- Bitcoin drops to $57,500, pushing the market back into fear mode after briefly hitting neutral.

- Traders are divided as they await a potential Federal Reserve rate cut decision.

- Analysts warn that a larger rate cut could unsettle investors and dampen market optimism.

The crypto market faced unexpected bearish pressure on Monday after several days of uptrend that saw Bitcoin surpass $60,000. Bitcoin dropped to $57,500 yesterday, pushing the crypto market’s fear and greed index back to fear mode just a day after it had reached neutral.

Although the market is currently in fear mode, popular community figure Sheldon The Sniper has advised against panic selling. He noted that he is currently more bullish than ever on altcoins despite the brief downturn.

Sheldon acknowledged that the market remains volatile, largely due to being at a critical resistance level, which he referred to as a period of relative stability or “the boring part.” He warned that the resulting price movement could catch many off guard once these resistance levels are broken.

All Eyes on the Fed’s Economic Decision

A key factor driving his optimism is the upcoming Federal Open Market Committee (FOMC) meeting, at which a major economic decision—such as a potential rate cut—will be made for the first time in years.

Historically, interest rate cuts have positively impacted risk assets, including cryptocurrencies. Many investors are hoping for a similar outcome this time. The reasoning is that high interest rates make cash more appealing, as it generates passive returns. When rates are cut, however, investors often shift focus toward assets with higher returns, such as Bitcoin.

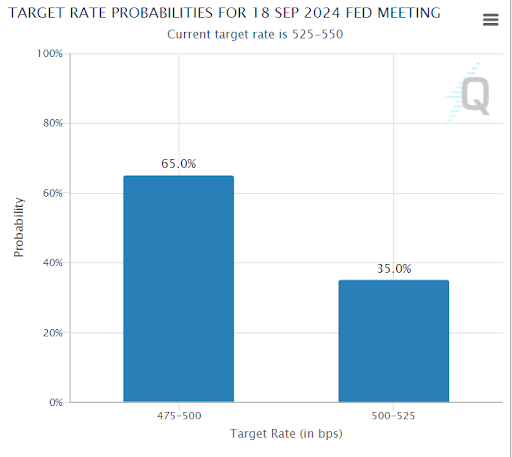

Notably, the size of the rate cut will significantly influence the market’s reaction. Traders are currently divided between two possibilities: a moderate 25 basis points (bps) cut or a more aggressive 50 bps cut.

At the time of reporting, CME Watchtool data shows a 35% probability of a 25 bps cut, bringing interest rates to the 5%-5.25% range. It also indicated a 65% chance of a 50 bps cut, lowering rates to the 4.7%-5% range.

However, analysts from 10x Research caution that a 50 bps cut might not have the desired effect. Rather than boosting the market, a larger cut could potentially unsettle investors by signaling concerns about the economy’s health, leading to increased caution toward riskier assets like Bitcoin.

At press time, Bitcoin and the broader crypto market is already rallying into the anticipated event of tomorrow. Bitcoin is back above $59K, seeking to re-enter the psychological $60K range.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.