- The recent crypto capitulation has caused heavy unrealized losses for digital asset treasury companies.

- Strategy and BitMine have faced the largest blow, but have continued to accumulate.

- The high unrealized losses have increased crypto traders’ fears especially after the closure of crypto lender BlockFills.

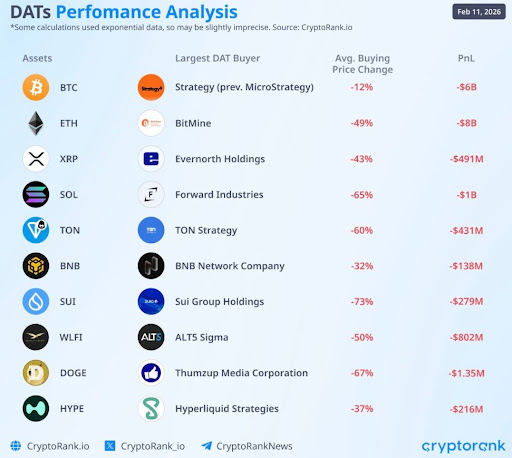

The Digital Assets Treasuries (DATs) are under significant unrealized losses. Following the recent capitulation in the crypto market cap from above $3 trillion to around $2.29 trillion on Thursday, February 12, DATS are cumulatively counting more than $15 billion in unrealized losses.

According to market data from CoinRank, Strategy Inc. has led other DATs in a drop of at least 12% from their average buying price. BitMine, which has a portfolio dominated by heavy Ethereum (ETH), is already down 49%, with an unrealized PnL of about $8 billion.

Solana (SOL) focused Forward Industries has an unrealized PnL of about $1 billion, with its average buying price down 65% to date.

Will the DATs Capitulate Other Whales?

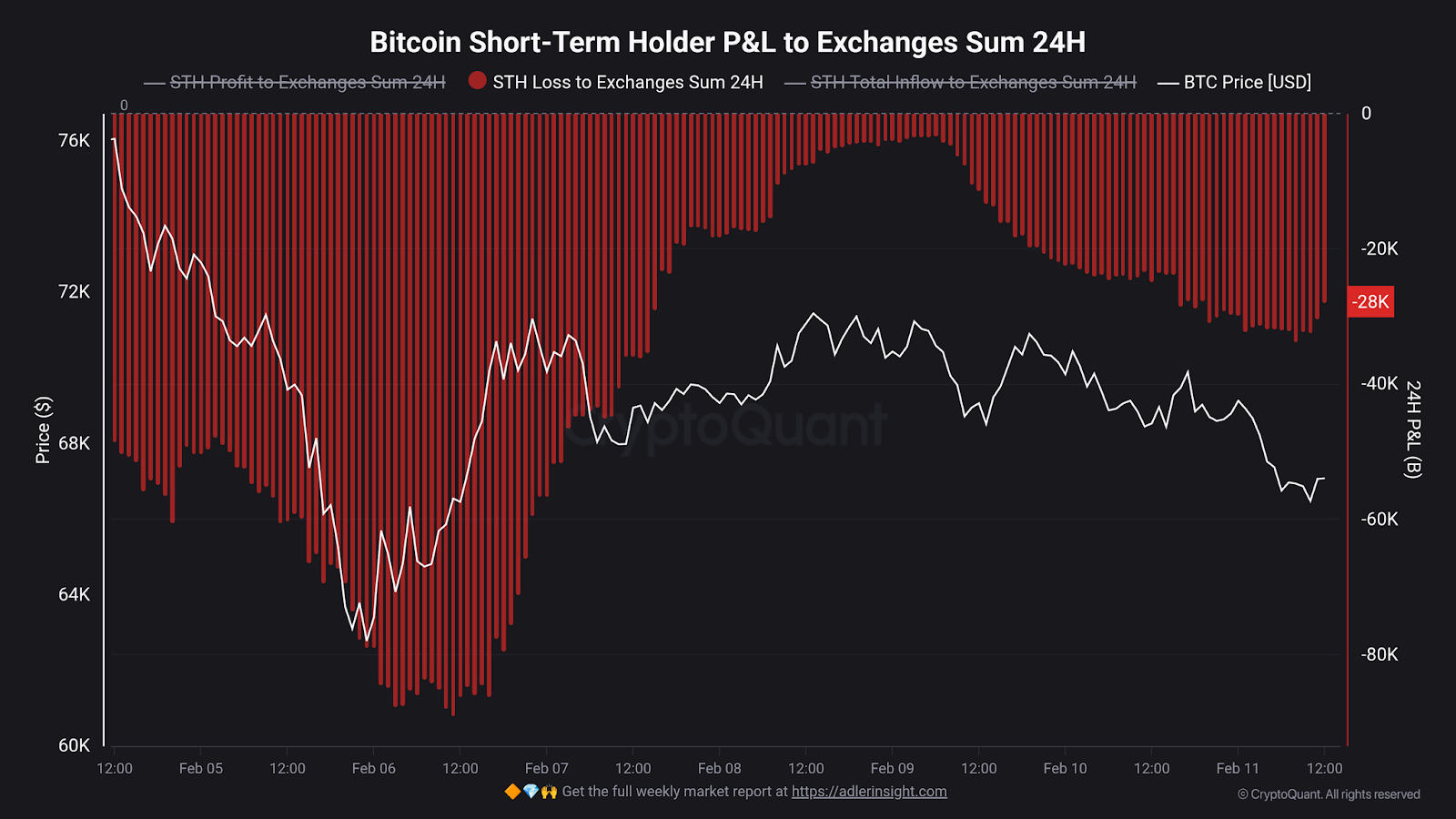

The notable unrealized losses in the DATs sector has raised concerns of potential capitulation alongside other whale investors. According to onchain data analysis from CryptoQuant, Bitcoin’s short-term holders have been sending their coins to exchanges in losses potentially to sell.

