- The Pump: The NY Fed conducted a $13.5 billion overnight repo operation, the second-largest liquidity injection since 2020.

- The Response: Bitcoin and Solana surged as the market sniffed out the stealth easing, adding $205 billion to the total crypto market cap.

- The Skew: Despite the liquidity-fueled rally, options traders remain defensive, hedging against a potential sub-$80k correction in Q1.

The crypto market’s $205 billion surge Wednesday was the direct downstream effect of a massive, under-the-radar liquidity injection by the Federal Reserve. While headlines focused on the formal end of Quantitative Tightening (QT), the Federal Reserve Bank of New York was actively flooding the banking system with cash via the repo market to stave off a collateral shortage.

Data confirms the Fed conducted a $13.5 billion overnight repurchase agreement (repo) operation on December 1. This intervention marks the second-largest liquidity injection since the 2020 crisis, exceeding levels seen even during the dotcom bubble.

Cantor’s ‘Solana Alpha’

While the Fed provided the fuel, Wall Street provided the spark.

Cantor Fitzgerald, the prime brokerage giant known for managing Tether’s Treasury portfolio, disclosed a $1.28 million position in the Volatility Shares Solana ETF via regulatory filings.

The disclosure sent Solana (SOL) ripping 10.29% higher to $141.37, outperforming Bitcoin and Ethereum as traders front-ran the narrative of a potential SOL ETF approval odds.

Related: Crypto Market Overview Today: Bitcoin Reclaims $91K But Extreme Fear Persists

Major Tokens Rally With Strong Volume

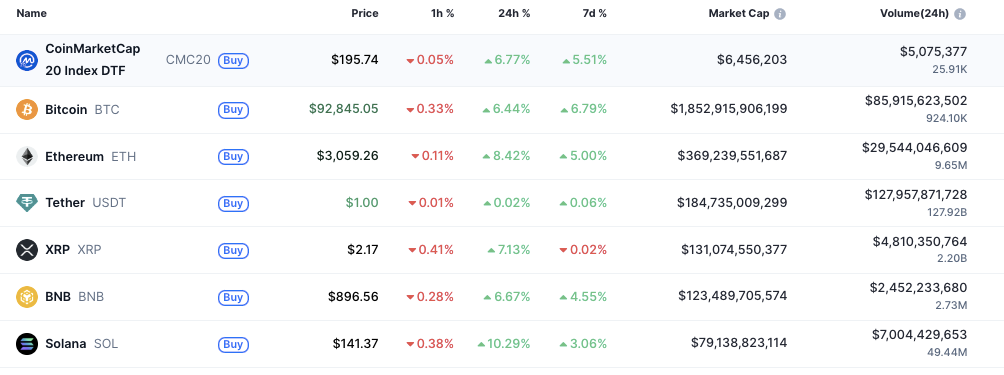

The CMC20 Index advanced by 7.32% to $196.2, reflecting broad stabilization across top cryptocurrencies and steady volume conditions. The latest data places the index at $195.74, up by 6.77% in the past day, supported by more than $5 million in turnover.

Bitcoin recovered to $92,845.05, gaining 6.44% over 24 hours. The cryptocurrency recorded a trading volume of $85.9 billion, underlining its role in leading the market bounce. Ethereum posted one of the strongest gains among major assets, rising 8.42% to $3,059.26, with daily volume topping $29.5 billion.

Stablecoin activity remained consistent, with USDT holding a $1.00 valuation and registering a 0.02% gain. XRP traded at $2.17, climbing by 7.13%, while BNB rose by 6.67% to $896.56. Solana outperformed most large-cap tokens, advancing with 10.29% to $141.37 on $7 billion in daily volume.

Derivatives: The Bearish ‘Put Skew’ Persists

The recovery follows a market decline earlier in the week. Derive.xyz founder Nick Forster noted that global liquidity tightened as sentiment weakened after the Yearn hack and concerns emerged over the Bank of Japan signaling a possible rate increase.

Nearly $1 billion in liquidations occurred within 24 hours, including $400 million in Bitcoin and $240 million in Ethereum perpetuals.

Forster stated that the volatility increased and skew fell as traders expanded their downside hedges. Options positioning around the December 26 expiry has been centered at the $84,000 and $80,000 Bitcoin strikes, levels he said imply a “meaningful probability” of BTC starting 2026 below $80,000.

Related: Crypto Market Rally: VET Surges 9% as ‘Hayabusa’ Hard Fork Begins

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.