- The FED confirmed that it would not raise interest rate levels for the first time in a year.

- Despite the positive announcement, the crypto market declined more than 3%.

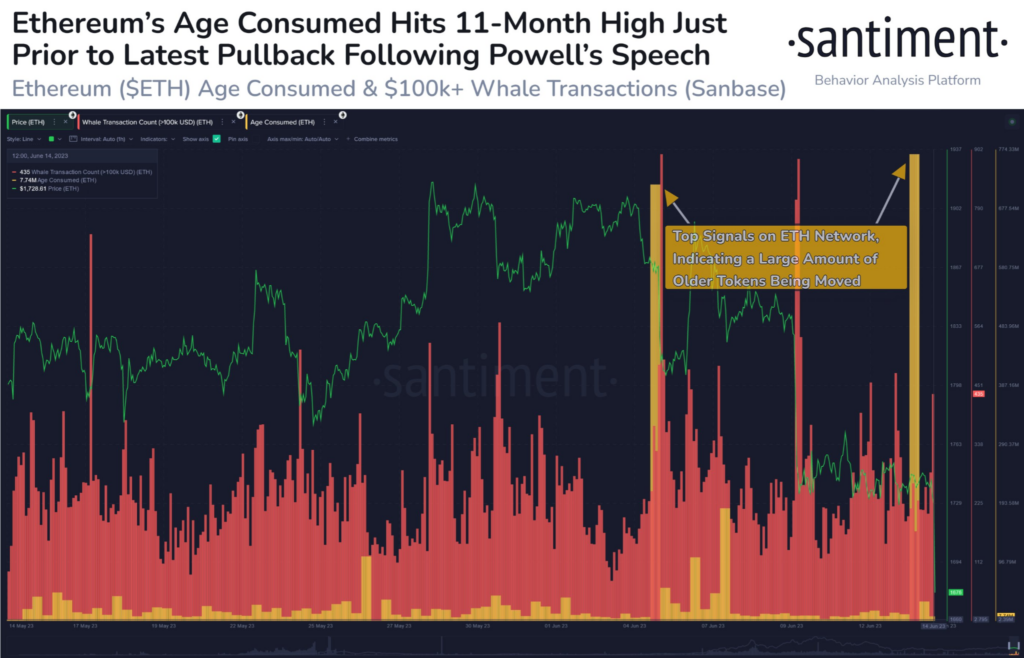

- A recent tweet by Santiment suggests that institutions expected ETH’s price to drop.

For the first time in a year, the U.S. Federal Reserve (FED) recently confirmed that it would not be raising interest rate levels. According to the blockchain intelligence firm Santiment, crypto prices had surprisingly dropped following the announcement. In the post, they also noted that Ethereum (ETH) looked as though institutions were expecting the move.

Santiment’s data showed that a large amount of older ETH tokens were moved leading up to the FED’s announcement yesterday. Furthermore, ETH’s age consumed hit an 11-month high just before the leading altcoin’s price dropped, which may be the result of institutional whales selling some of their ETH.

The FED’s decision to keep interest rates unchanged can benefit the crypto market in several ways. Firstly, it promotes increased liquidity in the financial system, as low interest rates encourage borrowing and spending. This surplus liquidity can potentially flow into cryptocurrencies, boosting demand and driving up prices.

Secondly, with traditional investments offering lower returns due to unchanged interest rates, cryptocurrencies become more attractive as an alternative investment option. Investors seeking higher profitability may choose to diversify their portfolios by allocating funds to cryptocurrencies.

Although the FED’s latest decision is a positive sign for the crypto market, CoinMarketCap indicated that the global crypto market cap dropped 3.29% over the past 24 hours. As a result, the total stood at $1.02 trillion at press time.

Both of the market leaders Bitcoin (BTC) and ETH saw their prices drop over the past 24 hours. The leading crypto was changing hands at $24,942.80 at press time following a 3.58% drop in the last day. Meanwhile, ETH’s price stood at $1,641.32 after it declined 5.62% during the same period.

Their negative price performances over the past 24 hours pushed both of their weekly performances further into the red as well. As a result, BTC was down more than 5% over the past 7 days, while ETH’s weekly performance dropped to -10.54%.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.