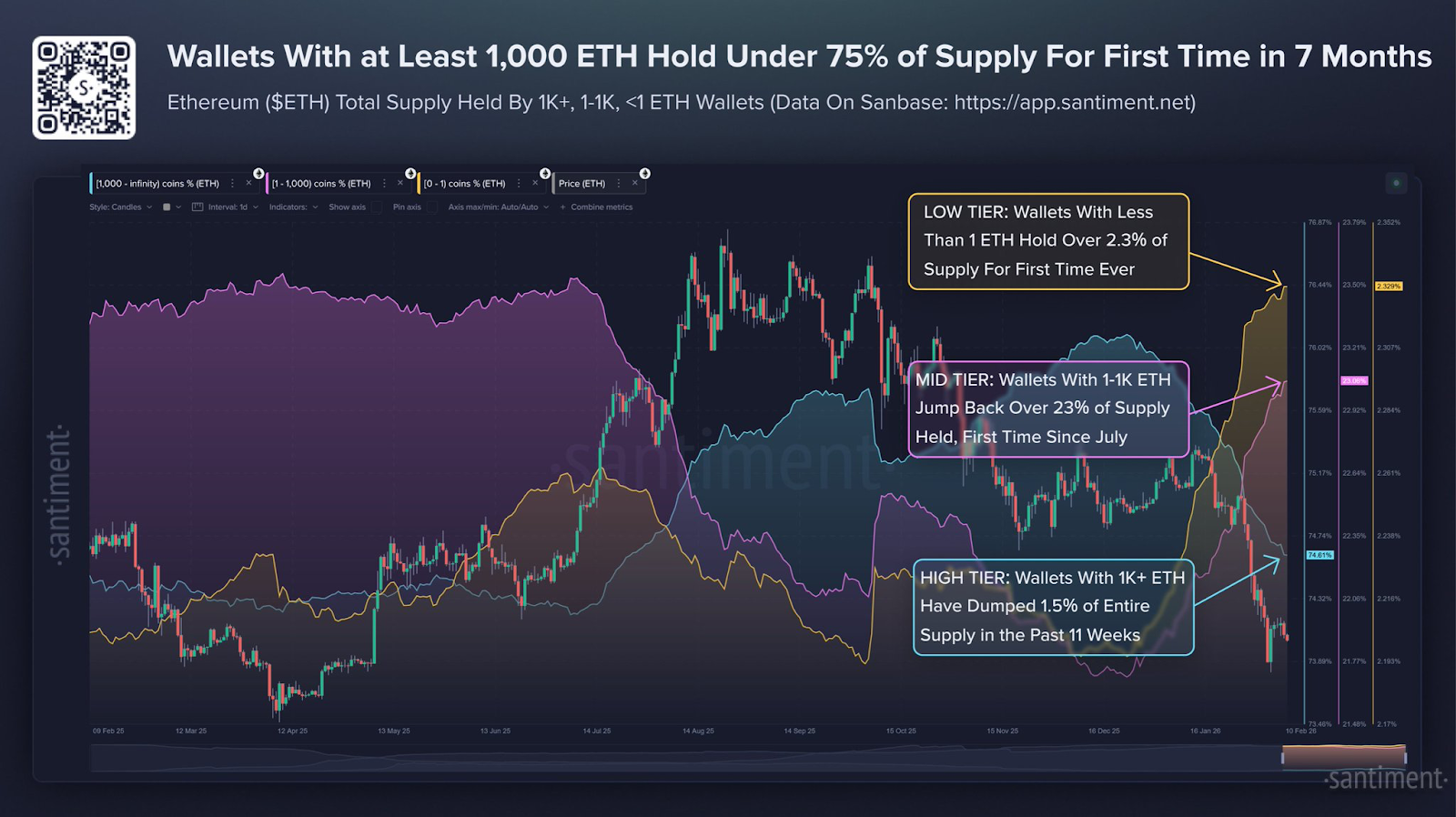

A similar scenario has been observed with Ethereum whales, whereby onchain data analysis from Santiment shows wallets with more than 1k ETH have been selling. Specifically, this group of investors has sold a total of 1.5% of their entire holdings in the last 11 weeks.

However, Strategy and BitMine executives have reaffirmed to their shareholders that their balance sheets are strong for a prolonged crypto winter. For instance, Michael Saylor announced that Strategy’s Stretch preferred shares ($STRC) closed at $100 per share on February 11, thus activating the company’s at-the-market offering to raise additional funds and purchase more Bitcoins.

Meanwhile, onchain data analysis from Arkham shows Tom Lee’s BitMine purchased another 40,000 ETH for $88 million. As such, BitMine now holds 3.58% of the ETH total supply, valued at over $9.2 billion.

What’s the Midterm Market Impact?

The palpable unrealized losses from the digital assets treasury companies are a huge blow to midterm bullish sentiment. Although most of these coins will not get sold, since the respective companies are leveraging the equities market, the rate of their accumulation will significantly slow down.

Furthermore, these DATs will be using their cash reserves to pay out interests amid the ongoing crypto winter. As such, the crypto buying pressure will likely slow down until the extreme crypto market capitulation ends in a consolidation.

Amid the extreme crypto fear, especially after crypto lending platform BlockFill closed its operations due to the bear market, the heavy unrealized losses in the DATs will further weigh down the crypto market outlook.

Related: “Stretch Closed at $100 Exactly as Designed,” Says Strategy CEO Phong Le

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.