- Dogecoin’s price steadies above key Fibonacci levels, signaling short-term resilience

- Rising open interest shows renewed trader activity despite ongoing net capital outflows

- House of Doge’s soccer club acquisition boosts real-world adoption and brand visibility

Dogecoin (DOGE) continues to consolidate near $0.1934 after recovering from a sharp drop to $0.1807. The cryptocurrency is gradually regaining momentum following its October decline from $0.27. Traders are watching closely as Dogecoin attempts to sustain this rebound while its on-chain and derivatives data reveal signs of growing market participation.

Technical Levels Indicate Gradual Rebound

Dogecoin is holding above its 50% Fibonacci retracement level, suggesting short-term stability after recent volatility. The next resistance sits at $0.2033, which aligns with the 0.618 Fibonacci level and two key moving averages the 20-EMA at $0.1953 and the 50-EMA at $0.1992. A clear breakout above this zone could strengthen bullish sentiment and open the path toward $0.2318 and the previous swing high of $0.27.

On the downside, $0.1807 remains a key support level. A sustained drop below it could trigger further weakness toward $0.1596 or $0.1335. However, the gradual flattening of EMAs suggests consolidation rather than renewed selling pressure. Holding above $0.19 may help DOGE regain momentum in the short term.

Related: XRP Price Prediction: $1B Treasury Sparks Debate While Price Tests Key Support

Open Interest and Inflows Reflect Mixed Sentiment

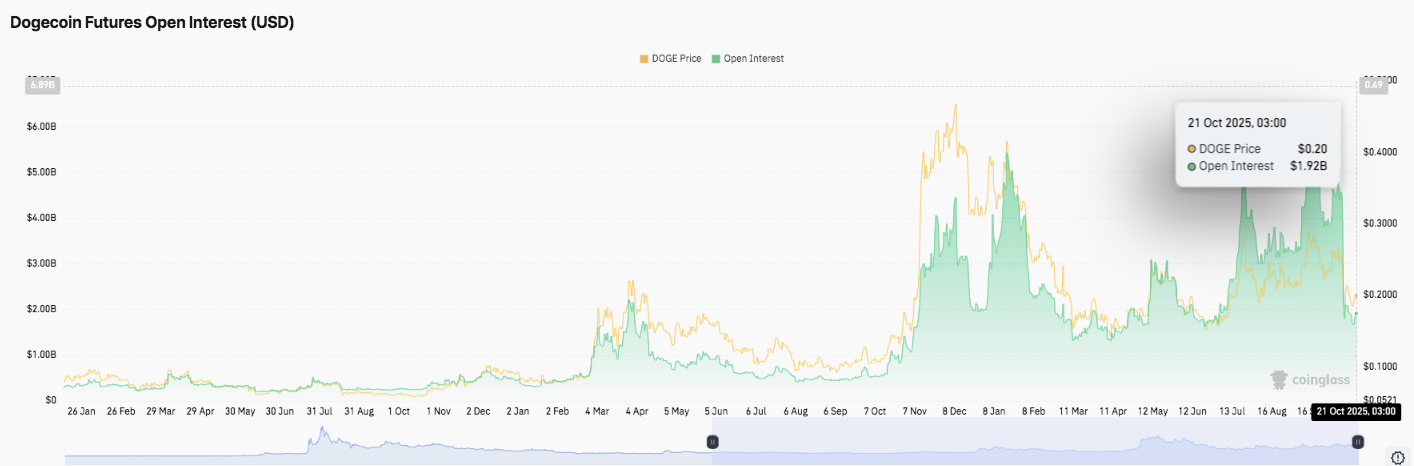

Dogecoin’s futures open interest has shown steady growth through 2025, highlighting rising speculative participation. After a quiet start to the year, open interest climbed sharply from March and again in June, peaking at $6.8 billion midyear.

As of late October, the figure remains near $1.92 billion, indicating that traders are re-entering the market. This trend reflects a cautious but returning appetite for leverage, often a precursor to larger directional moves.

