- Dogecoin price today trades at $0.232, holding above $0.22–$0.219 support after rejection below $0.25.

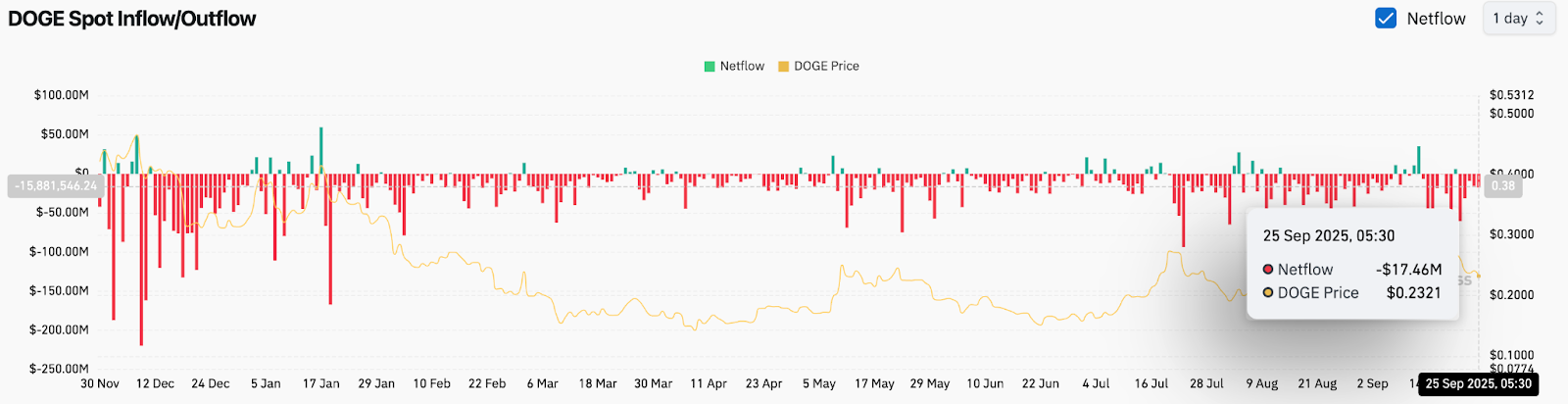

- $17.46M in net outflows show cautious sentiment, with accumulation too weak to spark a sustained rally.

