- Widow loses life savings after online romance turns into crypto scam.

- Scammers used fake trading platforms showing false profits.

- The victim wad pushed to borrow money and invest more.

A widow in San Jose who believed she had found a partner online, instead became the victim of a massive crypto scam, losing almost $1 million. The case, reported by ABC7 News, is another example of “pig butchering,” where criminals build emotional trust before pushing victims to invest in fake crypto platforms.

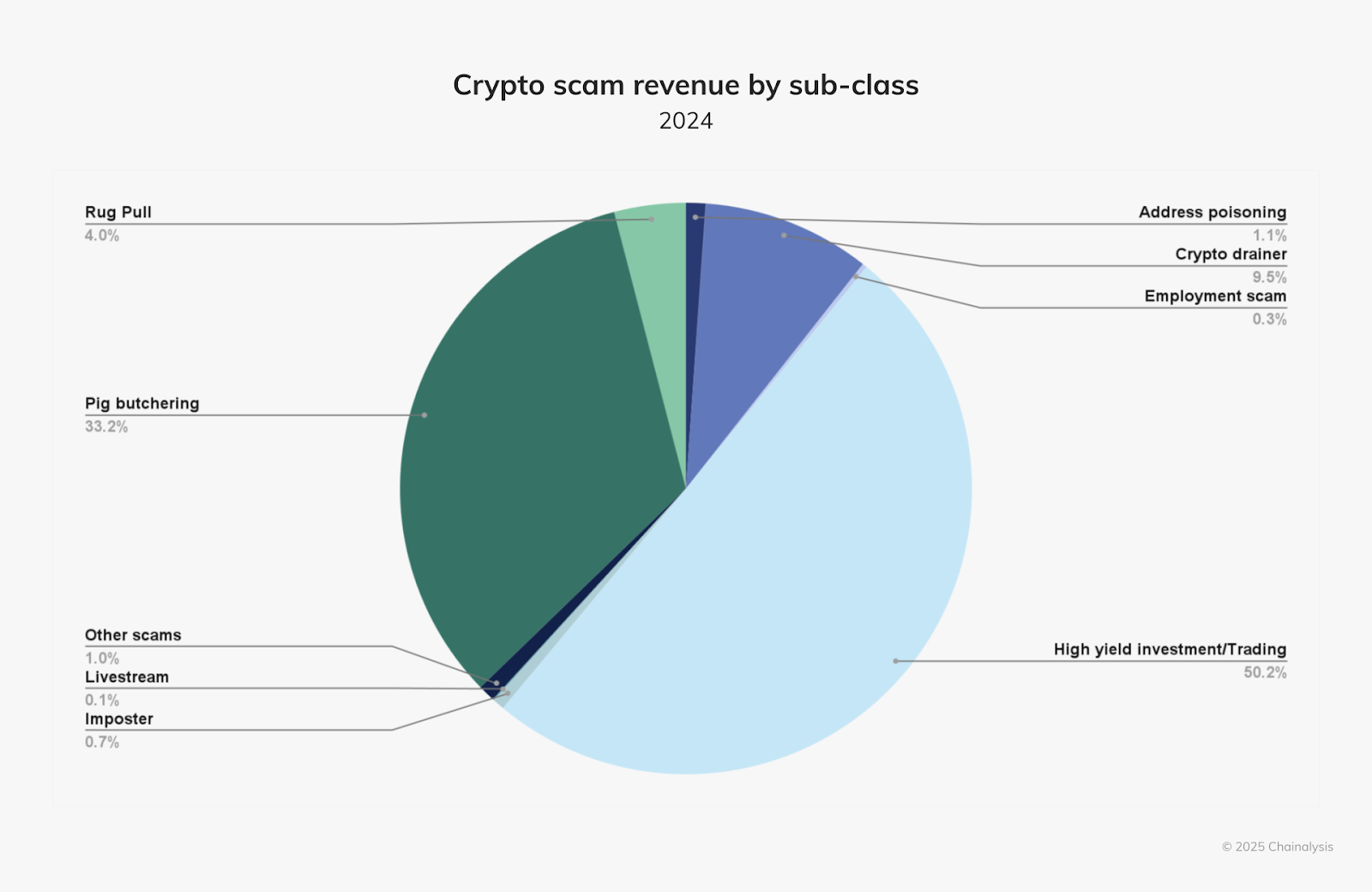

According to reports, criminals moved about $9.9 billion into crypto scam wallets in 2024, and experts expect the real total to be far higher once more fraud-linked wallets are identified.

A Friendship That Turned Into a Setup

Margaret Look lives alone in a condo she purchased for retirement. Last year, a friend introduced her to a man on Facebook who called himself Ed.

He claimed to be a businessman from Texas and said he shared her cultural background. Margaret believed she had found companionship after years of loneliness.

Related: A Bitcoin-Friendly President? Yes, A Crypto-Focused Strategy? Not Yet

The Investment Pressure Begins

Things changed when Ed asked about her finances. He told her she tried crypto trading and guided her to sign up on a platform he said was reliable. When she deposited $15,000, the app instantly showed large “profits,” convincing her she had made a smart choice.

Encouraged, she wired $120,000 from her IRA. The fake platform showed even bigger gains. Ed told her they were on track to build millions together and urged her to keep investing. Under his influence, she sent $490,000 next, then another $62,000, nearly emptying her IRA. As the fake balance on her account grew, she believed she was building a secure future.

Ed continued to pressure her, insisting she borrow more money. Overwhelmed, she took out a $300,000 second mortgage and sent that as well. Her online account appeared to show more than $2.4 million, even though none of it was real.

Everything Collapses

When Margaret tried to withdraw funds, the platform froze her account. She was told she needed to pay $1 million to unlock it. Ed’s messages turned harsh and he demanded she borrow again, even threatening legal action.

Confused and scared, Margaret asked an AI assistant for advice. It told her she was being scammed. She then realized all her transfers had gone to a bank in Malaysia used by criminal networks.

Pig-butchering scams are run by organized crime groups overseas. Margaret now faces the loss of her retirement money, heavy debt, and a large tax bill. Investigators say many more victims are coming forward as these scams expand.

Related: SEC Chair Atkins Formalizes ‘Tokenization First’ Policy to Modernize U.S. Capital Markets

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.