- Senator Cynthia Lummis riffs on a Franklin Bitcoin meme as BTC rebounds near $92K

- Her bullish tone leans on ETF, bank custody and 401k adoption as policy clears

- Supporters tie her message to a Bitcoin Act push and a more dovish Fed in 2026

United States Senator Cynthia Lummis posted a bullish Bitcoin message after the latest rebound, framing the asset as a path to financial freedom. The pro Bitcoin lawmaker joined other high profile voices in repeating a “buy the dip” narrative while the market worked through recent volatility.

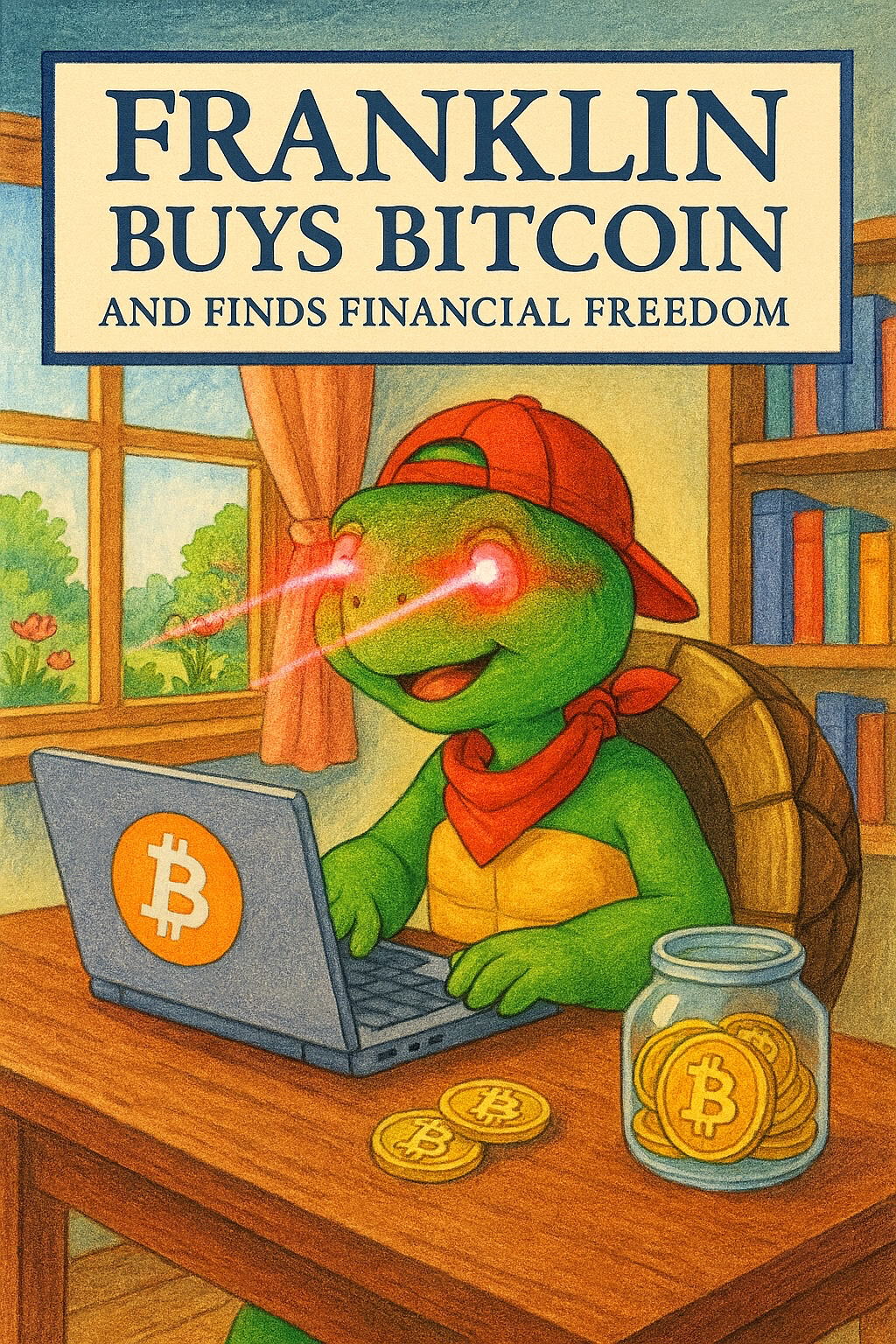

As Bitcoin reclaimed a key liquidity zone around $92,000, Senator Lummis shared an image of Franklin the turtle with bright “laser eyes” and a caption that joked about “Franklin buys Bitcoin and finds financial freedom.” The post drew heavy engagement on X, reaching around 741,000 views at press time and reinforcing the idea that another crypto summer could follow once policy and liquidity align.

Related: Fed Executes Massive $13.5B Liquidity Injection; Crypto Reprices Higher on ‘Silent’ Liquidity Pump

Why is Senator Lummis Bullish on Bitcoin?

Institutional Adoption And Bank Custody Sharpen Her Bullish Case

Senator Lummis has repeatedly argued that the United States government should buy Bitcoin for its reserves, framing it as a strategic store of value alongside more traditional assets. Her latest messaging builds on the ongoing adoption of BTC by institutional investors and an expanding base of retail holders who now access the asset through regulated channels.

Supporters point to recent regulatory approval that allows U.S. banks to custody Bitcoin for customers, a change that has encouraged large financial institutions to formalize their BTC strategies. That backdrop gives Lummis room to argue that Bitcoin has moved beyond a fringe trade and now functions as an investable digital commodity within the traditional system.

Vanguard, which has an estimated $9 trillion in assets under management, joined BlackRock and Franklin Templeton in widening access to Bitcoin. Earlier this week, Vanguard reversed its stance and allowed more than 50 million customers to trade spot BTC ETFs from third party issuers, led by IBIT and FBTC.

Regulatory Clarity, Bitcoin Act Narrative And Fed Politics

Lummis has also tied her optimism to what she describes as growing regulatory clarity in the United States. Backers argue that under President Trump, Bitcoin has gained enough structure and legal footing to attract hundreds of billions of dollars, including allocations from 401k plans and other retirement vehicles that once stayed on the sidelines.

Additionally, the U.S. government has gradually increased its Strategic Bitcoin holdings and is expected to expedite the process via the approval of the Bitcoin Act.

“A congressionally approved path for the US Gov to begin accumulating bitcoin (SBR) at an unprecedented rate… is coming. Slowly, suddenly, then all at once!” an X account replied to Lummis.

Why Supporters Say The Timing Of Her Message Matters

Bitcoin is expected to lead the wider crypto market in a bullish rebound during the first quarter of 2026. According to Alice Liu, Head of Research at CoinMarketCap, the crypto market will record a comeback in the first quarter of 2026.

“We are going to see a market comeback in Q1 of 2026. February and March will be a bull market again, based on a combination of macro indicators,” Liu stated.

The bull posting from a Binance-affiliated social account will heavily influence retail traders into FOMO (fear of missing out). As such, Lummis could be urging investors to focus on Bitcoin to achieve their desired financial freedom.

Related: Poland’s President Rejects Crypto Regulation Bill Despite EU Pressure

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.