- Dogecoin (DOGE) remains pinned below $0.20 despite the launch of Grayscale’s GDOG ETF.

- The Federal Reserve ends Quantitative Tightening (QT) on Dec 1, a key liquidity catalyst.

- Technical fractals suggest a “Third Wave” accumulation before a potential parabolic breakout.

Despite the combination of bullish catalysts that would have typically ignited a rally, Dogecoin (DOGE) stays structurally trapped. The leading memecoin is still trading around $0.15, failing to break resistance even as Wall Street opened its doors via the newly listed Grayscale Dogecoin Trust ETF (NYSE: GDOG).

Related: Grayscale’s DOGE and XRP ETFs Set To Surprise Market With Debut on NYSE

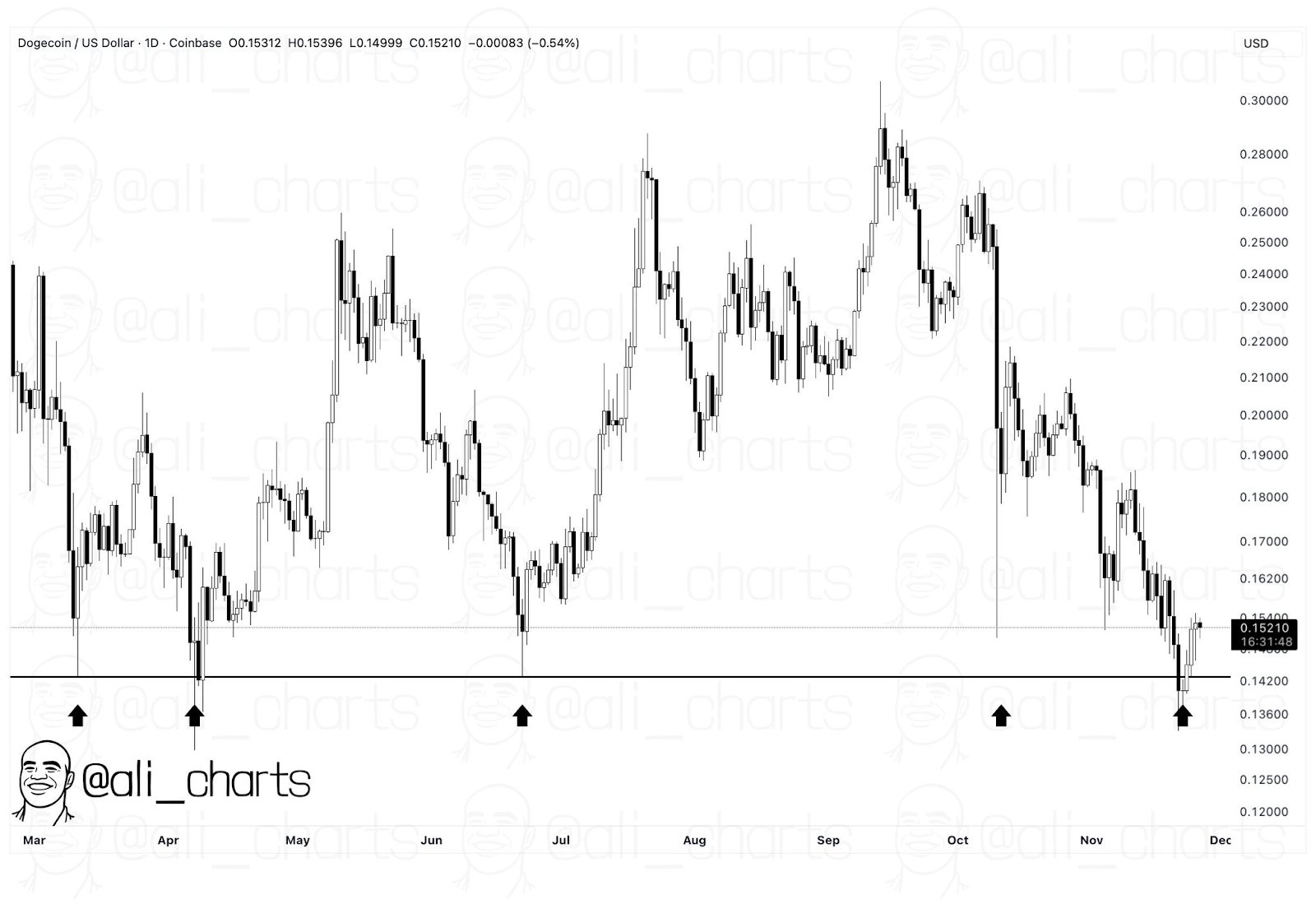

Crypto analyst Ali Martinez has noted that the DOGE/USD pair has retested the support level around $0.144 five times year-to-date. The large-cap memecoin, with a fully diluted valuation of about $22.8 billion, traded about $0.15 on Friday, November 28 during the Eary European session.

What’s Next for Dogecoin Price?

According to a crypto analyst on X alias @EtherNasyonaL, Dogecoin price is trapped within the third-wave dreadlock. The crypto analyst based the bullish thesis on the past two major bull cycles, 2017 and 2021.

Related: Dogecoin Price Prediction: DOGE Price Weakness Aligns With Softer Futures Activity

As such, the crypto analyst expects DOGE price to breakout towards its all-time high (ATH) in the near future. However, the midterm bullish outlook for DOGE is heavily reliant on the multi-year rising logarithmic trendline support. If DOGE price falls below $0.14 in the coming weeks, a full blown bear market will be inevitable.

