- Dogecoin price today consolidates at $0.197 within a symmetrical wedge, with key resistance set at $0.205.

- Exchange outflows of $26.6M signal accumulation, reducing sell-side liquidity ahead of a potential breakout.

- Derivatives open interest and long positioning rise, reinforcing bullish momentum toward $0.216–$0.220 targets.

Dogecoin price today trades near $0.197, steady inside a tightening wedge that has compressed volatility for nearly two weeks. The token is holding above immediate support at $0.189, while resistance around $0.204–$0.205 continues to limit upside attempts.

Dogecoin Trades Within Symmetrical Wedge

On the 4-hour chart, Dogecoin remains within a symmetrical wedge pattern that has developed since mid-October. The ascending base from $0.177 and descending resistance from $0.216 define the current range.

The 20-EMA near $0.1969 and 50-EMA near $0.1999 are overlapping, creating a short-term pivot band. A clean move above the 100-EMA at $0.2046 would confirm bullish control. Bollinger Bands have narrowed, indicating volatility compression before a likely breakout.

If buyers close above $0.205, price could target $0.216–$0.220 next. A failure to defend $0.189 would expose the lower support zone at $0.180–$0.177.

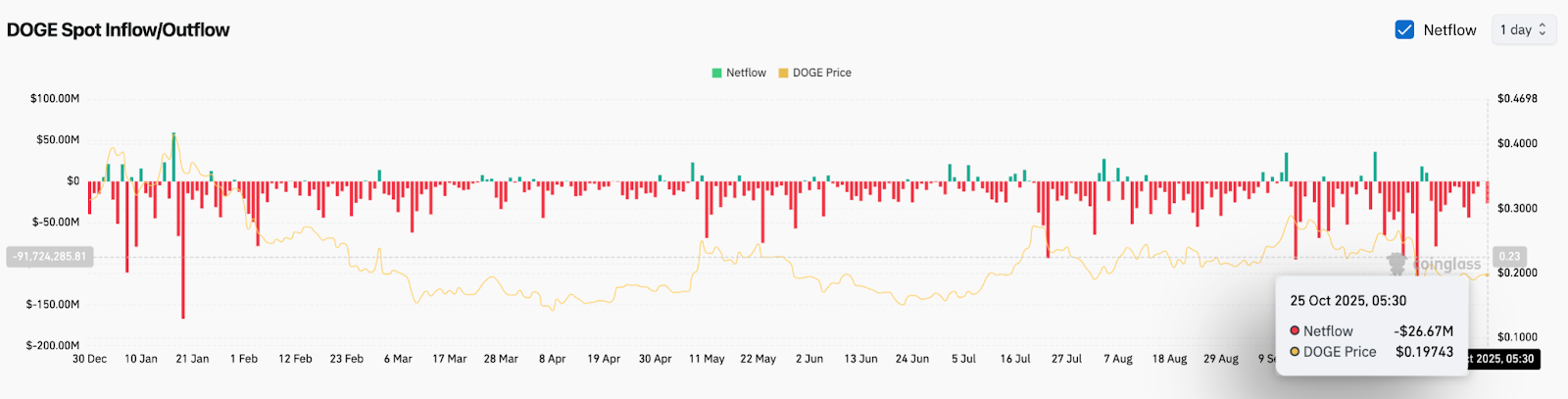

Exchange Data Shows Ongoing Withdrawals

Coinglass spot flow data recorded $26.6 million in net outflows on October 25. Continuous outflows through the month point to sustained accumulation, suggesting fewer tokens are available on exchanges. This trend has historically coincided with pre-breakout phases in Dogecoin’s market cycles.

The persistence of withdrawals indicates traders are holding for potential upside. Reduced liquid supply, coupled with a stable price base, forms a constructive backdrop heading into the week.

