- Balancer lost over $116M across v2 pools, triggering pauses and a third DeFi security scare.

- Bitcoin just logged its first red October since 2018, so traders are nervous about November follow-through.

- Whales, exchange promos, and high-beta tokens on BSC and Solana add to a jumpy market tape.

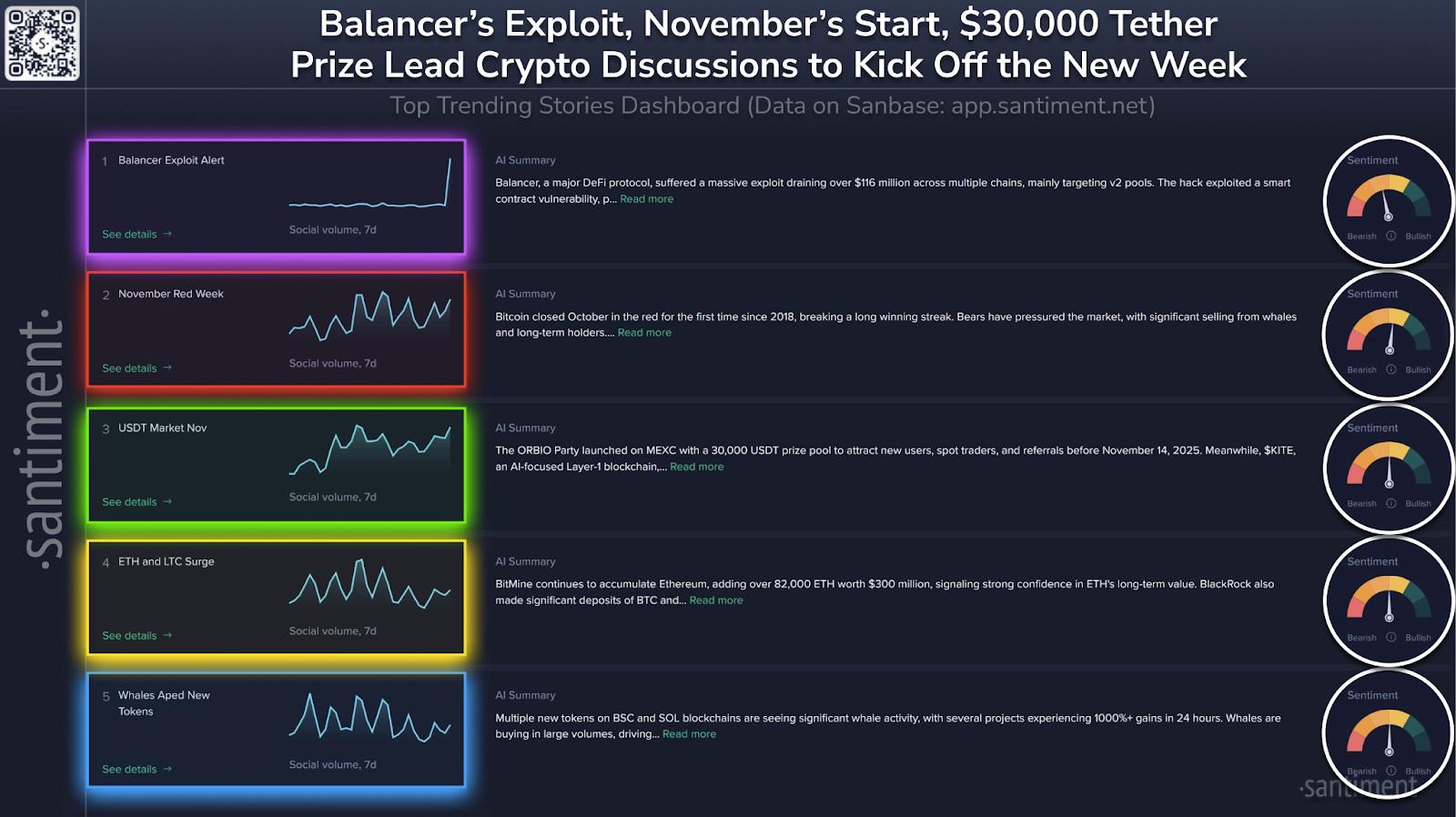

Balancer has become the most discussed topic across crypto forums after the decentralized finance (DeFi) protocol faced a large-scale exploit that drained more than $116 million in assets. According to Santiment’s data, the breach targeted Balancer’s v2 pools across multiple blockchains by exploiting a vulnerability in the smart contract.

The platform immediately paused affected pools and launched an investigation. This marks Balancer’s third major security breach. The event raises concerns about the persistent risks within DeFi infrastructures. Users were urged to withdraw remaining funds and review token approval settings.

Bitcoin’s Red October Sparks November Uncertainty

This exploit adds to a weak market sentiment. Bitcoin, for example, just ended October with a monthly decline. This is its first negative October close since 2018. Santiment’s analysis shows the drop followed heavy selling pressure from whales and long-term holders.

Despite this weak finish, traders are monitoring November. This month has historically delivered strong gains for Bitcoin. Market sentiment remains mixed as participants weigh this short-term volatility against historical performance.

Related: Not Headlines, Handoffs: Red October Hands November Its BTC Risk Map

Conflicting Signals: Altcoin Rallies and Whale Warnings

The ORBIO Party on MEXC also featured prominently among trending stories, with a 30,000 USDT prize campaign aimed at attracting new users and driving referral activity ahead of its November 14 close.

Meanwhile, $KITE, an AI-driven Layer 1 blockchain, continued to receive increased attention following its listings on several major exchanges, including MEXC, BTSE, Hotcoin, and Upbit. The project’s rollout was accompanied by futures trading options and zero-fee promotions, drawing interest from traders despite a broader market downturn.

Institutional Accumulation and Altcoin Signals

The data further showed that BitMine had accumulated over 82,000 ETH, valued at roughly $300 million, displaying institutional-scale confidence in Ethereum’s long-term prospects.

BlackRock made deposits of both Bitcoin and Ethereum to Coinbase wallets, strengthening signs of sustained institutional participation. Litecoin also registered increased trading volumes and upward price momentum, signaling a possible technical breakout.

Whale Activity on BSC and Solana

Whale transactions have surged across the Binance Smart Chain and Solana networks, with several new tokens recording gains exceeding 1,000% within 24 hours. Analysts attributed the movement to speculative trading and social media-driven interest, particularly in AI and security-themed projects.

However, Santiment cautioned that some of these tokens pose large risks, including phishing and developer concentration, due to ongoing market vulnerability resulting from rising volatility.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.