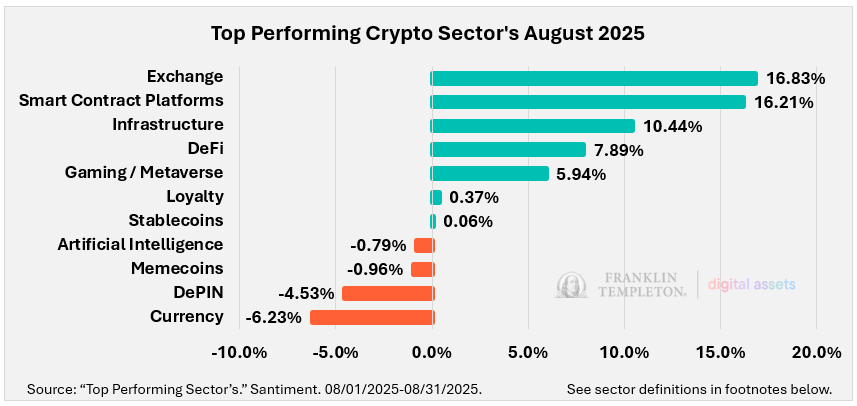

- The Exchange sector emerged as the top performer in August with a 16.8% gain.

- The smart contract platforms space also recorded notable gains of 16.2% in August.

- The memecoin space continued to underperform other sectors in August but a change could be ahead.

The crypto market recorded a heightened capital rotation from Bitcoin (BTC) to the altcoin space in August. Ethereum (ETH) price reached a new all-time high (ATH), thus leading the wider altcoin market in bullish sentiment.

The best-performing crypto assets in August built their momentum from a bullish outlook in July. According to an analysis from Franklin Templeton Digital Assets, Exchange-based crypto assets and smart contract platform tokens led in the highest gains in August with 16.8% and 16.2% respectively.

3 Reasons Contributing to Exchange Sector’s Growth

Renewed Demand from Institutional Investors

According to Franklin Templeton, the exchange-based crypto tokens, led by Binance Coin (BNB) and Cronos (CRO), were the best performing in the sector due to renewed interest from institutional investors.

For instance, BNB recorded an elevated futures market, which surged to an all-time high of about $1.72 billion on August 23, before retracing to around $1.35 billion on September 6, 2025. The mainstream adoption of the Binance ecosystem also helped increase the BNB quarterly burns amid the rising demand from whale institutional investors.

Moreover, several companies – led by CEA Industries Inc., Windtree Therapeutics, Nano Labs, Liminatus Pharma, and B Strategy – have already announced plans to implement their strategic BNB reserves.

As for the CRO token, its 39% surge in August was largely influenced by the announcement of a new treasury initiative by Trump Media. Notably, the Trump Media announced a $1 billion purchase of 6.3 billion CRO tokens, which represented 19% of its circulating supply.

Favorable Regulations Recorded in August

The notable performance of the Exchange-based crypto tokens was also influenced by favorable regulatory conditions. For instance, in early August, President Donald Trump signed an executive order enabling 401(k) plans to invest in alternative assets, including digital assets.

The improving regulatory environment helped increase mainstream adoption by institutional investors. Moreover, top financial regulatory agencies, the U.S. SEC and the CFTC, have eased crypto regulations to attract more investors in the country.

Altseason Renaissance

The exchange-based crypto tokens outperformed in August fueled by the renewed odds of altseason. As the Ethereum price surged to a new ATH in August, large to medium-cap altcoins gained bullish momentum.

Related: Analyst Cites On-Chain Data to Argue a Crypto Capital Rotation to Altcoins is Underway

The Next Emerging Sector in The Crypto Market

The crypto market is expected to record more volatility in the coming weeks, especially fueled by the high-impact news from the Fed rate decision on September 17. With the odds of a 25 bps Fed rate cut having surged to a new ATH on Kalshi and Polymarket, following Friday’s weaker-than-expected labor market, more traders are expecting a bull rally in the coming weeks.

As such, memecoins with robust fundamentals, including those with spot ETF filings, may likely record higher gains. The trading launch of World Liberty Financial (WLFI) token has also given limelight to DeFi-based tokens, which might perform well in the coming days.

Related: Altcoin Market Cap Closes August Above $1 Trillion: What Comes Next?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.