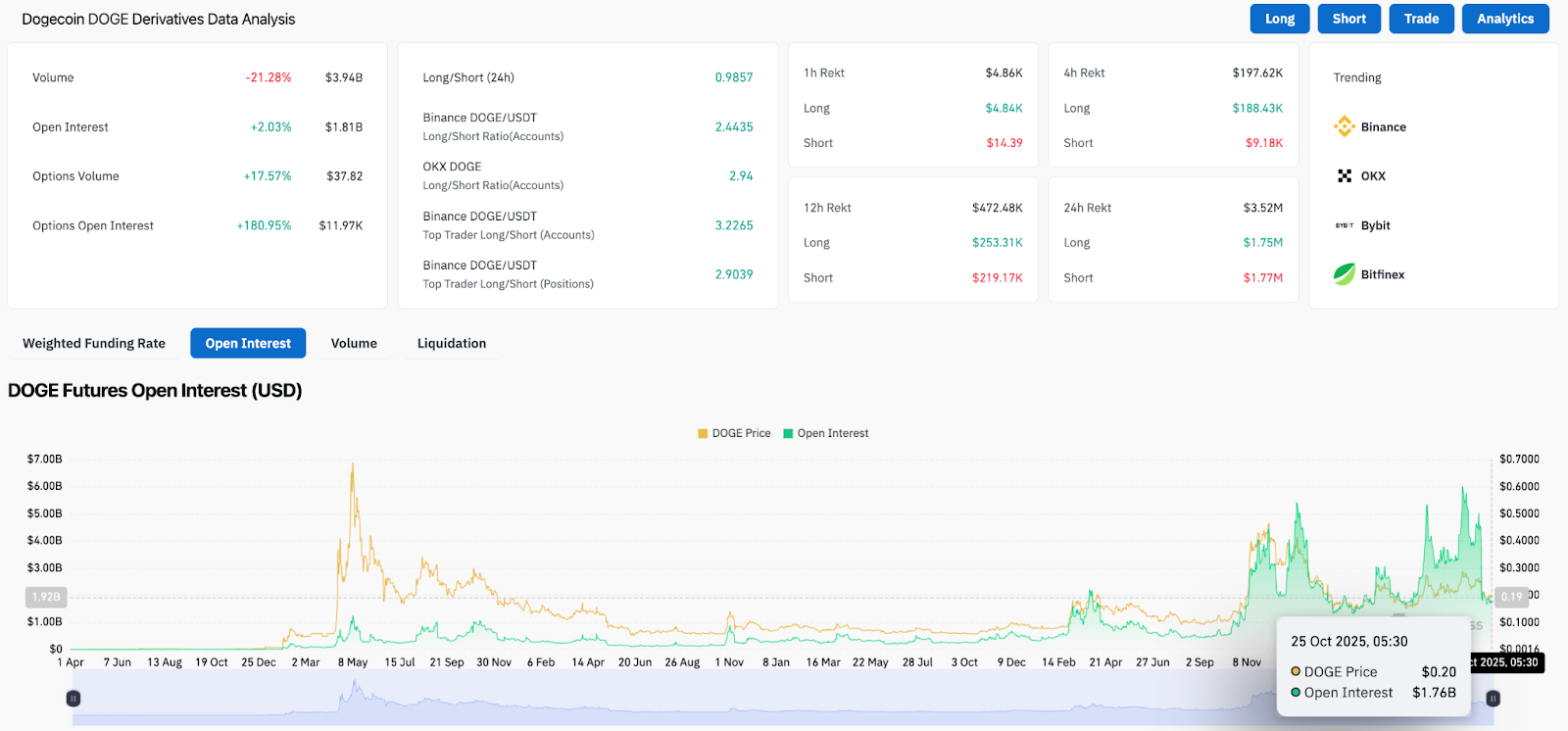

Derivatives Positioning Turns Positive

Derivatives metrics show renewed positioning ahead of the next move. Open interest rose 2% to $1.81 billion, while options volume increased by 17%. Options open interest jumped nearly 181%, showing speculative exposure building.

Across exchanges, the long-to-short ratio remains bullish. Binance, OKX, and Bybit show readings between 2.4:1 and 3.2:1, with top traders maintaining larger long exposure. Though total trading volume fell 21% to $3.94 billion, the increase in open interest suggests traders are preparing for directional volatility rather than exiting positions.

If volume expands with rising open interest, a confirmed breakout could follow — most likely through the upper wedge boundary.

Sentiment Steadies After Billy Markus Post

Dogecoin sentiment improved after co-founder Billy Markus, known as Shibetoshi Nakamoto, posted a brief message: “yay crypto didn’t die today.” The comment followed a volatile week across the crypto market and helped re-energize the Dogecoin community.

The token, which briefly touched $0.171 earlier in the week, recovered nearly 15% to current levels. Community optimism has returned, reinforcing short-term stability as broader market volatility eases.

Outlook: Will Dogecoin Go Up?

The technical picture favors a cautious bullish bias. A breakout above $0.205 would confirm the wedge expansion and open targets toward $0.216 initially, followed by $0.24 if momentum strengthens.

Losing $0.189 support would invalidate the setup and risk a pullback to $0.177.

Exchange outflows, steady open interest, and improving sentiment point toward gradual accumulation rather than panic selling.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.