- Dogecoin price today trades at $0.232, defending $0.23 support within an ascending channel since June.

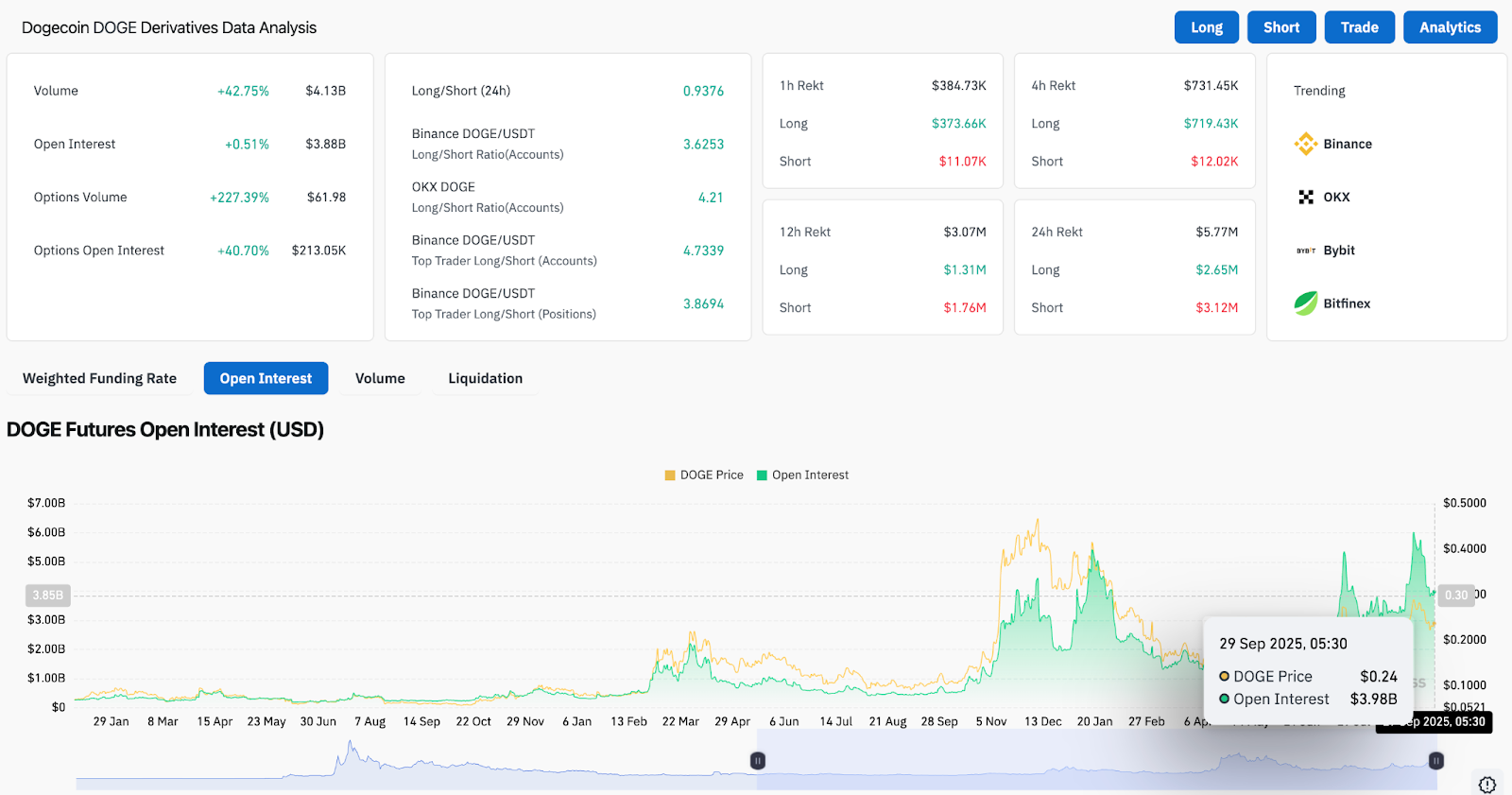

- Futures open interest at $3.88B and options volume surge 227%, signaling strong speculation despite spot weakness.

- Morgan Stanley plans to enable Dogecoin trading by 2026, adding an institutional tailwind to DOGE’s adoption story.

Dogecoin price today is trading at $0.232, defending the ascending trendline support after slipping from the $0.26–$0.28 resistance zone. Sellers tested the $0.23 floor, but buyers are still protecting the rising channel structure. Market focus is now shifting toward Morgan Stanley’s plan to launch Dogecoin trading by early 2026, a potential institutional tailwind that could reshape liquidity flows.

Dogecoin Price Holds Rising Channel Support

The daily chart shows DOGE consolidating inside an ascending channel since June. Price is currently pinned between the $0.23 support base and the $0.26–$0.28 resistance cluster. The 20-day EMA at $0.237 and the 50-day EMA at $0.226 are compressing close to spot, reflecting a neutral balance.

Related: Solana Price Prediction: SOL Price Consolidates Within Rising Channel

The 200-day EMA sits lower at $0.220, making this a crucial defense line. A breakdown here could expose the $0.20–$0.18 demand zone. On the upside, reclaiming $0.26 would reopen the path toward $0.28 and $0.30, where channel resistance and past supply converge.

