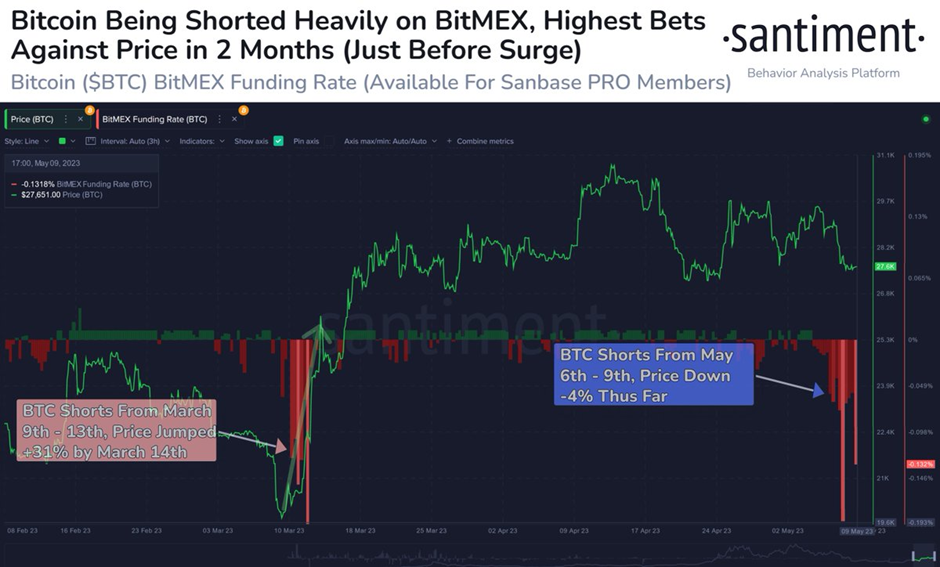

- Santiment recently highlighted that BTC’s funding rate on Bitmex has dropped to its most negative ratio since March.

- According to the firm, BTC’s price may surge soon if history repeats itself.

- At press time, the price of BTC was trading at $27,673.51 after a slight 24-hour gain.

Santiment, the blockchain intelligence firm, tweeted this morning that the funding rate for Bitcoin (BTC) on Bitmex has recently reached its most negative ratio since the middle of March this year. The platform also predicted that BTC’s price may soon soar as a result.

According to Santiment, the possibility of BTC’s price rising has historically increased when investors and traders overwhelmingly assumed that its price would drop. This theory has yet to play out, however, given that between 6 May 2023 and yesterday, BTC’s price had dropped approximately 4%.

At press time, CoinMarketCap had indicated that the leading crypto’s price was able to print a 0.27% gain over the previous 24 hours. As a result, BTC’s price stood at $27,673.51. Unfortunately, this positive price movement was not able to flip its weekly price performance into the green, and BTC was still down 2.86% over the past 7 days.

Technical indicators on BTC’s daily chart suggested that the crypto’s price would continue to fall in the following 24-48 hours. The descending triangle, which was formed after BTC’s price printed lower highs over the last 2 weeks, suggested that there was still overwhelming sell pressure present on the market leader’s chart.

Should BTC’s price succumb to this sell pressure, it will likely drop to $26,600 in the short term. This bearish thesis is supported by the recent bearish cross between the 9-day EMA and 20-day EMA, which suggests that BTC has entered into a short-term downtrend.

A confirmation of the bearish thesis will be when BTC’s price closes below the $27,380 level. On the other hand, BTC maintaining a position above this level will either result in a brief consolidation between $27,380 and $28,420, or a break above the 9-day and 20-day EMA lines at around $28,700.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.