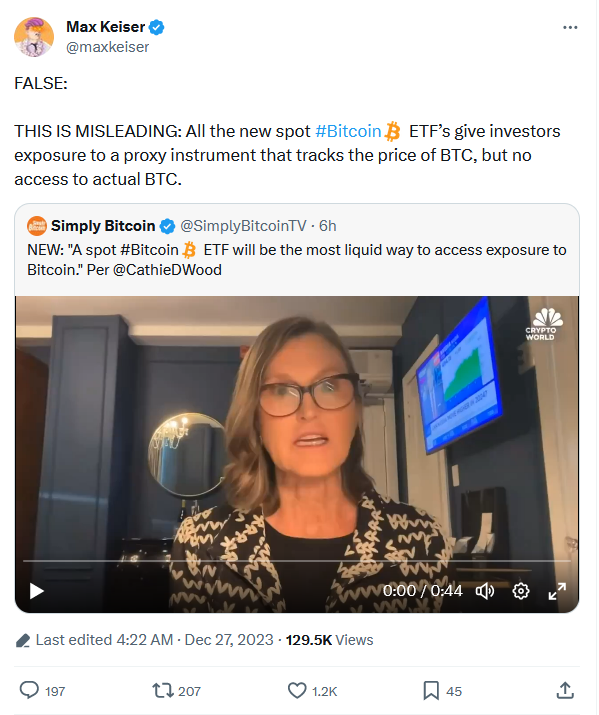

- Cathie Wood remarked Bitcoin ETF as “the most liquid way to access exposure to Bitcoin.”

- Max Keiser criticizes Wood’s statement, dismissing it as false and “misleading.”

- According to Keiser, Bitcoin ETFs do not give investors the right to take delivery of actual BTC.

Ark Invest CEO Cathie Wood acknowledged Bitcoin ETF as “the most liquid way to access exposure to Bitcoin” in a recent interview. The American financial broadcaster Max Keiser, censured Ark Invest CEO’s statement as “false” and “misleading.”

In an interview with CNBC, Wood addressed the imminent launch of Spot Bitcoin ETF, asserting that the latest signs of the Securities and Exchange Commission (SEC) are “very encouraging.” Reinforcing anticipations of the Bitcoin ETF launch in 2024, Wood elaborated on the potential benefits of the exchange-traded funds. She noted,

If we’re right, a spot Bitcoin ETF will be the most liquid way to access exposure to Bitcoin. I think that liquidity, and the ability to move in and out quickly is going to be important to institutions.

Wood based her statements on Bitcoin ETFs’ potential use cases and demand. According to her assumptions, some institutions will consider Bitcoin ETF a “new asset class”. In such cases, they need exposure as diversification increases “return per unit of risk” and “they can’t ignore it.”

In response to these comments, Max Keiser came forward with stark criticism. He asserted that the spot BTC ETFs do not give investors the right to take delivery of actual BTC. Instead, the “CBDC-shilling” government provides USD or CBDC equivalent redemption. The critic’s tweet read,

THIS IS MISLEADING: All the new spot Bitcoin ETFs give investors exposure to a proxy instrument that tracks the price of BTC, but no access to actual BTC.

Further, Keiser reiterated that the Bitcoin ETFs are not the investors’ belongings, stating, “Not your keys, not your coins.” Shedding light on the “unprecedented coordination” between Wall Street and the Federal Reserve on the notion of Bitcoin ETFs, Keiser commented, “The BTC ETFs are fiat roach motels.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.