- The crypto market has experienced a mild rebound after Trump cancels Europe tariffs.

- Santiment stated that crypto may attract more capital as tariff fears fade, boosting buying.

- Cathie Wood says BTC has bottomed, may trade $80K–$90K before next surge.

The crypto market has experienced a mild rebound after tariff fears cooled. Bitcoin (BTC) price briefly reclaimed $90k after President Donald Trump announced that the scheduled February 1 tariffs against several European countries had been canceled.

Santiment Predicts Further Crypto Upside

According to Santiment, the recent tariff FUD may lift the crypto market at a faster rate than expected. Based on historical trends, Santiment found that the crypto market gets a buy signal if tariff mentions spike after prices fall and vice versa.

Santiment stated that the crypto market has a high chance of attracting more capital today. Moreover, the prior source of fear has been debunked, and investors are only anticipating positive developments.

“Crypto markets saw an immediate small ‘buy the rumor’ boost before beginning to fade. But don’t be surprised if US markets open tomorrow with extreme optimism and institutional buying, across both equity and cryptocurrency sectors,” Santiment stated.

Are U.S. Investors Buying?

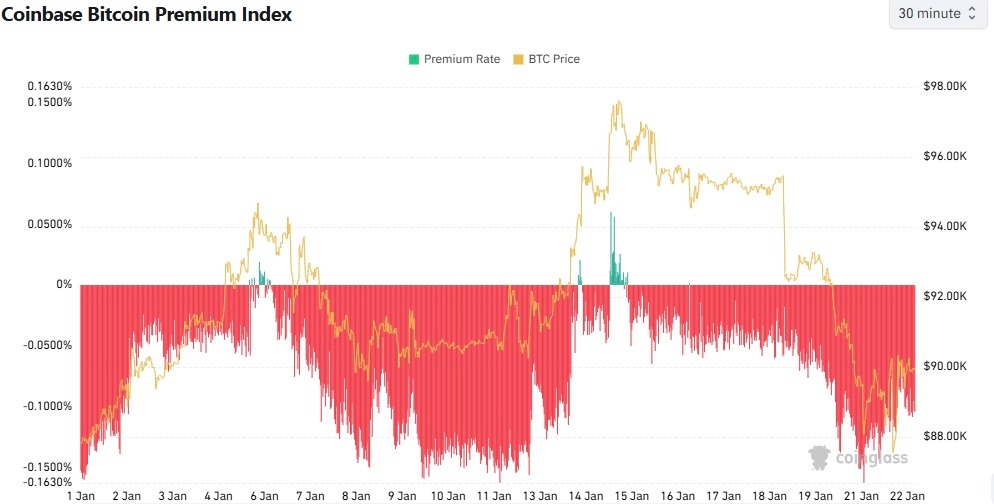

Notably, the Coinbase Bitcoin Premium Index has remained negative, signaling low buying pressure from U.S.investors. Year-to-date, this index has turned positive only twice, but it has quickly reversed, signaling low conviction among U.S. investors in Bitcoin.

Nonetheless, Strategy has made a huge comeback in 2026 after being pushed to the defensive end in the fourth quarter of 2025. Earlier this week, Strategy announced its acquisition of 22,305 BTCs for about $2.13 billion at an average price of $95,284 per Bitcoin.

As such, Strategy now holds 709,715 BTCs, currently valued at about $63.8 billion. In the altcoin market, BitMine has led in the relentless acquisition of Ethereum to boost its treasury portfolio.

What’s the Bigger Market Picture?

The crypto market, led by Bitcoin, previously wiped out gains made during the first week of January. Furthermore, capital flight to the precious metal industry pushed Bitcoin and the wider altcoin market lower in the past few days.

However, Ark Invest CEO Cathie Wood believes that the Bitcoin price has already bottomed out. She stated that Bitcoin price may consolidate in the range between $80k and $90k before its parabolic liftoff in the near future.

“This will be the shallowest decline in Bitcoin’s history,” she stated in an interview.

With the Senate’s momentum for the CLARITY Act on the rise, capital rotation from the precious metal industry to crypto is expected to increase. As such, Bitcoin price is well-positioned to lead the wider crypto market in a parabolic liftoff in the coming weeks.

Related: Trump Signals Quick Move on CLARITY Act as Bitcoin Holds Near $90K

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.