2023 starkly contrasted with the values for 2022, where the market experienced a downturn of approximately 64%. This decline was fueled by a series of destabilizing events, including the de-pegging of TerraUSD (UST), the bankruptcies of various lending institutions, and the repercussions of the FTX fallout.

Furthermore, the report highlighted that 2023 proved highly eventful for Bitcoin. This was marked by significant developments such as the introduction of Ordinals, Inscriptions, and BRC-20 tokens. According to the research, the developments contributed to Bitcoin elevating its market dominance from 40.4% to 50.2%, once again securing over half of the total crypto market capitalization.

Also, the report stated that 2023 was similarly eventful for Layer-2 crypto projects. This is characterized by a substantial 321.3% surge in total value locked and a 77.2% increase in L2 dominance.

Meanwhile, it was disclosed that the global stablecoin market capitalization fell by 5.2%, regardless of the rebound in October 2023. Centralized stablecoins extended their overall market command to 92%, with Tether’s USDT increasing its dominance to 70.6%.

Also, in Q4 2023, non-fungible tokens (NFTs) volumes rebounded, generating $1.7 billion in December. Interestingly, Bitcoin Ordinals contributed the most to the overall NFT trading volume.

Furthermore, Web3 projects secured 1,173 investments in 2023, generating a collective capital of $9 billion. About 36.5% of the total amount was invested in infrastructure projects. Other sectors like CeFi and DeFi got 13.3% and 8.6%, respectively.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.