- Santiment tweeted that crypto returns are showing signs of a short-term recovery.

- Data from the analytics firm showed that traders’ assets are mildly over water.

- At press time, the global crypto market cap stands at $1.11 trillion.

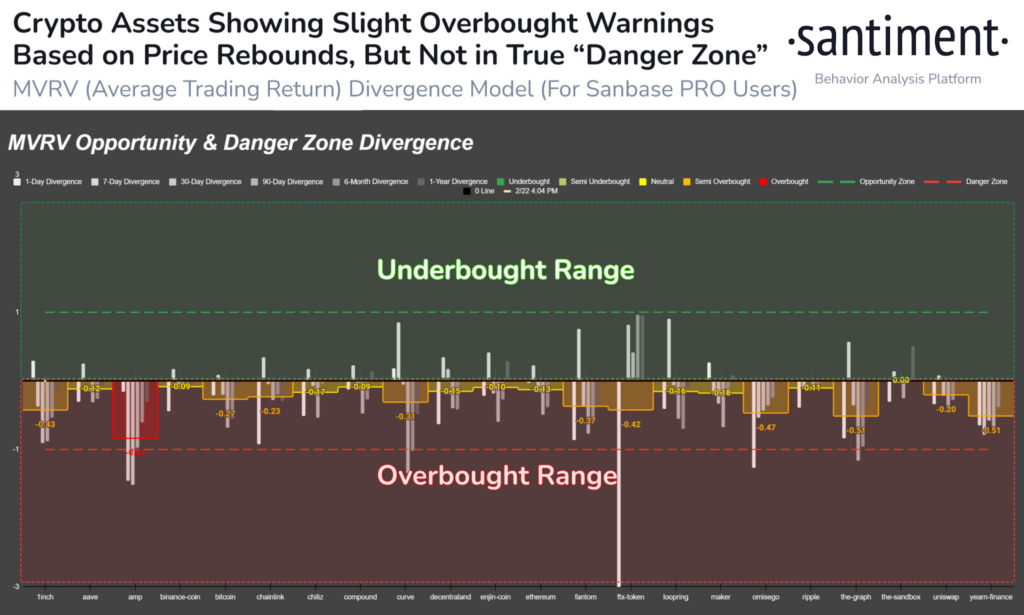

The blockchain analytics firm, Santiment, posted a tweet on their official Twitter page (@santimentfeed) this morning stating crypto returns are “beginning to show signs of a short-term recovery in the last 8 hours”.

In the tweet, Santiment went on to warn traders and investors that “cautiousness is advised with average returns positive in 2023,” stating that “markets move up with the highest probability when trader’s assets are under water. Currently, they’re mildly over.”

Although the crypto market was in the overbought range at the time that Santiment posted the tweet, the firm added that crypto assets are not yet in the “Danger Zone.”

At press time, the global crypto market cap has risen 1.65% over the last 24 hours according to CoinMarketCap. As a result, the total crypto market cap stands at $1.11 trillion at press time.

This comes after all of the top 10 cryptos by market cap posted 24-hour gains. Leading the pack is Polygon (MATIC) with its 24-hour gain of 3.36%. MATIC is currently changing hands at $1.40 at press time.

The second and third biggest gainers in the last 24 hours are Cardano (ADA) and Binance Coin (BNB), with their respective 24-hour gains of 2.53% and 2.07%.

The crypto market leaders, Bitcoin (BTC) and Ethereum (ETH) experienced price increases of 1.71% and 1.93% respectively in the last 24 hours. At press time, BTC is changing hands at $24,435.99, while ETH’s price currently stands at around $1,670.32.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.