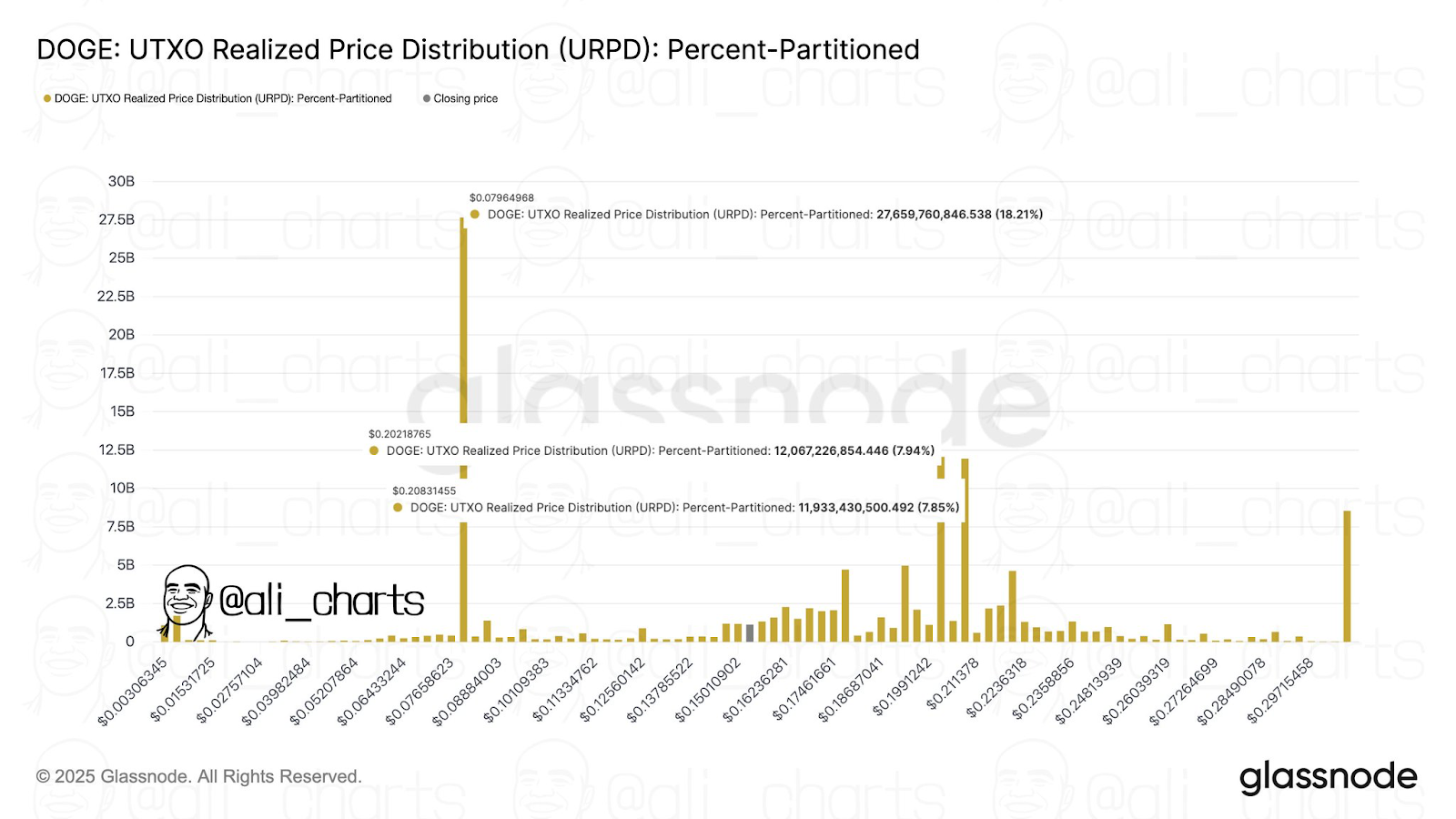

Meanwhile, crypto analyst Martinez noted that DOGE price will likely find a drop towards its support level around $0.08 if the support level around $0.14 fails to hold. Conversely, the crypto analyst has set a target of $0.2, based on the UTXO Realized Price Distribution.

Key Factors Likely to Impact DOGE in the Midterm

Spot ETF hype and cash flows

The midterm outlook for Dogecoin price will heavily be impacted by the performance of the recently listed spot DOGE exchange-traded funds (ETFs). Furthermore, Bitcoin (BTC) price rallied to its all-time high in 2024 even before the halving event fueled by the impressive performance of the dozen spot BTC ETFs.

During the past week, several fund managers in the United States have listed their respective Spot DOGE ETFs. At press time, the Grayscale Dogecoin Trust ETF had a total of $3.5 million in assets under management.

Crypto capital rotation amid anticipated Fed’s QE

The midterm outlook for Dogecoin price will heavily be impacted by the Federal Reserve’s monetary policy decision. Starting next week, December 1, the Federal Reserve will start its much anticipated Quantitative Easing (QE).

The last time that the Fed conducted its WE was during and before the 2017 crypto summer. With the ongoing surge in global money supply, Dogecoin price will heavily benefit from the anticipated capital rotation from Bitcoin and other large-cap altcoins in the near term.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.