- Ki Young Ju urges calm after Bybit’s reserves drop following a $1.5 billion hack.

- Bybit has secured 446,870 ETH through loans, whale deposits, and purchases.

- CEO Ben Zhou announces an upcoming proof of reserves report to confirm full asset backing.

CryptoQuant CEO Ki Young Ju has urged the crypto community to stop spreading FUD about the Bybit exchange after a sharp decline in its reserves following the ill-fated hack.

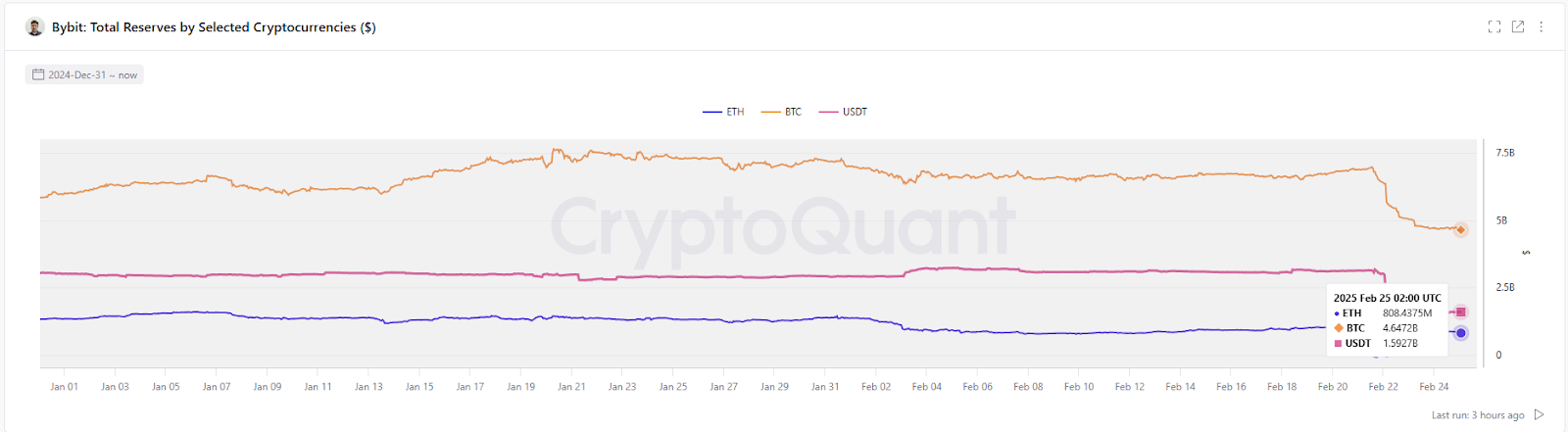

A CryptoQuant chart tracking Bybit’s BTC, ETH, and USDT reserves dating back to December 31, 2024, shows a sudden drop in holdings on February 24. This sparked concerns over the exchange’s financial stability. However, he stressed that Bybit “is fine” and there is no need for panic.

Ethereum Reserves Show Signs of Recovery

Bybit’s Bitcoin reserves remained relatively stable but fell from over $7.5 billion to below $5 billion around February 22. USDT reserves also remained steady before showing a noticeable dip on the same date, possibly indicating withdrawals or fund movements.

Similarly, Bybit’s ETH balances plunged sharply on February 21 when hackers stole $1.4 billion worth of Ethereum from the exchange.

Despite the initial panic, Bybit’s Ethereum reserves initially declined to approximately 600,000 ETH, before rebounding to above 800,000 ETH as of the latest data.

Bybit’s ETH holdings surged as the exchange secured 446,870 ETH, worth approximately $1.23 billion, through loans, whale deposits, and purchases to close the gap.

Related: Bybit Sees Surprise $4B Inflows After Major Hack as Partner Support Floods In

Exchanges, Institutions, and Whales Contribute to Recovery

Data from Lookonchain revealed that Bybit received 157,660 ETH (approximately $437.8 million) from one address, likely through over-the-counter buying. Another 109,033 ETH ($304.1 million) came from an entity that bought ETH from both centralized and decentralized exchanges.

Meanwhile, Whales and institutions’ contributions to the recovery include over $127 million in ETH as loans, with crypto exchange Bitget providing 40,000 ETH ($106 million) and MEXC contributing 12,653 stETH ($33.9 million).

CEO Ben Zhou earlier assured users that a proof-of-reserves (PoR) report will be released using Merkle tree verification to confirm holdings soon to confirm Bybit’s full asset backing.

Related: Bybit Closes ETH Gap After Billion Dollar Hack, Proof of Reserves Coming

Exchange Stability and Future Outlook

Bybit’s efforts to replenish reserves suggest that the exchange has stabilized operations and is working toward a full recovery. The replenishment of the ETH reserve, coupled with proof-of-reserve data, could help restore user confidence and potentially contribute to a market recovery.

Despite Bybit being fully operational, the broader crypto market has seen a sharp decline following the hack. Bitcoin is currently trading at $91,680, a 4.3% drop in the past day. Ethereum and XRP are trading at $2,491 and $2.26, respectively, with both falling by 8.4% in the same period.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.