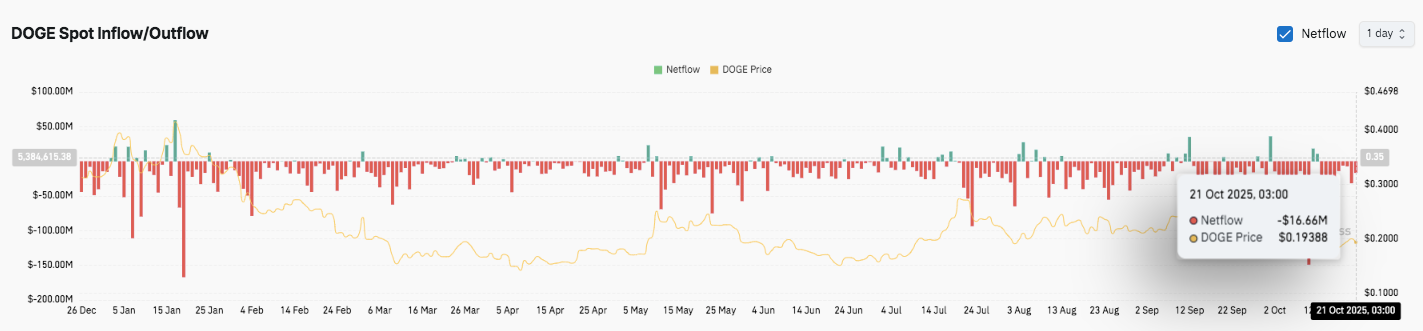

Conversely, net capital flows continue to show a cautious market tone. DOGE has recorded consistent net outflows throughout the year, totaling $16.66 million by October 21. Although brief inflow surges in July and September suggested temporary accumulation, investors remain hesitant to increase exposure amid lingering market uncertainty.

House of Doge Strengthens Real-World Ties

In a move bridging crypto and sports, House of Doge, the commercial arm of the Dogecoin Foundation, has acquired a majority stake in Italian soccer club U.S. Triestina Calcio 1918. The deal, completed with Brag House Holdings ahead of its planned public listing, signals Dogecoin’s effort to integrate digital assets with mainstream culture.

Related: Ethereum Price Prediction: ETH Price Consolidates Below $4K as Developer Rift Surfaces

Technical Outlook for Dogecoin Price

Key levels remain clearly defined as Dogecoin (DOGE) trades around $0.1934, stabilizing after its recent correction from $0.27.

- Upside levels: $0.2033, $0.2130, and $0.2318 serve as immediate hurdles. A breakout above this zone could pave the way toward $0.25 and $0.27 the swing-high from mid-October.

- Downside levels: $0.1807 acts as primary support, followed by $0.1596 and $0.1335, aligning with 0.382 and 0.236 Fibonacci retracement levels. A drop below $0.1807 may weaken near-term sentiment and invite deeper consolidation.

- Resistance ceiling: $0.2033, which coincides with the 20- and 50-EMA cluster, remains the key level to flip for medium-term bullish momentum.

The technical structure shows DOGE compressing within a mild ascending channel, suggesting accumulation after a sharp retracement. Volatility is tightening, indicating that a decisive breakout could soon define the next directional move.

Will Dogecoin Go Up?

Dogecoin’s short-term outlook hinges on whether bulls can sustain price action above $0.19 while reclaiming the $0.2033 resistance zone. Stronger inflows or rising open interest could trigger renewed momentum toward $0.23 and $0.27. However, failure to hold $0.19 may extend consolidation near $0.18 before the next major move.

For now, DOGE remains in a pivotal range. The confluence of flattening EMAs and historical accumulation behavior suggests that volatility expansion is imminent making $0.2033 the level to watch for a potential breakout confirmation.

Related: Bitcoin Price Prediction: BlackRock Selling Challenges Bullish Sentiment

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.