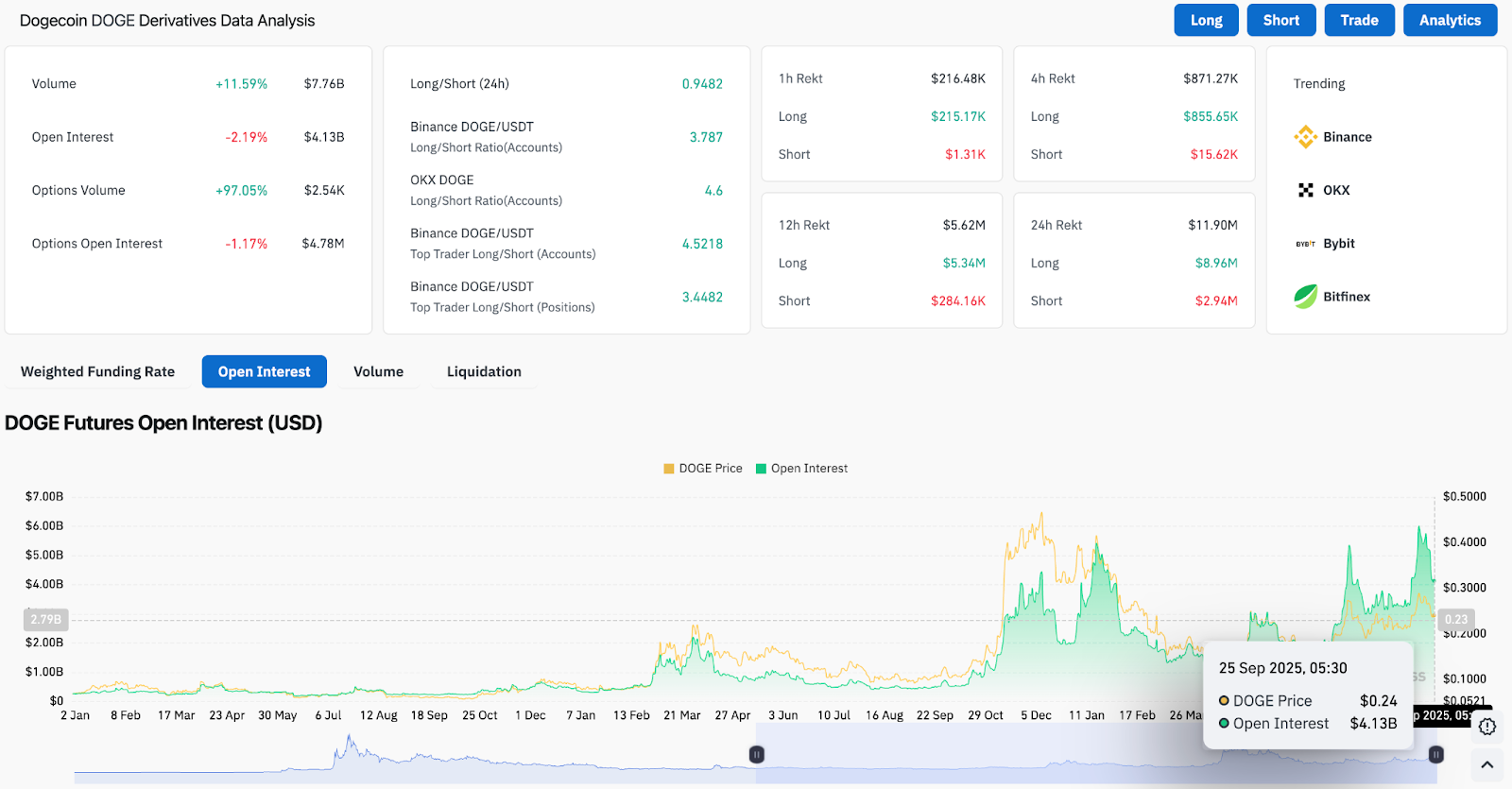

- Derivatives data shows long bias but rising liquidations, keeping DOGE momentum capped below $0.25–$0.30.

Dogecoin price today is trading near $0.232 after slipping 3.8% in the past 24 hours. Sellers remain active below the $0.25 resistance level, while the $0.22–$0.219 zone has emerged as the immediate support cluster. Traders are weighing technical compression against weak inflows to decide the next move.

Dogecoin Price Faces Resistance After Recent Pullback

The daily chart shows Dogecoin consolidating within an ascending channel, but recent sessions have seen the token lose momentum after a failed attempt near $0.30 earlier in September. Price has now retreated toward the mid-range, testing the 20-day EMA at $0.238 as a ceiling.

The 50- and 100-day EMAs sit clustered around $0.226 and $0.219, making this zone critical for short-term direction. Holding above $0.219 would preserve the bullish channel structure, while a breakdown risks exposing $0.20 and deeper liquidity near $0.18. On the upside, reclaiming $0.25 would allow buyers to retest $0.28 and $0.30, with the channel’s upper boundary closer to $0.32.

Related: Pi Coin Price Prediction: Pi Struggles To Recover After Breakdown

Momentum indicators show cooling strength. The RSI has dipped from overbought territory and now sits near neutral levels, while MACD lines are flattening. This suggests that Dogecoin price action may be entering a consolidation phase before the next decisive breakout.

On-Chain Flows Highlight Cautious Sentiment

Exchange flow data shows a persistent outflow trend, yet the magnitude remains inconsistent. On September 25, net outflows reached $17.46 million, reflecting mild accumulation but not enough to signal strong conviction. Overall, the past two months have been dominated by red netflow bars, indicating that traders are more inclined to reduce exposure during rallies rather than aggressively accumulate.

This lack of sustained inflows is a key concern. Dogecoin price volatility has often depended on sharp bursts of retail activity, but the current flow profile suggests a more measured market. Without stronger inflows, any rally attempt above $0.25 risks stalling against overhead supply.

Derivatives Market Shows Mixed Positioning

Dogecoin’s derivatives data paints a cautious picture. Open interest stands at $4.13 billion, down 2.2% in the past day, while daily volume increased 11.6% to $7.76 billion. This divergence signals active trading but with fewer outstanding contracts, a sign of traders closing exposure after recent swings.

Related: Ethereum (ETH) Price Prediction: ETH Slips Below Key Support

Long/short ratios across major exchanges show a tilt toward longs, with Binance and OKX both above 3.5, reflecting that many traders still expect upside continuation. Options activity has also spiked, with a 97% jump in volume to $2,540 contracts. However, the options open interest remains modest at $4.78 million, underscoring that this surge may be speculative rather than structural.

Liquidation data shows that longs absorbed the majority of recent losses, with $11.9 million wiped out over the past 24 hours. This suggests that optimistic traders were caught off guard by the pullback, reducing leverage appetite in the short term.

Technical Outlook For Dogecoin Price

Dogecoin price prediction for September 26 highlights a battle between support at $0.22 and resistance at $0.25.

- Upside levels: $0.25, $0.28, and $0.30 remain the immediate targets if momentum strengthens.

- Downside levels: $0.22, $0.20, and $0.18 as key defense points, with $0.16 as the larger cycle low.

- Trend structure: The broader channel stays intact above $0.219, but breakdown risks rise sharply below this level.

Outlook: Will Dogecoin Go Up?

The near-term trajectory for Dogecoin depends on whether buyers can defend the $0.22 support cluster while flows begin to turn positive. Current on-chain and derivatives data suggest caution, with muted conviction limiting the scope for a sharp rally.

Related: XRP Price Prediction: Can SEC ETF Approval Spark A Rebound Above $3?

As long as Dogecoin price holds above $0.219, the broader bullish channel remains valid, giving buyers room to attempt another move toward $0.28–$0.30. However, failure to sustain this zone would expose the $0.20 handle and weaken the mid-cycle bullish thesis. For now, consolidation is the base case, with traders awaiting stronger inflows before committing to directional bets.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.