- Binance’s spot market share rose from 59.4% in January to 61.8% in February.

- The 24-hr trading volume of Binance exceeded $15B, while its closest rival got $4.1B.

- The exchange also leads the perpetual futures space with the highest offering.

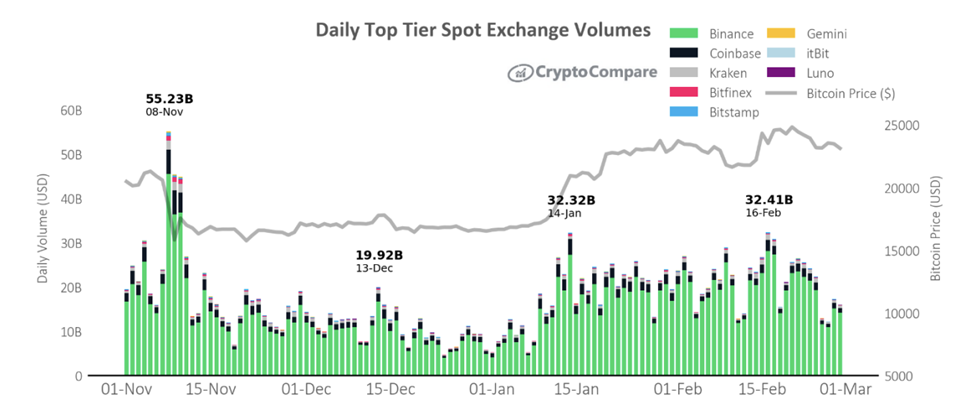

For four consecutive months, the Binance crypto exchange has maintained an upper hand over its competitors regarding the crypto spot market share. According to a recent report from CryptoCompare, a market research firm, Binance’s market share rose from 59.4% in January to 61.8% in February.

CryptoCompare also noted that Binance’s spot volumes increased by 13.7% to an all-time high of $504 billion despite the widespread regulatory frictions and community FUDs against the exchange. Additionally, Binance led other top-tier crypto exchanges, such as Coinbase and Kraken, with an extensive margin in the crypto spot market.

Jacob Joseph, a research analyst at CryptoCompare, attributed Binance’s dominance to the vast amount of liquidity on the exchange. Joseph added:

Despite the recent criticism the exchange has received, market participants continue to take shelter on Binance under the premise that the largest exchange is seen as one of the safer trading venues.

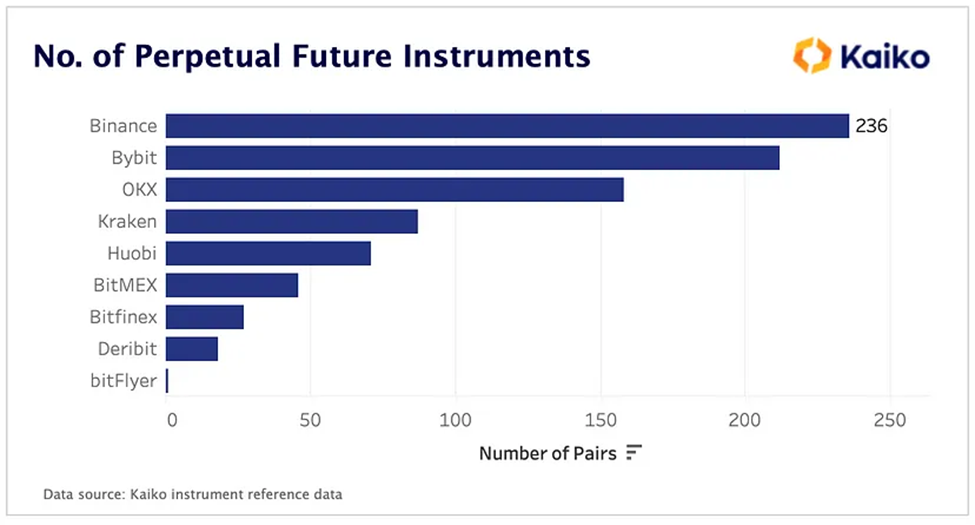

Interestingly, Binance also dominates the crypto derivative market. According to a report from an institutional-grade market tracker last month, the Binance exchange took over from FTX as the market leader in the perpetual futures space, with the most number of pairs offered.

The now-defunct FTX exchange was on the frontier of derivative contracts until its demise last November. However, Binance now occupies the position with 236 listed pairs. While Bybit and OKX are within close range of Binance, other exchanges such as Kraken, Huobi, and BitMex are far behind, offering fewer than 100 perpetual futures instruments.

In the last 24 hours, Binance trading volume exceeded $15 billion. The exchange closest to Binance on the ranking had only $4.1 billion in 24-hour trading volume.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.