- DOGE momentum improves but major resistance at $0.152–$0.155 still caps upside strength.

- Futures leverage resets sharply as open interest drops, signaling a healthier market.

- New ETF filings from 21Shares and Grayscale boost confidence in broader DOGE adoption.

Dogecoin continues to draw attention as the market responds to fresh ETF activity and shifting technical signals. The token attempted a rebound after stabilizing near the $0.133–$0.136 zone, a region that attracted steady buying through early December. Price climbed toward $0.15 as traders assessed the broader trend and weighed new ETF developments.

Technical Momentum Builds but Key Resistance Stays Firm

Dogecoin moved above the short-term moving averages after its recent bounce. This shift placed price back inside the middle region of the Bollinger Bands. However, the broader trend still leans lower. The 100 EMA near $0.152–$0.155 remains a critical barrier.

Any close above this region would help bulls challenge the heavier supply cluster near $0.162. Analysts note that this area stopped recovery attempts since mid-November. Additionally, the 200 EMA sits around the same zone, creating a decisive line for the next breakout attempt.

On the downside, support stays firm at $0.143–$0.147. This range aligns with the 20 and 50 EMAs. A breakdown exposes the recent swing low at $0.133. Hence, traders are watching whether momentum can build before the structure returns to a deeper correction.

Related: Ethereum Price Prediction: ETH Attempts to Stabilize as Market…

Futures and Spot Flows Show a Market Reset

Dogecoin’s futures market shows a major reset after months of heavy speculation. Open interest fell from peaks above $6 billion toward $1.51 billion by December 4. This shift indicates thinner leverage and reduced appetite for aggressive trades. Significantly, open interest remains higher than early-year levels, suggesting baseline interest still exists.

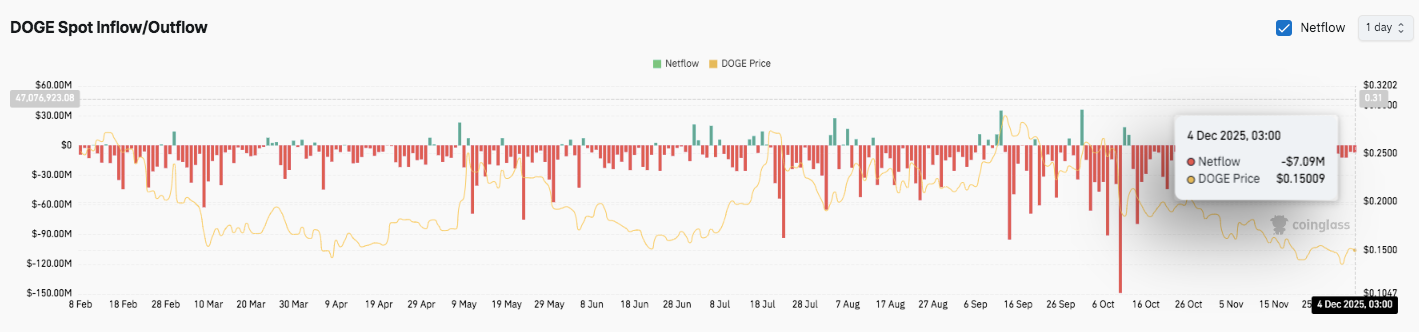

Spot flows show persistent outflows, with many sessions displaying strong distribution. Several large outflow spikes near the $60 million to $120 million range reveal sustained selling pressure. Moreover, December activity remained negative, with about –$7.09 million recorded as Dogecoin traded near $0.1509.

ETF Developments Add New Catalysts for December

ETF activity strengthened optimism. 21Shares advanced its spot Dogecoin ETF by submitting an updated S-1 with new operational details. The fund will trade under the TDOG ticker when approved. The filing outlined its 0.50% management fee, named its custodians, and confirmed plans for seed capital purchases.

Related: Chainlink Price Prediction: LINK Faces a Critical Turning Point…

Besides this update, Grayscale converted its Dogecoin product into a spot ETF. Bitwise also prepared to launch Dogecoin funds. Moreover, these moves increased confidence that Dogecoin ETFs may enter mainstream financial products soon.

Technical Outlook for Dogecoin Price

Key levels remain well-defined as Dogecoin trades inside a pressured structure.

Upside levels sit at $0.152, $0.155, and $0.162 as immediate hurdles. A breakout above these zones could extend toward $0.171 and $0.180, where stronger supply clusters appear. The $0.162 zone remains the most important level because it aligns with the 200 EMA and repeated rejection points.

Downside levels include $0.147 at the EMA confluence, followed by $0.143. The deeper support remains at $0.133, which marked the recent swing low and defines the current accumulation base. A drop under that level exposes the next bearish continuation structure.

The technical picture suggests DOGE is compressing inside a broad descending channel, where tighter price coils signal an upcoming volatility expansion. A decisive breakout above the upper channel line could shift the short-term trend and encourage stronger spot inflows.

Will Dogecoin Move Higher?

Dogecoin’s next move depends on whether buyers can defend the $0.147–$0.143 zone long enough to retest the $0.155–$0.162 cluster. Technical compression and reduced leverage both point toward a cleaner setup as December progresses. If bullish momentum strengthens, DOGE could revisit $0.171 and potentially $0.180.

Related: Bitcoin Price Prediction: Sellers Block Recovery as Price Compresses Near…

Failure to protect $0.143 risks another sweep toward $0.133, where losing support would reopen the broader downtrend. For now, DOGE sits in a pivotal area. Momentum improves, but confirmation remains essential before expecting a sustained rebound.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.