Parabolic SAR dots remain above price, signaling short-term bearish bias, but the broader trendline structure has not broken.

Derivatives Data Signals Strong Speculation

Dogecoin futures open interest sits at $3.88 billion, up 0.5% on the day, while trading volume has surged more than 42% to $4.1 billion. Options activity also spiked, with a 227% jump in daily volume and open interest rising 40%.

Long/short ratios remain skewed in favor of longs, particularly on Binance where top trader positioning shows more than 3.6 accounts long for every short. This signals strong speculative appetite despite spot weakness. However, liquidation data highlights risk: $5.7 million was liquidated in the past 24 hours, with $3.1 million hitting longs, suggesting traders are overleveraged.

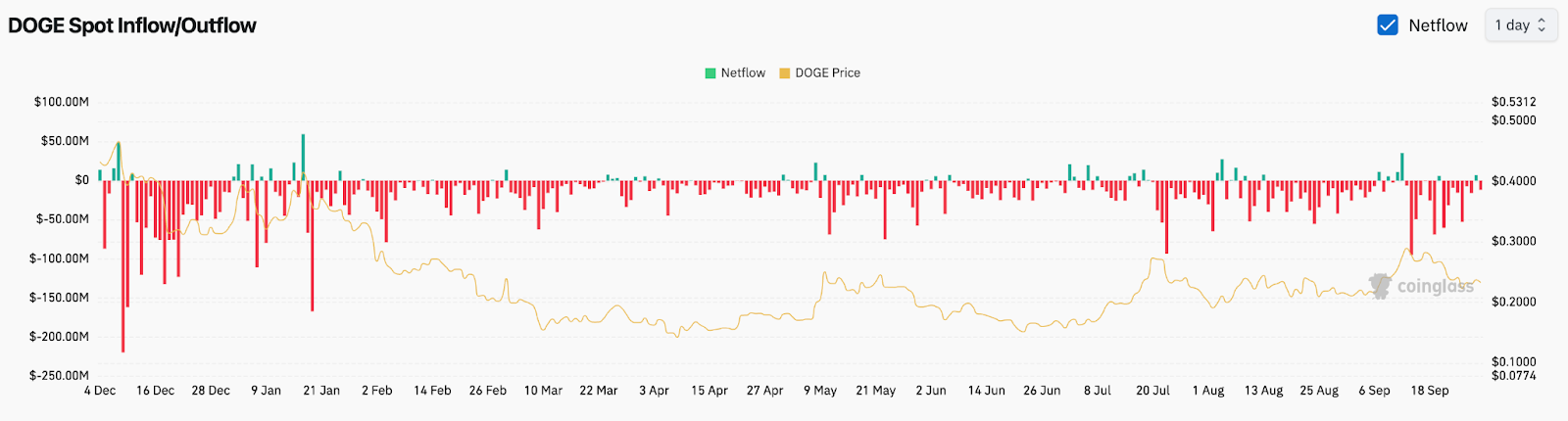

On-Chain Flows Highlight Cautious Accumulation

Spot flows show mixed sentiment. Coinglass data reveals persistent net outflows from exchanges through September, a sign of longer-term accumulation, though recent inflows have added volatility. Net outflows are moderating, implying that buyers are positioning but not aggressively.

If flows turn positive and align with derivatives activity, DOGE could gather momentum. But if inflows spike during price weakness, it would suggest profit-taking, putting pressure on the $0.22 support.

Morgan Stanley’s Trading Plans Boost Narrative

A key catalyst surfaced with reports that Morgan Stanley, managing $1.3 trillion in assets, plans to enable Dogecoin and Bitcoin trading by early 2026. This development represents one of the first major Wall Street banks preparing to include DOGE in its trading infrastructure.

Related: Bitcoin Price Prediction: BTC Holds $111K As Traders Eye $115K Liquidation Trigger

Institutional access could expand liquidity pools and bring fresh participation from traditional investors. For Dogecoin, which has historically thrived on retail speculation, a bridge into institutional markets could significantly impact long-term adoption and valuation.

Technical Outlook For Dogecoin Price

Dogecoin price prediction for the short term remains tightly bound to its channel:

- Upside levels: $0.26, $0.28, and $0.30 as near-term resistance.

- Downside levels: $0.23 as immediate support, followed by $0.22 and $0.20.

- Trendline base: The rising channel trendline from June, now aligned with $0.22, remains the key structure.

Outlook: Will Dogecoin Go Up?

The near-term outlook for Dogecoin depends on whether buyers can defend $0.23 and flip $0.26 into support. Derivatives markets show bullish speculation, while on-chain flows suggest cautious but steady accumulation. The Morgan Stanley announcement adds a long-term bullish tailwind, potentially positioning DOGE for broader adoption.

If Dogecoin price today holds above $0.23, analysts expect attempts to reclaim $0.26 and retest $0.28. A break below $0.22, however, would weaken the bullish structure and shift focus back toward $0.20. For now, the balance of technicals and news catalysts leaves DOGE in consolidation, with momentum hinging on buyer conviction at current levels.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.