- Dogecoin’s RSI nearing the overbought level suggests a potential price correction, but room for short-term growth remains.

- Bonk’s RSI remains neutral, hinting at price stabilization despite a recent downtrend and weakening bullish momentum.

- Increased speculative activity in Dogecoin and Bonk derivatives shows mixed market signals, with liquidations driving potential corrections.

Santiment, a market intelligence platform, reports a notable increase in discussions surrounding memecoins like Dogecoin (DOGE) and Bonk (BONK). This surge occurred as both tokens experienced price spikes, capturing attention from traders. However, market experts suggest that when focus shifts toward speculative assets, such as memecoins, corrections tend to follow.

Dogecoin Experiences Price Dip

Dogecoin’s price is $0.127748, with a 24-hour trading volume of $1.39 billion. DOGE has experienced a 1.07% decrease in value over the last 24 hours, bringing its market cap to $18.7 billion. Despite this dip, Dogecoin maintains a strong presence in the market with a circulating supply of 146.4 billion DOGE coins.

Besides, Dogecoin’s Relative Strength Index (RSI) stands at 69.17, nearing the overbought level of 70. This suggests the coin is approaching a critical point where a potential price correction could occur. However, since the RSI is just below 70, there’s still room for price growth. Market participants should keep a close eye on any signs of weakening momentum.

Moreover, the Moving Average Convergence Divergence (MACD) analysis reveals weakening bullish momentum. The MACD line is crossing below the signal line, suggesting a potential trend reversal or consolidation phase. While the histogram remains in slightly negative territory, signaling a decrease in upward momentum, traders should proceed with caution.

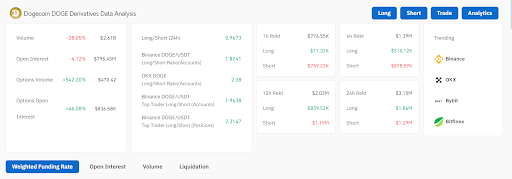

Dogecoin Derivatives Show Mixed Signals

Dogecoin derivatives also present a complex picture. Volume has dropped by 28.05% to $2.61 billion, and open interest decreased by 4.12%. However, options trading surged by 542.20%, while open interest grew by 46.08%, indicating increased speculative activity. Long positions continue to dominate on exchanges like Binance and OKX, reflecting overall bullish sentiment.

Read also: Meme Coins Rally: Dogecoin and Bonk Surge as Bitcoin Profits Flow In

Short positions experienced notable liquidations, but long liquidations have also increased over the past 12 hours. The market remains active, with traders balancing long and short positions and engaging in options trading.

Bonk Faces Market Cooling as Traders Adopt a Bearish Stance

BONK is also showing signs of cooling and is valued at $0.000023 at the time of writing. Bonk saw a 9.59% decline over the past 24 hours while its trading volume reached $263.41 million, and the market cap stands at $1.67 billion, with a circulating supply of 74 trillion BONK coins.

Besides, Bonk’s RSI is at 55.12, indicating a neutral to slightly bullish sentiment. Although the price dropped, the momentum has not yet shifted toward oversold territory. This suggests that the recent downtrend might stabilize soon.

Similarly, the MACD indicates mild bullish momentum, with the lines converging and the histogram showing weakening upward movement. Traders should remain cautious as the market could shift toward bearish trends if these indicators continue to soften.

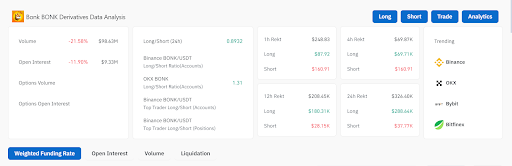

Bonk Derivatives Show Bearish Trends

Bonk’s derivatives market reflects a more bearish sentiment. Volume dropped by 21.58% to $98.63 million, while open interest fell by 11.90% to $9.33 million. The long/short ratio sits at 0.8932, pointing to a slight bearish tilt.

Nonetheless, Binance’s long/short ratio of 1.31 shows more optimism among traders on the platform. Notably, long positions saw notable liquidations in the past 12 hours, reinforcing the likelihood of a market correction.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.