- Dogecoin remains pressured as weak structure and consistent outflows weigh on sentiment.

- Derivatives data shows softer leverage while open interest stays active despite declines.

- New Grayscale DOGE ETF expands institutional access and may shape sentiment phases ahead.

Dogecoin continues to struggle as selling pressure builds across spot and derivatives markets, creating a difficult environment for sustained recovery attempts. The market has been grinding lower since the rejection near the October peak, and recent trading shows the asset struggling to reclaim short-term resistance. Besides price weakness, Dogecoin now faces shifting market flows and a new institutional product that may influence future sentiment.

Market Structure Remains Heavy

Dogecoin is trading inside a clear downtrend on the 4-hour chart. Price continues to respect lower highs, while every bounce struggles at the red Supertrend band. The asset trades near $0.147 after failing to hold gains above $0.150.

Additionally, the 0.618 Fibonacci level around $0.20 remains a major ceiling. The broader structure turns positive only if price reclaims that level with conviction.

Support sits at $0.133, where buyers have stepped in several times. However, a breakdown could open a move toward $0.120. Hence the next sessions are important because Dogecoin is approaching a decision point between short-term relief and deeper decline.

Spot and Futures Flows Signal Softer Demand

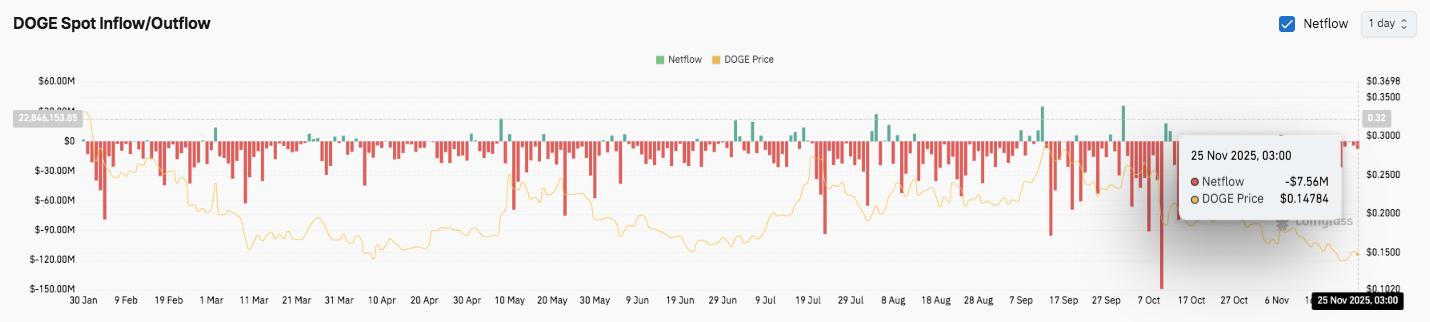

Dogecoin’s spot flows show consistent outflows through the year. Red sessions dominate the chart and confirm that supply continues to leave the market. Moreover, several sessions recorded withdrawals above $40M, which often followed sharp declines.

Related: XRP Price Prediction: Downtrend Stays Dominant as $39M Outflows Hit

The latest reading on November 25 shows a $7.56M outflow as Dogecoin trades near $0.148. This activity suggests that buyers remain cautious and prefer to reduce exposure during uncertainty.

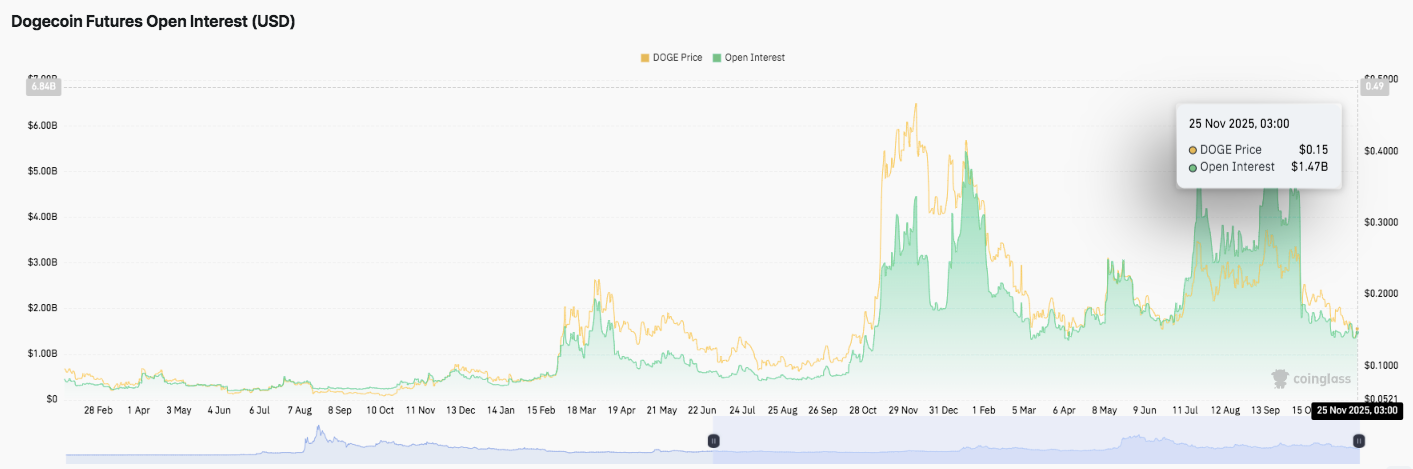

Futures activity reflects a similar slowdown. Open interest peaked above $5B between February and April before trending lower into the final quarter. The metric now sits near $1.47B.

This level still exceeds early-year readings, and it shows that traders remain active, although with less leverage. Consequently, the derivatives landscape signals reduced speculation but sustained participation.

Institutional Access Expands Through New Grayscale Products

Grayscale launched the Grayscale Dogecoin Trust ETF yesterday, giving investors direct DOGE exposure through a regulated structure. This move broadens institutional access and adds a new path for market participation. Additionally, the launch represents increasing recognition of DOGE’s shift from internet culture to utility-driven adoption.

Technical Outlook for Dogecoin Price

Key levels remain defined as Dogecoin moves through a heavy consolidation zone near $0.147. Upside levels sit at $0.150, $0.159, and $0.180 as immediate hurdles. A breakout through these zones may open a path toward $0.200 if momentum improves. The $0.200 level aligns with the 0.618 Fib, making it the most important resistance for a broader trend shift.

Related: Bitcoin Price Prediction: Buyers Defend Key Support as ETF Outflows Intensify

Downside levels show $0.133 as the first support, followed by $0.120 and $0.090. The $0.133 region forms a key structural base that has held multiple times this month. A clean breakdown exposes lower volatility pockets that stretch toward the $0.120 range.

The technical picture shows DOGE compressing inside a declining structure, where momentum cools at each relief bounce. The pattern resembles a controlled downtrend, with lower highs shaping the broader bias. A decisive break above $0.159 remains required for medium-term strength.

Will Dogecoin Recover?

Dogecoin’s short-term outlook depends on whether buyers can defend the $0.147–$0.133 band long enough to build a base. A sustained reclaim of $0.150 followed by strength above $0.159 would signal a positive shift and may support a move toward $0.180 and $0.200. Seasonal flows and derivatives positioning also point toward higher volatility in the coming weeks.

However, losing $0.133 risks breaking the current accumulation zone and exposes DOGE to $0.120 and deeper levels. Until a breakout forms, the asset remains in a pivotal zone where buyers attempt to slow downside pressure.

Related: Ethereum Price Prediction: ETH Struggles in Downtrend While BitMine Grows to 3% Supply Share

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.