- Dogs Community cracks down on bot farms, ensuring fair airdrops for real users.

- Binance lists DOGS memecoin, leveraging Telegram’s massive user base and meme culture.

- DOGS token launches with 81.5% community allocation and no vesting, fostering quick adoption.

The Dogs Community cracked down on accounts suspected of bot farming for airdrops. The community announced on X that they found and removed several accounts trying to game the system.

Even though the number of accounts was small, the community stressed its commitment to making sure only real people – “real Dogs” – get rewards. The affected accounts have had their airdrops frozen on exchanges, showing the community’s dedication to fairness.

Following this, Binance has thrown its support behind the DOGS token, a new memecoin emerging from the Telegram ecosystem. Binance announced that it would be listing DOGS on its platform, beginning with its inclusion in the Binance Launchpool on August 23rd. This initiative allows users to stake their coins and farm new assets, creating a unique opportunity for DOGS holders. Trading for DOGS is scheduled to commence on August 26th.

According to Binance, the DOGS token leverages Telegram’s vast user base and its established meme culture. The token, centered around a dog icon initially drawn by Telegram’s founder, aims to introduce millions to blockchain technology through a fun and engaging ecosystem.

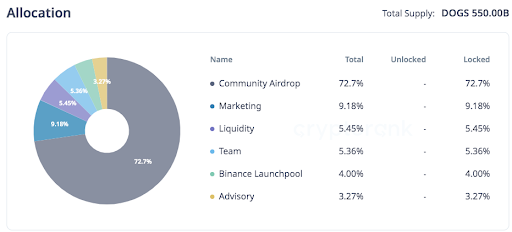

Binance noted that the total supply of DOGS is 550 billion, with 94% of that, or 516.75 billion tokens, circulating right from the start.

The token distribution model, or “Dogenomics”, gives 81.5% of tokens to the community, with 73% specifically for long-time Telegram users. The rest of the tokens are set aside for traders and future community members.

Importantly, DOGS tokens can be traded or used immediately after the airdrop, with no locks or vesting periods. The team kept 10% of the total supply for future development, locking up most of these tokens for 12 months. Another 8.5% of the supply is reserved for liquidity on centralized and decentralized exchanges.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.