- Decred’s consolidation between $35–$37 suggests growing bullish strength and accumulation.

- Exchange outflows highlight investor confidence and signal expectations of higher prices.

- Rising social engagement and sentiment confirm expanding retail interest in Decred’s rally.

Decred (DCR) has regained market attention after stabilizing from its recent pullback, signaling renewed investor confidence. The token, which fell sharply from the $69.76 peak, found solid footing near the $26.68 level, setting the stage for a potential recovery.

At $36.83, Decred trades above key moving averages, showing that buying activity is strengthening after months of volatility. The broader market shift toward accumulation and exchange withdrawals suggests growing optimism for a mid-term rally.

Technical Landscape Shows Signs of Reversal

After a steep correction, DCR has begun consolidating between $35 and $37, forming a potential base structure. Maintaining closes above this zone could attract more buyers and confirm a short-term uptrend. The Fibonacci retracement levels highlight key price areas, with $26.68 acting as crucial support and $48.30 marking the next breakout point.

Besides, the alignment of 20, 50, 100, and 200 EMAs indicates that a bullish crossover may form if momentum persists. Bollinger Bands show widening volatility, suggesting that trading activity is accelerating. The token’s resilience around the $32–$35 range reinforces the ongoing accumulation phase, which could fuel the next upward leg toward $41 and $48.

Liquidity Trends Support Accumulation Behavior

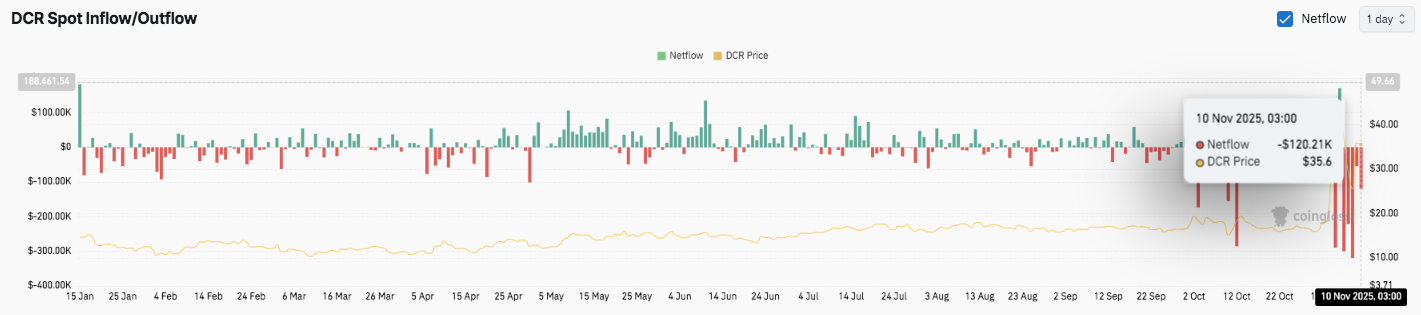

Decred’s inflow and outflow patterns have revealed an interesting trend throughout 2025. While netflows stayed mostly negative, suggesting consistent withdrawals, sharp inflows appeared during key recovery phases in May, June, and November. This behavior indicates that investors often deposit funds during rallies but withdraw to hold when prices consolidate.

Significantly, the latest data shows a $120,000 outflow as DCR trades near $35.6. That movement reflects long-term holders moving coins off exchanges, typically a bullish signal in anticipation of higher prices. The pattern suggests a healthy market structure, where traders take profits near resistance, while new participants accumulate during retracements.

Market Sentiment and Social Activity Strengthen Outlook

Social data reinforces the technical optimism. LunarCrush reports show DCR gaining 145% in price over the past year, alongside a 1,300% increase in social mentions. Positive sentiment has reached 87%, indicating stronger retail engagement.

Technical Outlook for Decred (DCR/USDT)

Key levels remain well-defined as Decred consolidates after recovering from a steep correction. Upside targets stand at $41.00, $48.30, and $57.74 levels that represent resistance zones aligned with key Fibonacci retracements. A sustained move above $48.30 could confirm a broader bullish reversal, opening room toward the $57.74 mid-term target.

On the downside, $32.56 serves as short-term support, while $30.42 (50 EMA) and $26.68 (0.236 Fib) mark deeper cushions for buyers. Losing $32 may expose Decred to extended correction pressure toward $30 or even $26 if momentum fades.

The Bollinger Bands show expanding volatility, reflecting renewed participation and directional uncertainty. Meanwhile, all EMAs (20/50/100/200) are converging, hinting at a possible bullish crossover if the price holds above $35–$37.

Related: Zcash, Decred And ZKsync Outperform As Traders Revive Privacy Tokens

Will Decred Continue Its Recovery?

Decred’s next major move hinges on its ability to sustain strength above $35. Stabilizing above this zone may attract momentum buyers aiming for a breakout past $41–$48.

Broader sentiment and recent outflows from exchanges indicate accumulation, suggesting confidence among long-term holders. However, failure to maintain short-term supports could trigger a pullback before any renewed advance.

For now, DCR remains in a pivotal consolidation range. A breakout above $48.30 could shift the structure decisively bullish, while a slip below $32.56 would delay the recovery narrative.

Related: Decred (DCR) Price Prediction: Will DCR Reach $80 in 2022?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.