- Bitcoin is looking healthier during the current cycle than in the previous one.

- The current cycle lacks “a dominating narrative.”

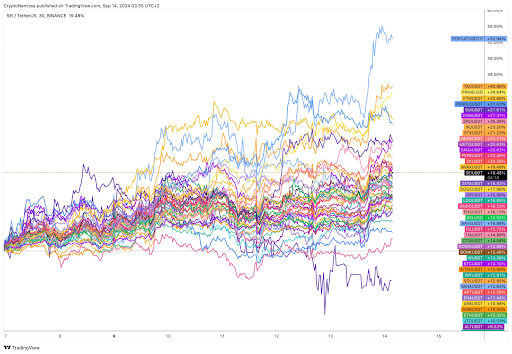

- Meme coins might soon try to catch up with POPCAT’s massive gains.

The crypto market is due a rally and is showing signs of strength, as pointed out by Miles Deutscher, a crypto analyst and DeFi expert. Deutscher highlighted that the bearish performance of digital assets will result in investors taking “massive offside positioning,” pushing prices higher.

In a thread on X (formerly Twitter), Deutscher gathered bullish sentiment from across the platform, predicting a Q4 rally leading to a market top in 2025. He believes Bitcoin is in a healthier position than in the previous cycle and suggests “VC coins” (tokens backed by venture capital) could reach new highs soon.

The Top Performers

Deutscher highlighted the top-performing sectors since the recent market low on September 6th. Infrastructure tokens, Layer 1 tokens, omnichain tokens, and Layer 2 assets are all showing bullish signs. Meanwhile, the ETH/BTC ratio continues to decline, with analysts predicting a bottom is near.

Meme Coins and NFTs: Mixed Signals

Meme coins, with the exception of Popcat (POPCAT), have yet to join the uptrend. However, there is a chance that other memecoins like dogwifhat (WIF), Pepe (PEPE), and Dogecoin (DOGE) could catch up to POPCAT’s performance.

Read also: Top 10 Most Centralized Cryptos: Should You Be Worried?

Deutscher also noted that the crypto market currently lacks a “dominating narrative,” leaving room for AI, RWA, or modular blockchains to take center stage in this cycle. Additionally, NFTs and GameFi tokens are also showing signs of a slight surge in prices in the near future, forming lower highs.

In the past 24 hours, the total market capitalization of the crypto space dipped 3.9% and its value stands at $2.12 trillion. Additionally, the total volume traded in the market stands at $74.78 billion.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.