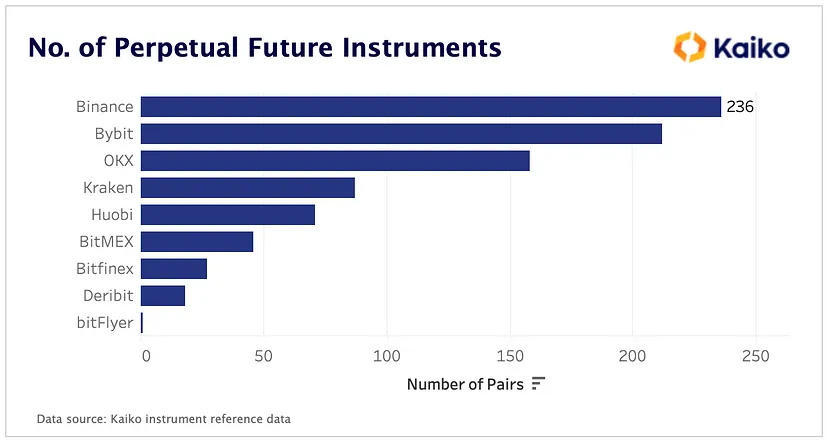

- Binance exchange now leads the perpetual futures space with the hights offering.

- Kraken, Huobi, and BitMex offer below 100 perpetual futures instruments.

- Open Interest for derivative contracts remained relatively stable at around 280K BTC.

According to a blog post by Kaiko, an institutional-grade crypto market tracker, the Binance exchange has taken over from FTX as the market leader in the perpetual futures space, with the most number of pairs offered.

Kaiko stated this point in a recent bulletin analyzing the current state of the global crypto market. The market tracker claims FTX was on the frontier of derivative contracts until its demise last November, but Binance now occupies the position with 236 listed pairs.

While Bybit and OKX are within close range of Binance, other exchanges such as Kraken, Huobi, and BitMex are far behind, offering fewer than 100 perpetual futures instruments.

Furthermore, the institutional market tracker discussed other metrics for trading Bitcoin (BTC) perpetual contracts, such as Open Interest (OI). It noted that OI for derivative contracts remained relatively stable at around 280k BTC last week even though the volatility of the Bitcoin market surged to its highest levels since the FTX collapse.

Contextually, Open Interest refers to the total number of outstanding derivative contracts, such as options or futures, awaiting settlement. The fact that OI remained steady despite increased volatility suggests that traders made no significant changes to their positions during the week.

However, according to Kaiko, Open Interest is still down 17% relative to November 2022. Commenting on macro trends, the market tracker stated that crypto has been decoupling from traditional assets in 2023 as macro headwinds subside and crypto-specific events increasingly drive the market. Bitcoin trades at $25,042.58 after seeing an over 15% increase in the past week.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.